By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 Bulls VS Bears: These Two Patterns Support Both Sides!

💎 Time To Give Up On Altseason?

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

💭 Banter’s Take

GM Degens,

Crypto is going down, stocks are going down; fear is all around.

The data is quite mixed, but there are both bear and bull cases to be made when it comes to the market.

Let’s dive in!

🌍 Market Catch-Up

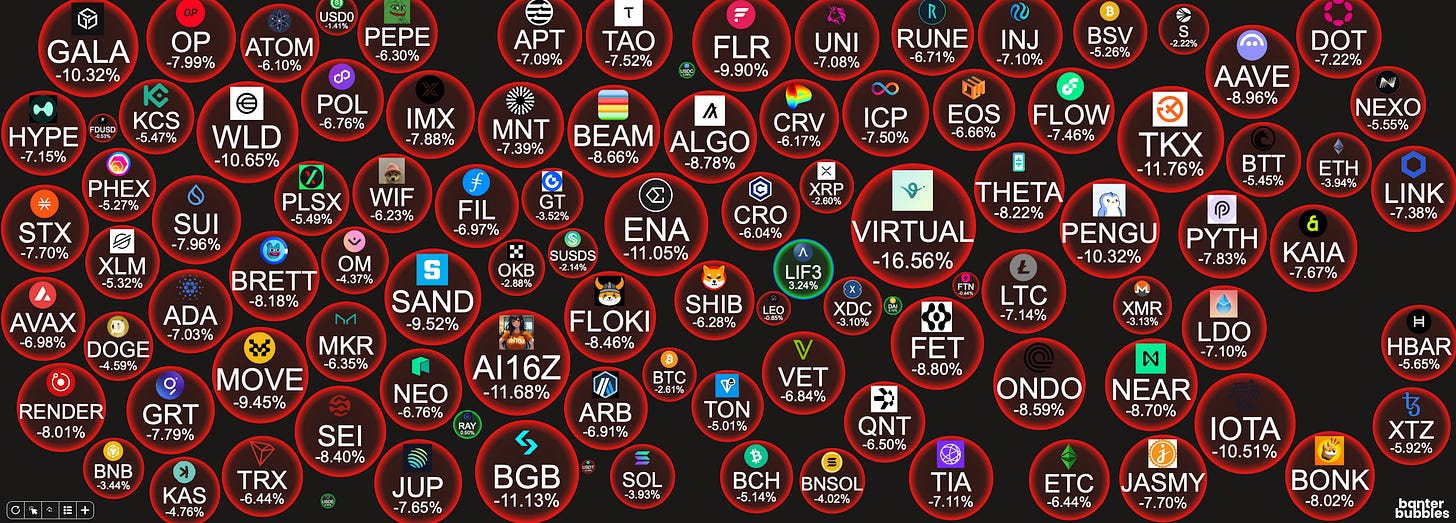

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 Question of the Day

Bulls VS Bears: These Two Patterns Support Both Sides!

The market is looking extremely red, and it's all down to what we talked about last week with people considering all the macro happenings and not feeling too bullish.

This week is going to be a big one. We have inflation data coming out with PPI on the 14th and CPI on the 15th. But as if that isn't enough, we also have big bank earnings too, with heavyweights like JPMorgan and Goldman Sachs reporting. Can these reports turn things around, what with the S&P futures are now trading below 5,800 for the first time since November 5th, having erased most gains since the elections.

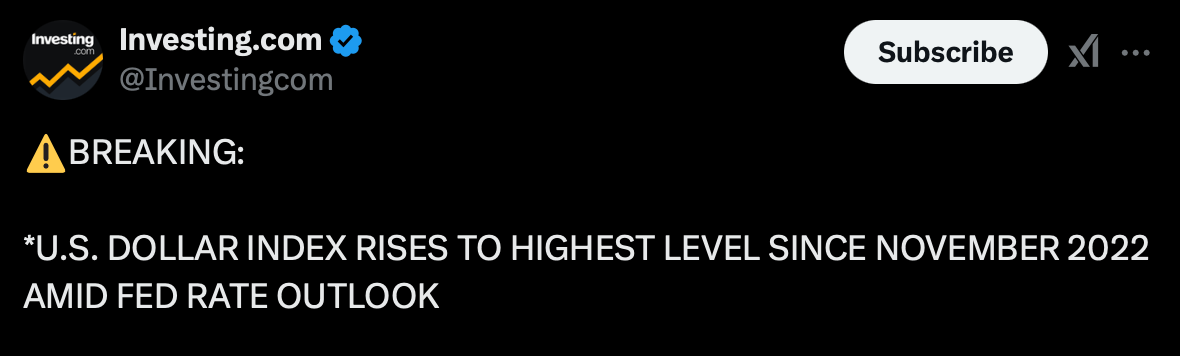

Risk-on assets are dropping like rocks into the ocean. However, one of the biggest culprits of that is the US dollar Index (DXY), which is now at its highest level since November 2022.

