By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 Bitcoin OTC Desks Are Drying Up Fast!

💎 90% Token Dump Causes Mass Chaos!

🐸 MEMEoirs of a Degen!

💭 Banter’s Take

GM Degens,

Drama is rampant in this space. We just saw a massive protocol get completely obliterated, and people want answers.

Meanwhile, Bitcoin seems to have taken a different route, having stabilized a little more than usual. But will the stability last as a supply shock gets ever closer?

Let’s dive in!

🌍 Market Catch-Up

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 News of the Day

Bitcoin OTC Desks Are Drying Up Fast!

Bitcoin has been trading sideways over the last few days, including the weekend. While this can feel stale at times, there’s always a silver lining: no CME gap was created over the weekend. This means Bitcoin has no immediate pressure to push higher or lower to fill a gap and can continue with business as usual.

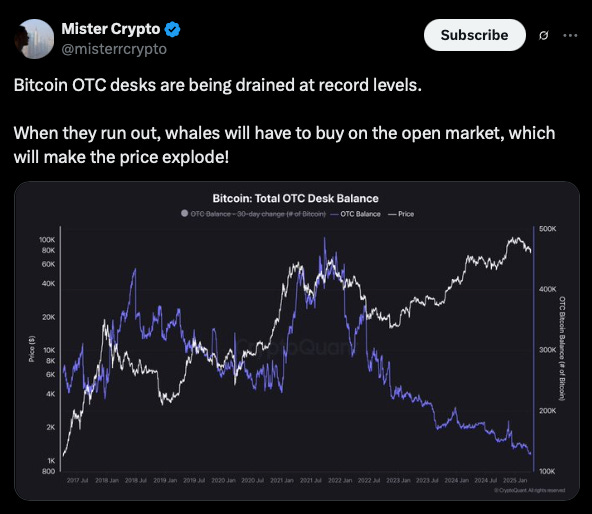

An interesting topic gaining attention again is the Bitcoin supply on over-the-counter (OTC) desks dropping significantly. According to a chart from Mister Crypto on X, the purple line shows exchange balances have reached under 150,000 BTC, with the supply decreasing rapidly.

Why is it dropping at such a rate?

Well, Eric Trump’s recent statement might be contributing:

"Bitcoin is one of the greatest stores of value, immediately liquid, and an unbelievable hedge against real estate."

Whether retail investors are also driving this is debatable, but big players are eating up the supply at a fast pace. As usual, none of this is financial advice, and you all need to do your own research. But common sense suggests:

Once OTC desks dry up, exchanges will be raided, as there’s nowhere else to buy Bitcoin.

Aggressive buying on exchanges will push prices up—something that doesn’t happen with OTC buys, which are off-chain. These transactions often involve exchanging Bitcoin directly or passing private keys to the buyer, without moving the Bitcoin on the blockchain.

Once exchanges dry up, the real party begins. A supply shock will occur, with entities wanting to buy something that’s no longer available. This will push prices higher as buyers try to convince holders to sell.

According to a post by CryptoRank from earlier in the month, “Despite Bitcoin’s weakest Q1 in 7 years, companies were busy buying the dip. While Bitcoin is down 11.7% YTD, firms like Strategy, Tether, and others scooped up 94,646 BTC in Q1 2025, taking full advantage of lower market prices.”

At that pace, it won’t be long before the open market is raided. In fact at that pace we are 1-1.5 quarters away from a supply shock. But we must remember that Bitcoin will also simultaneously enter the OTC desks—it’s not a one way street and that’s why no one can predict a supply shock date.

On the tariff situation (and mess), some are vocal about how the U.S. has lost leverage over China. But Trump has stated, “China’s days of abusing the U.S. on trade are over,” adding that no one is getting off the hook for unfair trade practices. Reports show China is calling for all tariffs to be lifted, but Trump says he has no plans to speak with President Xi about the tariff war.

130 countries are reportedly trying to negotiate with the U.S. Howard Lutnick told ABC that current tariff exemptions on electronics are short-lived, with new semiconductor tariffs expected within a month or two.

Looking ahead, one key event could shape the market this week is Fed Chair Jerome Powell speaking on Wednesday. All eyes will be fixed!

90% Token Dump Causes Mass Chaos!

Last week, we discussed how whales were buying up Ethereum (ETH), and they continue to do so, with one whale accumulating 15,953 ETH ($26.16M). However, Ethereum is losing momentum against Solana (SOL) in price performance. The SOL/ETH weekly chart closed at a new all-time high.

The worst news came for holders of Mantra (OM). In an unfortunate turn of events that just shows how new this industry still is, the OM token price collapsed by over 90% in about an hour yesterday. But there was no hack; instead, according to the Mantra team, it was caused by “reckless liquidations”, something that some third party posts and analyses on X also support.

Recovery is uncertain. We’ve seen projects drop 90% and struggle to bounce back, though nothing is impossible. The Mantra team released an official statement.

Our team spoke to Mantra founder JP, who was apparently woken up to the chaos while in Korea. According to statements, the Mantra team is still active and working.

All eyes are now on the project to see if it can deliver good news or a recovery plan. However, the seeming loss of trust may make some skeptical of going anywhere near it.

Our sympathies go out to anyone holding OM who suffered losses.

Win a Chance to Chat With Ran and the Team, Directly!

Ever wanted access to talk directly to our hosts?

Well, if you’re subscribed to either this newsletter or The Daily Candle—your daily peek into the trading journals of our chartists: Dylan, Sheldon, Kyle, and Kapoor—you’ll be automatically entered into a draw for a chance to win a 2-Week Free Trial to one of Crypto Banter’s paid communities, including:

Front Runners - Talk to Ran directly! 👀

The Whale Room - Want to DM Kyle?

The Sniper Club - Say “Hi” to Sheldon!

Chart Hackers - Catch up with Dylan!

Free Trial Terms and Conditions (T&Cs):

Two Chances to Win!

Must be subscribed to either newsletter to enter.

Next Draw Date: Monday, April 21st.

Codes are non-transferable and valid for 2 weeks from activation.

Winners to be picked from entire list of subscribers at time of draw.

Good luck, and subscribe to The Daily Candle below to increase your chances of winning! 👇

🐸 MEMEoirs of a Degen!

💭 Banter’s Take

It’s not the greatest start to the week for many altcoin holders, but the week is young. Bitcoin, on the other hand, seems to be holding strong. Having roughly followed the M2 global money supply chart since January 2024, will it continue to do so? We’ll dive into this tomorrow.

See you all then!

Want to join our school courses?

Sniper School - In 10 days, learn to chart with Pro Trader Sheldon the Sniper—covering tools, TA, and risk management. Sign Up Now!

The Whale Trading School - In 10 days, learn to chart any market with Kyle Doops—master hidden setups, risk management, and pro-level strategy. Sign Up Now!