💥 Even MORE Bullish on THIS Layer-1! Here's Why!

📰 Blast’s Munchables Gets Exploited - But There’s a Plot Twist!

📰 Blast’s Munchables Gets Exploited - But There’s a Plot Twist!

💎 Near (NEAR) Even MORE Bullish Now!

💥 RWAs Hit the Real World and Chainlink Doubles Down on Them!

🚀 The Trade That Doesn’t Last!

💭 Second Cycle Delusion

Good Morning Degens,

Yesterday we saw a net inflow of +$418m to the Bitcoin spot ETFs. The market didn’t move much as it is probably becoming a little numb to these stats. At some point the inflows vs outflows will calm down and stagnate, but for now we all know more is coming. No one cares about the outflows much, and the inflows are being priced in.

Ted here is calling for another $20-50b of inflows by the end of the year!

Meanwhile, Coinbase’s Bitcoin reserves are dropping ever more, now hitting a 9-year low!

If you’ve been following along, I believe that a Bitcoin supply shock will be a major catalyst for the crypto market to pump harder - amongst other things. Subscribe below so you don’t miss a thing!

And let’s dive in!

🌍 Market Catch-Up

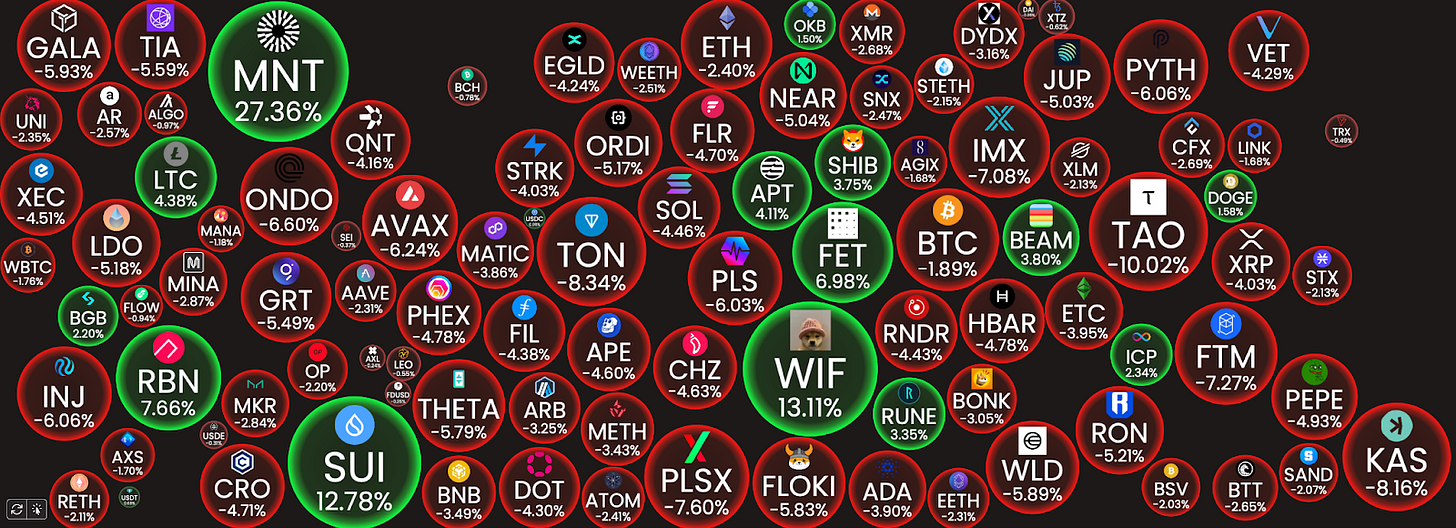

Top 100 coins Daily Performance - Banter Bubbles

📰 Story of the Day

Blast’s Munchables Gets Exploited - But There’s a Plot Twist!

Yesterday was crazy. Specifically this.

Rumors started coming in that the developers were past hackers who, after creating the smart contracts, actually held onto the private keys.

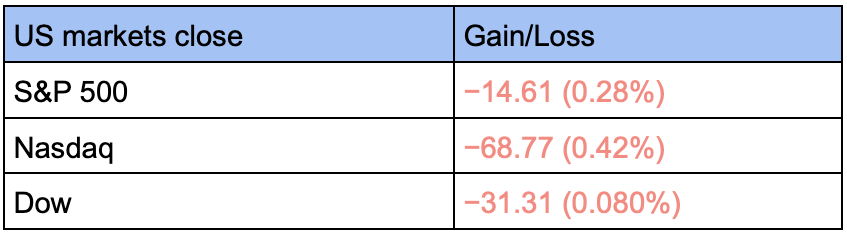

It was later confirmed by ZachXBT that the four developers/hackers hired by the Munchables team were actually the same person.

The malicious developer decided to cash out the $62m worth of Ethereum (ETH) that they drained, but actually, due to the way the Blast bridge is constructed, couldn’t get the ETH out fast enough. Many started calling for the Blast team to set the network back (and yes, this is something that can easily be done when the chain is centralized).

Plot twist!

Since they couldn’t take the ETH, in the end the exploiter/s decided to give the keys back! You can’t make this stuff up!