Many are expecting the new government to come in with a more pro-crypto and Bitcoin stance—Trump’s Treasury pick Scott Bessent has now disclosed that he owns up to $500,000 worth of Bitcoin spot ETF shares. However, things might not change on day one with the new gov. They might not even change in week one or month one, with more dire situations in the US currently taking precedence, like the LA fires for example. But the promises are there, I guess now everyone needs to see those words put into action. We are seeing this circulating on X but cannot verify it as of yet. 👇

Over to the charts, the weekends usually create a CME gap for Bitcoin, but this time it seems that there is no gap.

Also on the charts, there are two patterns playing out right now which have people talking: one is bullish and the other is bearish. Let's take a look.

Bearish Pattern

As we mentioned recently, there is a head and shoulders pattern playing out on the Bitcoin chart, which has surely got many people scared. Peter Brandt analyses it below.

Bullish Pattern

But on the bright side, there is also a triple bottom. Usually, when a chart forms a double bottom, it shows signs that the bears are struggling to break through support, and a triple bottom adds to that thesis by making the support even stronger. This is seen as a bullish sign for the technical analysts; however, nothing is certain, and things could go south quite quickly. It's important to remember that none of this is financial advice, and you all need to do your own research.

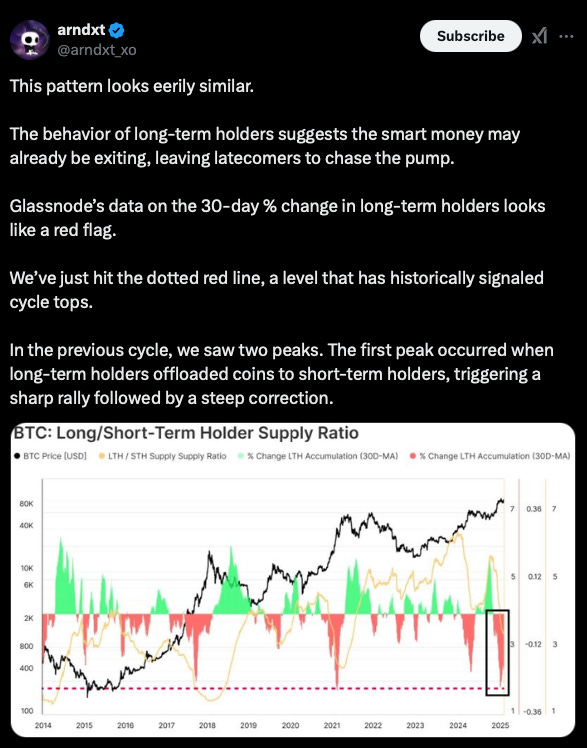

Lastly, on the bearish side again, there is data to suggest that long-term holders are starting to exit, and you can see that in arndxt’s post below.

💎 Degens’ Den

Time To Give Up On Altseason?

We recently mentioned the market’s exhaustion and how a lot of people are getting tired of the chop and the ongoing downward momentum that some altcoins are showing.

Mister Crypto has also noticed this, and according to his chart which takes into account the Bitcoin Liquid Index (the Bitcoin Liquid Index measures Bitcoin's liquidity in the market, and when it drops, it typically signals increased interest and potential price growth for altcoins) he seems to believe that this may be the worst time to give up. He says, "I see many people giving up now. But this is literally the worst time to give up. We are about to enter the altseason stage."

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

Bitcoin Spot ETFs See $1.9 Billion Inflows In 2025 So Far

💭 Banter’s Take

Overall, as we can see, there are mixed emotions both for Bitcoin and for the altcoins.

But, it's still early days both in the week and the month, and also in the new US presidency—well, earlier than early days, I guess—which promises to give crypto more love than the current one.

See you all tomorrow!