🚨 Dump Incoming: Time To Move Into Altcoins?

Crypto Treasury Summer 2025: Which Coins Will Make It?

By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 Positioning for the Dip: Are Altcoins The Better Choice?

💎 Crypto Treasury Summer 2025: Which Coins Will Make It?

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

💭 Banter’s Take

GM Degens,

The rising narrative around crypto treasury companies, as we’ve discussed before, could potentially trigger the end of this bull market one day. If a domino effect unfolds—causing crypto prices to drop, share prices to plummet, and companies to go bankrupt—it won’t be long before headlines declare that crypto was always a scam.

For now, however, more companies are adding crypto to their treasuries, presenting opportunities while this trend lasts. It's impossible to predict exactly when a collapse might occur, so caution remains paramount. However there is also opportunity in the same narrative right now.

With a market wide crypto dip likely on the way, which coins are we watching when it comes to crypto treasuries?

Let’s dive in!

🌍 Market Catch-Up

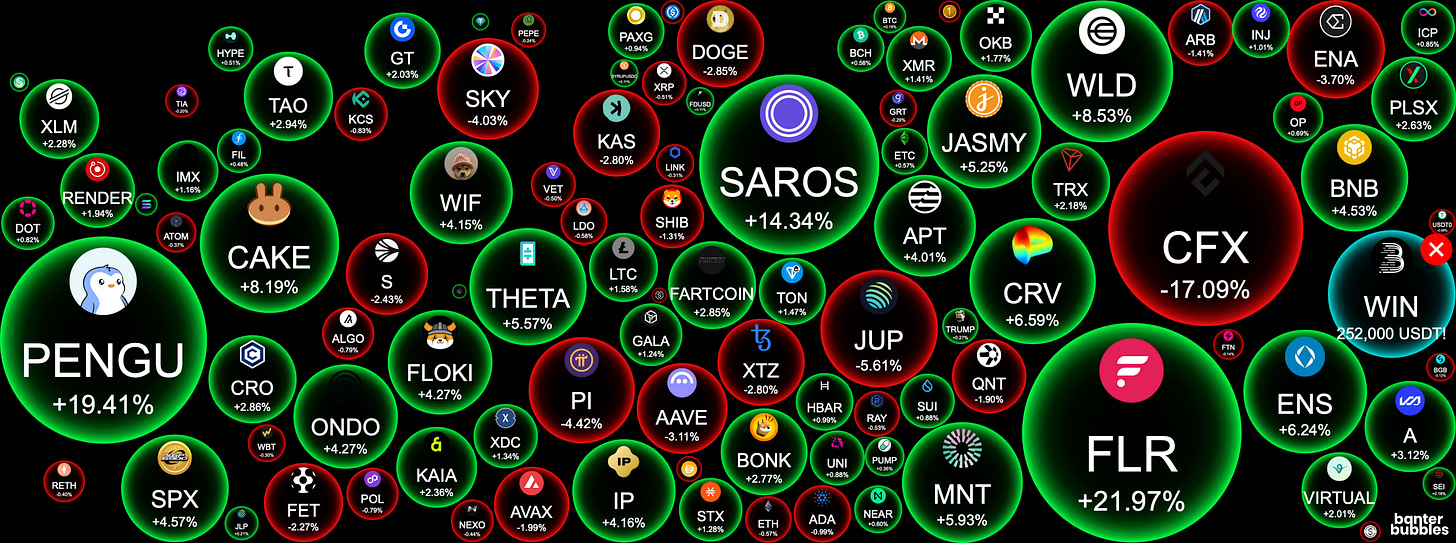

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 Question of the Day

Positioning for the Incoming Dip: Are Altcoins The Better Choice?

Bitcoin faces resistance at the $120,000–$121,000 level. Key support lies just below $116,000. A break below this could be bearish, even though momentum still favors the bulls. Bitcoin needs to hold and move up to avoid losing its streak. It has been on a run for seven days straight and is now consolidating.

If you read yesterday’s issue, you know we're expecting a market-wide dip soon. Despite this, trends remain upward overall. Zooming out, the market is still fundamentally bullish. This is evident not just in charts for retail investors and traders, but also among institutions, who are going heavy into crypto and buying altcoins like Solana (SOL). CME SOL futures have been trading higher than spot and open interest is rising.

