By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 Can Bitcoin Break Out Soon?

💎 Massive FUD Hits Solana!

💥 Best Alpha Posts of the Day

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

💭 Banter’s Take

GM Degens,

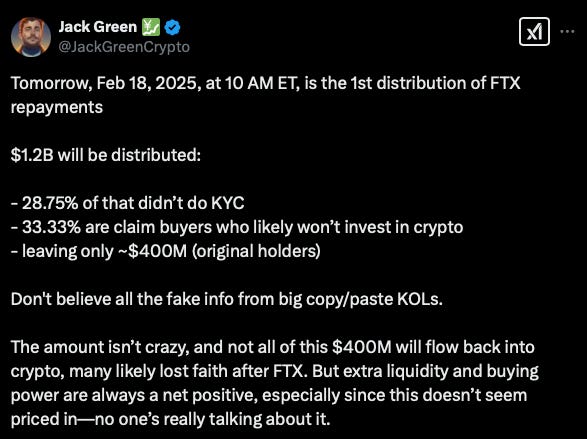

FTX creditor repayments are beginning today, and though many hoped that capital would flow back into crypto, one user gives us a reality check with solid points. Meanwhile, Solana (SOL) is being bombarded with massive FUD, with some losing hope and others believing this is just organized manipulation.

Let’s dive in!

🌍 Market Catch-Up

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 Question of the Day

Can Bitcoin Break Out Soon?

FTX will finally start paying back its creditors today, which is a big deal considering how much chaos the company caused when it collapsed back in 2022. Right now, the crypto market is still pretty dull, with some feeling sentiment is back at those low points we saw during the FTX disaster. This is the moment many hoped could turn around the market, with capital from these repayments flowing back into crypto, but realistically, will it?

Jack Green analyzes this below.

However, from outside the crypto trenches, things don't seem nearly as bad as they did with FTX's fall. While traders are feeling the squeeze, the average person or those not in the thick of it might not even notice the storm. Basically, zoom out.

If the market gives us a few good days and some positive headlines, the "we're so back" sentiment might come rushing back in no time. What is happening now is echoing what happened in the past according to the below info.

Moustache posts a chart which shows Bitcoin trading in a falling wedge pattern, calling for a potential breakout as is common after such a pattern. Will it happen? No one knows for sure. As usual, none of this is financial advice, and you all need to do your own research!

💎 Degens’ Den

Massive FUD Hits Solana!

Other than Sonic (S), which just crossed $1B in DEX volume, and Maker (MKR), there don’t seem to be many tokens on the rise today (at time of writing). But some in the Solana ecosystem are down quite a bit after recent FUD.

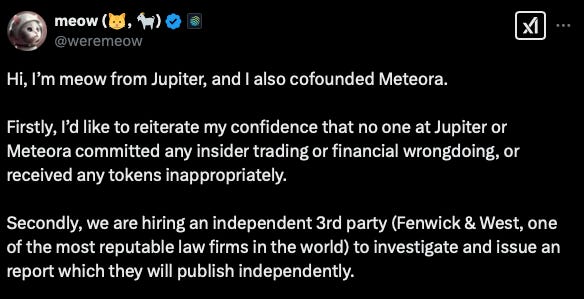

After the LIBRA token launch and dump that sparked major controversy within the lat few days, many are now criticizing Solana and various projects on the chain, some accusing Meteora and Jupiter of insider trading; however, there doesn’t seem to be solid evidence for this.

Overall, lots of FUD is going around.

Meow from Jupiter, who co-founded Meteora, came out to make a long public statement mentioning third-party audits on the way to clear the air. We can’t post the full thing here, so click on the post below to see it.

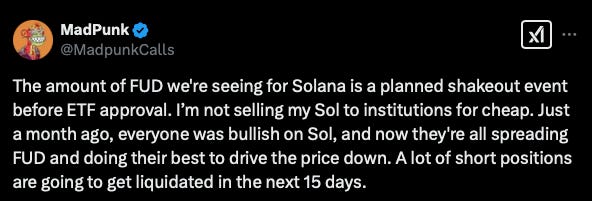

Though this has caused Solana to drop to levels seen 3 months ago, down 43% since the top, some stay hopeful, unchanged in conviction.

ElonMoney posts on X saying, “I've never been a SOL-maxi but remember how $SOL managed to recover from $8 after the FTX crash. What's happening now is nothing more than manipulation caused by unlocks and unclear FUD that has no direct relation to the chain. So I think we'll be able to recover and go higher.”

And some Solana bulls believe this is a pre-ETF approval shakeout tactic.

It is unclear whether some users feel that the chain they have been using is letting them down, or if people are hedging against a massive SOL unlock that is coming up, releasing 6-7% of the supply that they speculate could cause sell pressure.

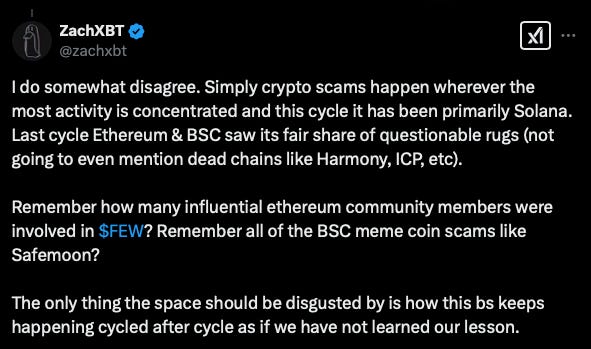

One thing is for sure, Solana is not to blame because this could have happened on any chain. It happened on Solana because it’s the one that is currently attracting the most attention, as stated by ZachXBT.

💥 Best Alpha Posts of the Day

What’s Up With AO?

A nice thread on the state of AO (AO).

Bitcoin To Soon Replace Gold?

We discussed this yesterday!

The gold reserves at Fort Knox have not been audited in decades, whereas Bitcoin is audited (by the entire network of nodes) every block—so roughly every 10 minutes!

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

OpenSea Hits $900 Million in Revenue Since Launch, with Majority Earned in Last Cycle

Reserve Bank of Australia Cuts Interest Rates for First Time Since November 2020

💭 Banter’s Take

Crazy times we are living in.

The bulls and bears are playing tug of war right now.

See you all tomorrow!

Good Morning