Lessons to be learnt:

For the time being, it may be in investors’ best interest for projects to remain centralized and for developers to not dispose of the keys to smart contracts, so that (in the worst case scenario) mistakes can be rectified.

We need to be extremely vigilant with new projects and always do our due diligence.

💎 Degens’ Den

Near (NEAR) Even MORE Bullish Now!

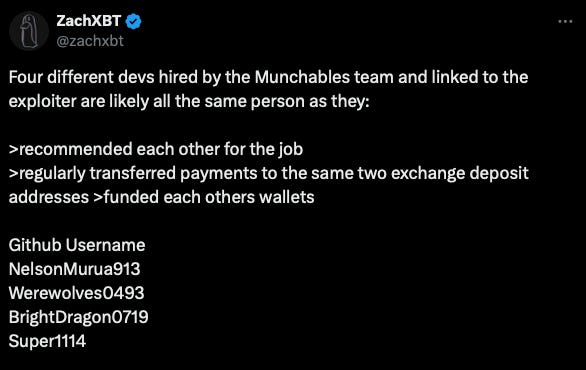

This is huge!

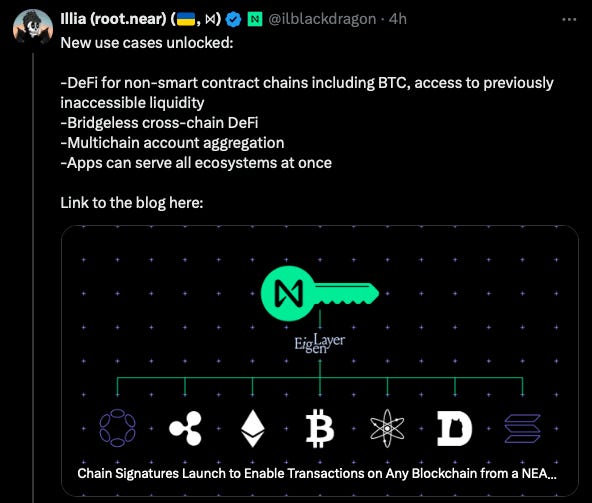

Near has just launched Chain Signatures and it makes the chain even more interoperable. Chain Signatures essentially enable NEAR addresses (e.g. wallet accounts and smart contracts) to sign transactions on other blockchain, without the need for bridges.

Right now, Chain Signatures support the following chains:

Bitcoin (BTC)

Ethereum (ETH)

Cosmos Hub (ATOM)

DogeCoin (DOGE)

XRP (XRP)

These are some of the major use cases that come with the introduction of Chain Signatures.

According to Near (NEAR), this is how it works:

Controlling accounts and their assets on other blockchain platforms is made possible thanks to the interaction between three elements:

Derivation Paths - Deriving foreign addresses from your NEAR account.

Multichain Smart Contract - Receiving requests to sign a transaction for other blockchains.

Multiparty Computation Service - A third-party service providing signatures to the contract.

That might be a little technical, but at the end of the day it’s progress towards getting chains to interact.

I’m bullish on NEAR!

💥 Best Posts of the Day

RWAs Hit the Real World

And so it begins!

We have talked about on-chain Real World Assets (RWAs) a lot recently, especially after BlackRock decided to go full on with the narrative. Now, HSBC has taken the actionable lead in Hong Kong, allowing retail to buy tokenized Gold on their website and app.

According to The Block “The HSBC Gold Token is built with the bank’s digital asset platform, HSBC Orion.”

Chainlink (LINK) - Tokenize Everything!

Oh look, more RWA news!

Chainlink (LINK) has had a great past year, up over 2.5x. Below is fuel to add to the chain reaction.

This is Chainlink Labs Chief Business Officer Johann Eid speaking about how RWAs will bring mass adoption of blockchain tech:

“Right now, our industry from my point of view has been a POC for something much, much greater. And this much greater thing has been tokenizing everything on-chain. Putting all the world’s value on blockchain, because blockchain is better. Blockchain is ownership. It is decentralization. It is transparency. When you have a financial system built on top of blockchain, it's a fairer, better, more global ecosystem. The way we get there is with tokenizing everything. Real estate, Gold, FX.”

Dogecoin (DOGE) Chart Looking Bullish

Price has been consolidating and the volume is spiking.

🚀 Trade of the Day

The Trade That Doesn’t Last!

We won’t chase these pumps. They don’t last!

As soon as Pocket Network (POKT) got its UpBit listing announcement, with it came a god candle! But the harder they pump, the harder they dump. In situations like these I personally wait for the price to correct.

It’s already back down to $0.279 since that pump.

But nevertheless, many are bullish on Pocket Network’s tech.

📢 Biggest Announcements

Tidal and Hashdex Spot Bitcoin ETF Set To Begin Trading.

Sui (SUI) Hits New ATH.

Hong Kong Bitcoin ETFs Expected to be Approved in Q2.

💭 Banter’s Take

We shouldn’t be overconfident!

This, that The Defi Edge describes below, is 2nd cycle delusion. Investors think they know everything after they ride the ups and downs of their first crypto bull run.

They don’t!

Not even the most experienced ones do. Having an exit strategy is their only hope.

Take it from Edgy.

See you all tomorrow!

Love your recap!