🇯🇵 Bitcoin Pushes For $100K; Japan Causes FUD, But US Grinds On!

👉 This L1 Is Taking Everyone By Storm!

By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 Bitcoin Pushes For $100K; Japan Causes FUD, But US Grinds On!

💎 This L1 Is Taking Everyone By Storm!

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

💭 Banter’s Take

GM Degens,

One L1 is crushing metrics and has everyone talking about it. Meanwhile, progress is being made in the U.S. surrounding crypto, and it’s hard to see how the future isn’t brighter now for the industry—more so than it’s ever been.

Let’s dive in!

🌍 Market Catch-Up

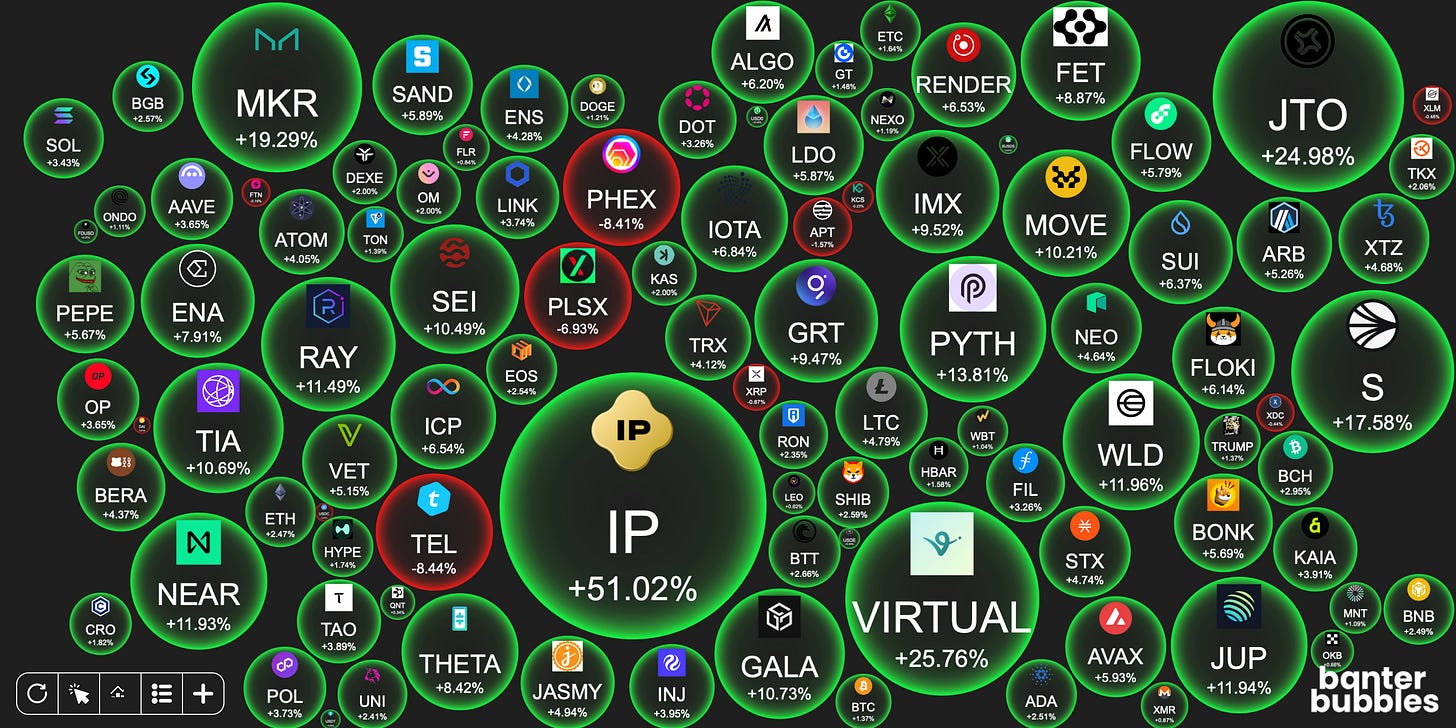

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 Question of the Day

Bitcoin Pushes For $100K; Japan Causes FUD, But US Grinds On!

Bitcoin seems like it wants to push toward $100,000 again, but it’s struggling to do so. It’s in this weird spot where it feels like the whole world is adopting it, yet nothing is moving enough. Meanwhile, Bitcoin open interest is rising again, meaning people are trading with leverage on the futures markets. This is never healthy when it reaches high levels and usually ends in a flush.

Something extremely interesting is happening in Europe, where the European Central Bank (ECB) seems to want to adopt a blockchain-based payment system. Could this be for a dreaded Central Bank Digital Currency (CBDC), or do they have other ideas? We can’t say for sure, but ECB chair Christine Lagarde recently said they won’t adopt Bitcoin into the EU reserves because—long story short—it’s illiquid, not safe, and used by criminals for money laundering amongst other things. Someone should tell her how much cash is used by criminals; maybe she doesn’t know. I don’t know what she knows! But taking that into account, it’s probably for a CBDC, which anyone who understands the freedom that Bitcoin and blockchain offer won’t want to see come to fruition. A CBDC could be programmed to do things like detect when you’ve bought too many unhealthy groceries, causing your health insurance premium to rise. Everything could ultimately be linked, and people’s money could theoretically be frozen in a heartbeat—it’s literally just a matter of adding three lines of code as a function to the CBDC smart contract. If all payments are on a blockchain and all stores and products integrate it, such dystopian features become plausible. And so George Orwell might transition from fiction writer to prophet.

