👉 Bitcoin Hasn’t Crossed This Line In 8 Years!

🚀 QE Not Needed For Altseason; Has Anything Changed?

By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 Bitcoin Hasn’t Crossed This Line In 8 Years!

💎 QE Not Needed For Altseason; Has Anything Changed?

💥 Best Alpha Posts of the Day

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

💭 Banter’s Take

GM Degens,

We found two very interesting charts that we will look at today.

One of them, Bitcoin has adhered to over the last 8 years, and if it crosses this time, it could mean bye-bye alts—at least short term.

The other shows how quantitative easing (QE) is not needed for an altseason, as many have been talking about on X.

Let's dive in!

🌍 Market Catch-Up

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 News of the Day

Bitcoin Hasn’t Crossed This Line In 8 Years!

Over the last few days, one of the biggest pieces of news for crypto has been the US Federal Reserve Chair Jerome Powell has said that the Fed won’t get in the way of banks wanting to serve Bitcoin and crypto customers. There is a major shift happening, as crypto is becoming more normal than not. But there is bad news as well.

The bad news is that the CPI in the US for January increased by 3% year on year, surpassing expectations of 2.9%. This caused the market to drop significantly, however, many are blaming this on Donald Trump, but this is January inflation. His inauguration wasn't until halfway through January. So, any Trump-related inflation will have to wait for February.

Some expect the CPI print to mark the bottom, like Moustache here. But, more importantly, he also takes a look at Bitcoin dominance which touching an eight-year long trend line. If Bitcoin dominance is rising, the alts are dropping, that is how the numbers work here.

So, will it break the 8-year trend line, or will history repeat?

Anything is possible, and none of this is financial advice as you all need to do your own research.

Will the Fed ever reach their goal of 2% inflation in the US? Many ask why 2% inflation over 0% inflation, but that's another story. Today we have PPI coming in, which hopefully will not cause as much of a scare as CPI, but again, anything is possible. If the Department of Government Efficiency (D.O.G.E.) is able to cut, let's say, one trillion dollars a year, bringing the US debt deficit closer to 0, then the results will be amazing. If as a result, the 10-year yield starts coming down, it will show the rest of the world that the US has become super efficient. They will have to, of course, tackle other obstacles like bringing an end to the war in Ukraine, but Trump and Putin are already in discussion about this, according to a Trump post on X.

Meanwhile, for risk assets, it seems like the US dollar (DXY) is still continuing its breakdown. When the dollar goes down, risk-on goes up! Allegedly!

💎 Degens’ Den

QE Not Needed For Altseason; Has Anything Changed?

21Shares has proposed staking for the Ethereum (ETH) spot ETFs in a recent filing. This would effectively divide the ETFs into two parts: ones with dividends, and ones without. And seeing as the yield could be higher than on traditional stocks, many investors may find it appealing.

Don't forget that World Liberty Financial (WLFI), which is associated in one way or another with the Trump family, has been picking up Ethereum like crazy; almost as if they know something that everyone else doesn't.

What people usually refer to as ‘altseason', is when Bitcoin liquidity flows to Ethereum before flowing into the major altcoins and then into the smaller altcoins categories. However, recently, many people have been talking about how quantitative easing (QE) is needed for an altseason. This is something that CryptoAmsterdam goes on to debunk below.

According to CryptoAmsterdam: "We don't need QE for Altseason to happen[...]We need a lot of money to flow into Bitcoin and majors, and greed will do the rest eventually. This triggers Altseason, and so far, regardless of QE, QT, or whatever, we are well on track because the total crypto market[...]grew from $700B to almost $4T."

Go take a look at the full post below on X.

CryptoAmsterdam includes this chart in the thread that shows how “crypto saw big gains, bull markets, and altseasons without QE. Only once did QE align with a bull market—in 2021.”

🐸 MEMEoirs of a Degen!

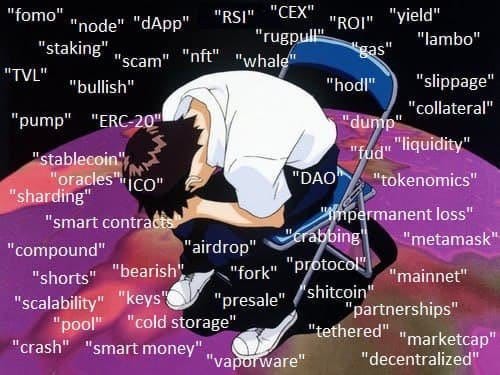

We need that flashy device from Men In Black to wipe our minds of these words!

📢 Biggest Announcements

Coinbase Engages with Indian Regulators, Eyes Return to Indian Market - Tech in Asia

Morgan Stanley Maintains Tesla Stock "Bull Case" at $800

💭 Banter’s Take

How many people remain in the market?

How many are out for good after the recent downturn?

Many remain hopeful that things will improve soon, and that we might even see the onset of an altseason.

What do you believe degen?

See you all tomorrow!