There are reasons to believe a dip is imminent though:

Ethereum (ETH) surged 83% from its local bottom within days, showing no significant correction during the rally. Historically, ETH tends to face resistance and pullbacks when its Relative Strength Index (RSI) hits the 70 mark—a level we're currently approaching.

The TOTAL2 index (reflecting the altcoin market cap excluding Bitcoin) typically undergoes corrections whenever daily RSI values signal overbought conditions, like now.

In terms of sentiment, there isn’t too much euphoria or excessive greed, which suggests we might still go a bit higher before a correction occurs. But, nevertheless, it could be close?

So, if we’re expecting a dip, what should we do?

The dip likely won’t last long, not in the current conditions the crypto market finds itself in.

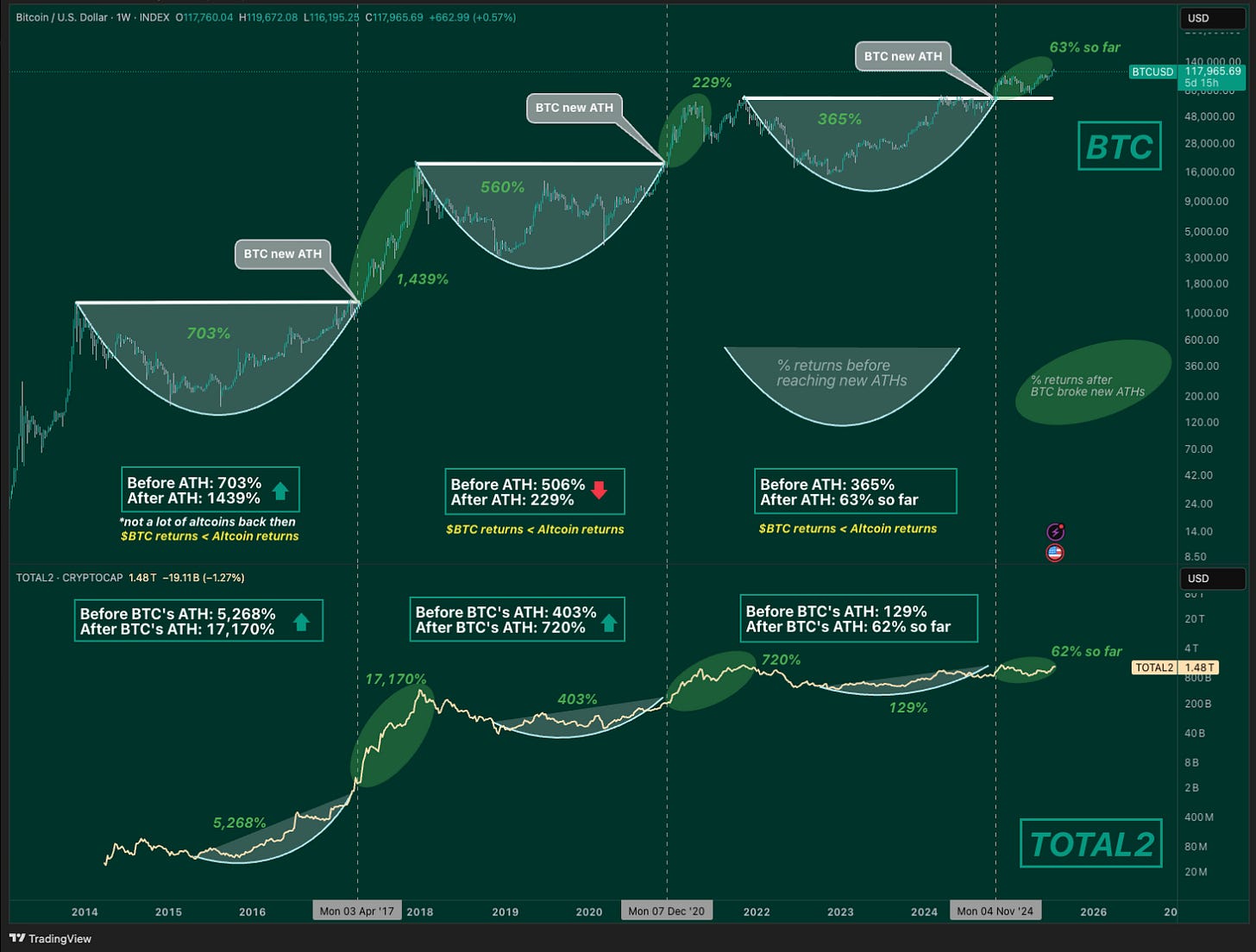

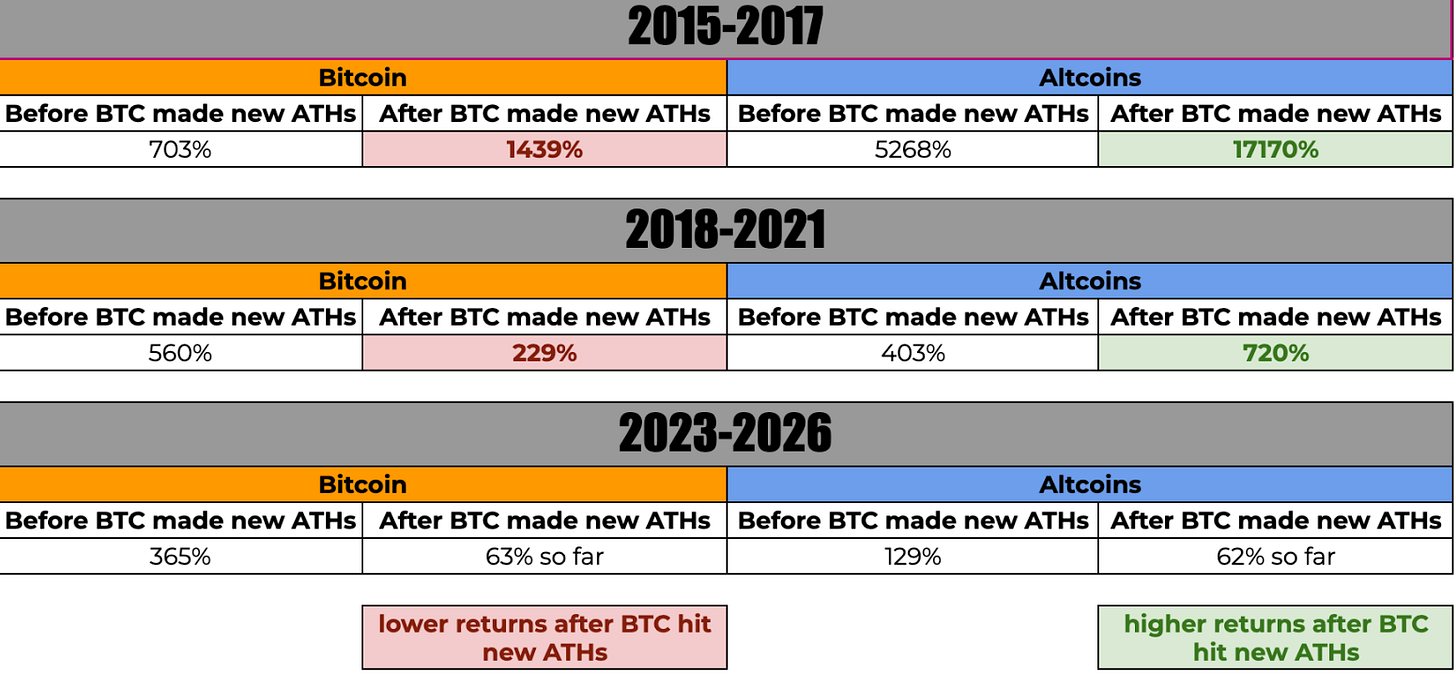

So, if this is the next big phase of the bull market—possibly the last major one before an October peak—it looks like the best returns could be found in altcoins rather than Bitcoin alone. History shows that after Bitcoin breaks new all-time highs (ATH), altcoins tend to outperform.