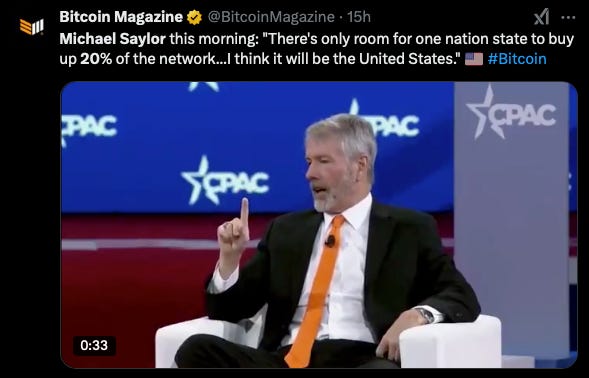

Meanwhile, MicroStrategy CEO Michael Saylor says only one nation can buy about 20% of the Bitcoin supply, and he thinks it’ll be the United States. This guy!

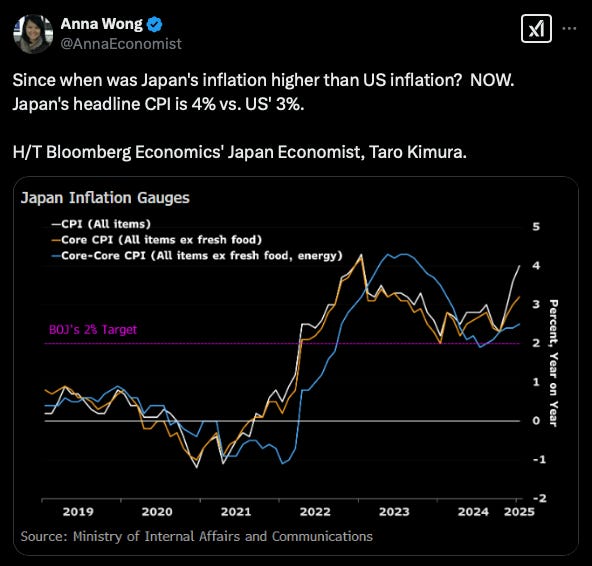

No matter how you interpret all the above, something spooky is brewing in the market, which last time caused a roughly one-day bear market: Japan’s inflation rising to 4%, its highest since January 2023. This could lead the Bank of Japan (BOJ) to raise interest rates. The BOJ governor has said the central bank is ready to increase government bond buying if long-term interest rates rise sharply.

Meanwhile, in the U.S., the SEC has launched the Cyber and Emerging Technologies Unit (CETU), replacing the Crypto Assets and Cyber Unit. This unit will tackle fraud in crypto, AI, and other emerging tech.

It’s interesting to see how the US was lagging behind in the blockchain and crypto race for the last few years, but seems to now be making a 180 turn.

💎 Degens’ Den - Powered by LunarCrush

This L1 Is Taking Everyone By Storm!

Not too long ago, Fantom (FTM) converted to Sonic (S) and became the shiny new thing the market couldn’t ignore. Well, Sonic is currently seeing strong bullish momentum—up roughly 53% over the last seven days and over 20% in the last 24 hours. People are praising Andre Cronje, the developer behind Fantom and now a key player in Sonic for helping build the protocol up.

The total value locked (TVL) in the Sonic ecosystem is growing exponentially. Just look at what’s happened over the last two months!

There are many token unlocks coming up, which you can see below. If the people holding these tokens want to sell, it’ll inevitably cause selling pressure—that’s just how math works. If they hold, it could be seen as bullish, showing higher conviction in their holdings even though they now have the ability to sell. As usual, none of this is financial advice, and you all need to do your own research.

Meanwhile, people keep talking about alt season being close—or already here! This post from Ki Young Ju highlights how stablecoins are flowing to alts rather than Bitcoin, with alts seeing 2.7x more volume than Bitcoin. That’s an interesting metric and food for thought!

So what is everyone talking about?

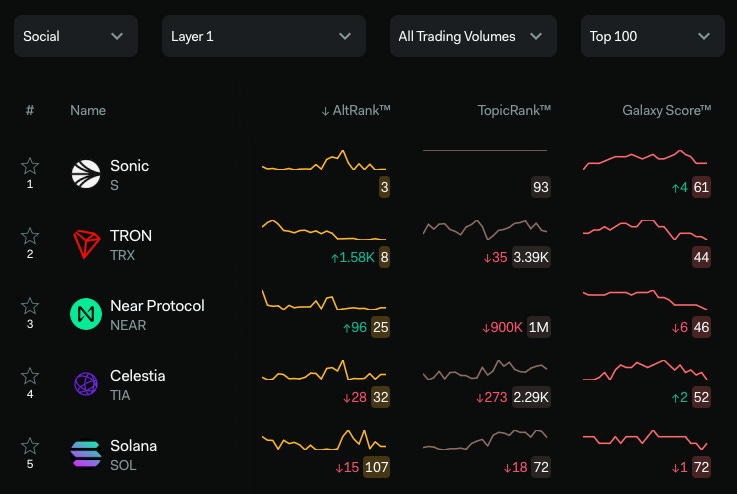

When looking at AltRank on LunarCrush, we see the leader among Layer-1 (L1) chains (from the top 100 by market cap) is yet again Sonic (S). AltRank™ evaluates both market and social data, assessing an asset’s price movement alongside its social activity indicators, offering a comprehensive view of its current standing in the crypto market.

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

Canary Litecoin ETF Officially Listed on DTCC Website

Utah’s Bitcoin Reserve Bill (HB230) Passes Key Senate Committee, Nearing Historic First State Bitcoin Reserve

💭 Banter’s Take

As you can see, so many things are happening, even if it doesn’t always feel like it. The phrase “slow at first, then everything all at once” comes to mind.

See you all on Monday!