It’s important to remember that during the first cycle from this chart, altcoins were relatively scarce. As a result, Bitcoin’s returns remained robust compared to altcoins, even after new ATH. In the end, however, altcoins outperformed Bitcoin.

See below a breakdown of the returns on Bitcoin vs altcoins after each new Bitcoin ATH.

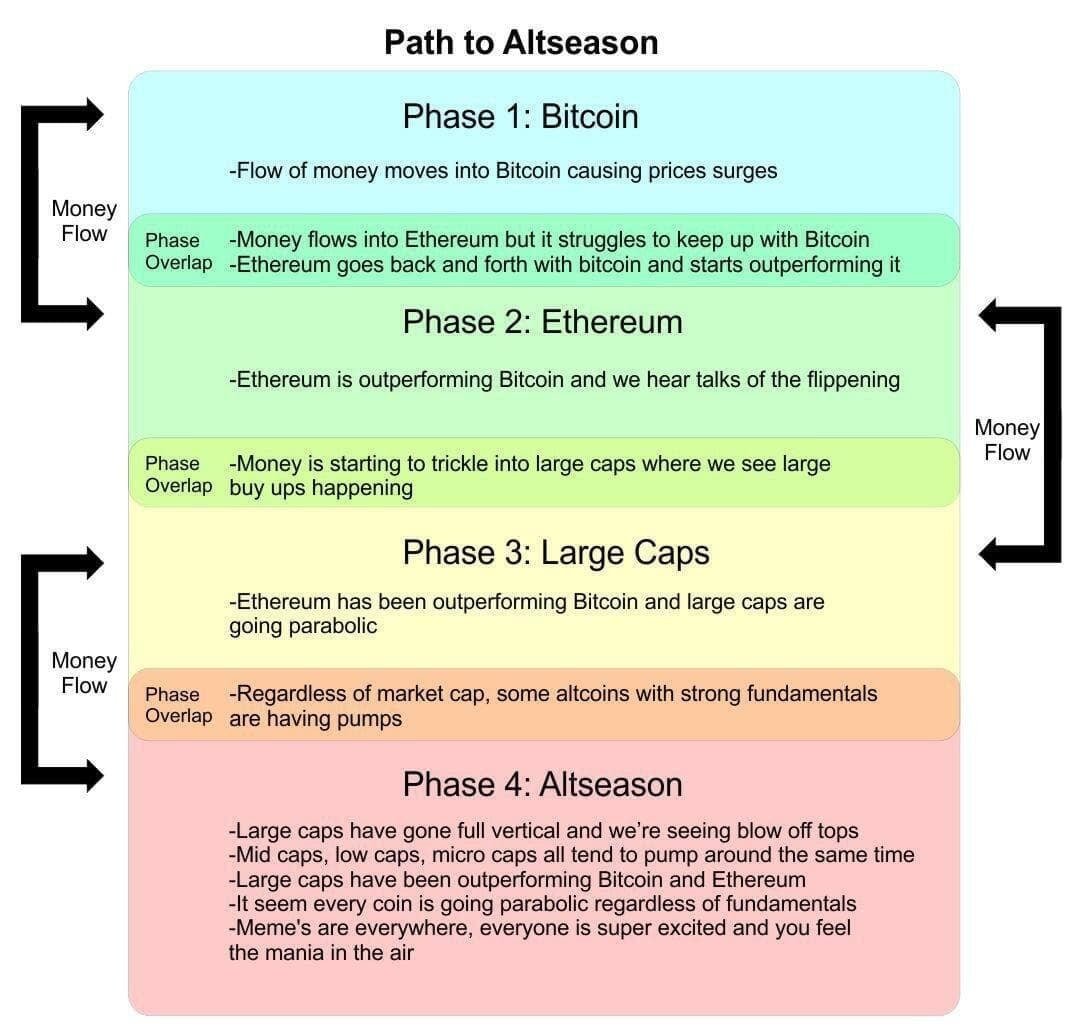

Recently, Ethereum (ETH) has been leading this market pump, classic evidence of capital rotating from Bitcoin to Ethereum before trickling into mid and smaller coins. This is the rotation everyone has been expecting. The “Path to Altseason.”

Looking ahead, we remain bullish—especially with notable events like the UK preparing to sell $7B in BTC (about 61,000 coins). For reference, Germany’s BTC sale marked a local bottom and BTC more than doubled since then. Many believe the UK sale could do the same. However, that is extreme speculation. But the most likely outcome is the most ironic one they say.

Final Thoughts

In summary, if there is a correction to happen, we think it's time to protect capital first, before deploying into altcoins. Instead of holding old tokens which feel like they’re dead and nothing is going on for them, with metrics falling, we should be positioning ourselves in new tokens with good fundamentals, growth and better price action.

And that’s Ran’s topic for today’s Crypto Banter show. Don’t miss it! 👇

But, we also have the crypto treasury narrative, which is key: sure, it could trigger a collapse, but there may be opportunity in the meantime…

💎 Degens’ Den

Crypto Treasury Summer 2025: Which Coins Will Make It?

Okay, so based on the narrative that many companies have positioned themselves with a strategy of buying crypto and putting it in their treasury, we need to look at and understand which coins these are. Simple logic says that where the large money is, the better chances of survival are.

This week saw a flurry of major treasury moves across crypto and public markets. Bit Origin, listed on Nasdaq, made headlines by adding 40.5 million DOGE (worth $10M) to its balance sheet. MicroStrategy continued its aggressive Bitcoin strategy, purchasing nearly $800M in BTC and filing for an additional $500M IPO to fund even more buying. Ethereum also drew significant attention, with heavy institutional accumulation reported.

Here are some companies adding crypto to their treasuries that we are eyeing:

Ethena (ENA) — StablecoinX Inc.

Primary Plan: Raise $360 million to purchase approximately 260 million ENA tokens—about 8% of the circulating supply—from a mix of open market and locked sources.

Hyperliquid (HYPE) — Sonnet BioTherapeutics

Primary Plan: Raise and deploy ~$800 million for the purchase of 12.6 million HYPE tokens, establishing the largest U.S.-listed public treasury of Hyperliquid’s native asset.

Source: CoinMarketCap

Litecoin (LTC) — MEI Pharma

Primary Plan: Raise $100 million via private placement to acquire and hold LTC, becoming the first and only public company on a national exchange to offer direct Litecoin treasury exposure.

Fetch.ai (FET) — Interactive Strength Inc.

Primary Plan: Raise and deploy up to $500 million exclusively for the acquisition of Fetch.ai's FET tokens, establishing what is expected to be the largest publicly listed crypto treasury focused entirely on an AI token.

Which Ones Come Next?

It’s hard to say which tokens will be adopted next, but the best bet is to look at those which have been around for a while, have achieved notable milestones, have a good team, and are able to position themselves so Wall Street can understand their goal and mission. For example:

XRP (XRP) has strong ties with the banking ecosystem, and it wouldn’t be hard to believe it could be next.

Meanwhile, Sui (SUI), with its close ties to Meta (Facebook), could also be a contender. Sui’s founding team includes former Meta employees.

And the narrative of Wall Street understanding Decentralised Finance (DeFi) could mean we’ll see more Ethereum-based projects adopted into company treasuries. For example, imagine a company with an Ethereum DeFi treasury, holding digital assets like Aave (AAVE) and Uniswap (UNI).

There’s speculation that BNB (BNB) could soon be adopted too. BNB recently surged past $800, setting a new record and overtaking Solana (SOL) in market cap.

Source: CoinMarketCap

Projects with tokens and coins that aren’t in the spotlight or don’t have proactive teams likely aren’t going to make the list.

If the main narrative of this summer is crypto treasury companies, then that’s where we need to focus our attention the most. Just like 2021 brought DeFi Summer, this summer may very well be remembered as Crypto Treasury Summer 2025.

Of course, as always, none of this is financial advice and you all need to do your own research.

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

Crypto Prediction Market Polymarket Weighs Launching Its Own Stablecoin

UK Reconsiders Digital Pound Strategy

💭 Banter’s Take

Everything seems great, doesn't it? But again, be wary.

The bull market looks like it's still going to continue, but a dip may be just around the corner… followed by a massive pump across the board for crypto.

See you all tomorrow!