By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 First US Trade Deal Revealed: But Is It Bad News?

💎 Are These Altcoins About To Dump?

🐸 MEMEoirs of a Degen!

💭 Banter’s Take

GM Degens,

The first US trade deal has been announced—and it’s with the UK!

So far, the crypto market likes it. Will the US stock market reflect this at the open? The bad news is that the UK is not one of the biggest trading partners with the US, so things could realistically go south.

Meanwhile, some big tokens listing on a major exchange could spell disaster for their charts soon.

Let’s dive in!

🌍 Market Catch-Up

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 Question of the Day

First US Trade Deal Revealed: But Is It Bad News?

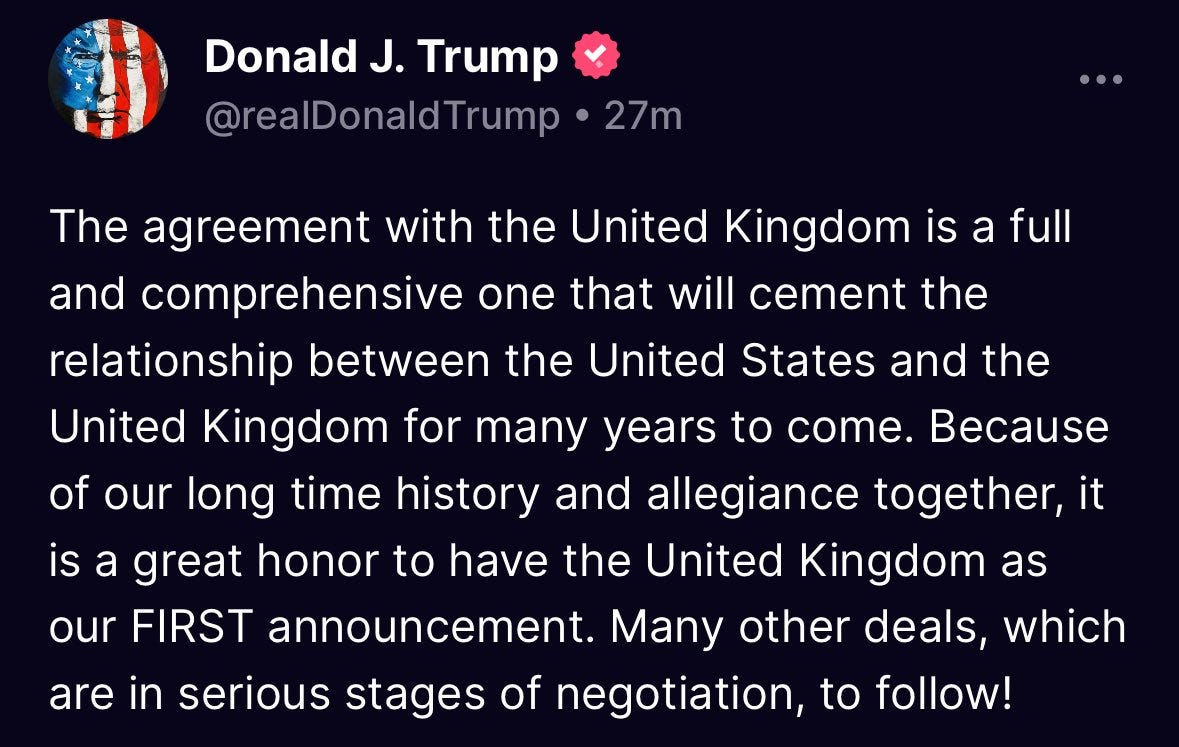

President Trump has dropped news of a trade deal with the UK! But the best is yet to come, and we're gonna look at what might happen next further down.

Rumored yesterday, the anticipation of the good news affected crypto as well as stocks, and the news is now sending them both higher. Bitcoin (BTC) is on the verge of breaking $100K again. This is a major psychological level, and getting above it really matters.

Can it break soon?

Well, Bitcoin has now made a higher high and higher low, and, according to Crypto Yoddha, “is about to break the red dotted resistance[…]and make a new ATH”.

Meanwhile, with Texas and other US states racing to approve their Bitcoin Strategic Reserves, the bitcoin on exchanges continues to deplete. We just saw Bitcoin ETFs take in over $142M in net inflows (Ethereum (ETH) ETFs saw nearly $22M in net outflows).

The S&P 500 closed up 0.5%, and the NASDAQ rose 0.3% yesterday. If they imitate crypto today, feeling bullish with the first US trade deal done, stockholders could be in for a treat. However, note that the UK is not among the US’s biggest trading partners, so we wait to see if the market will actually dip on this news.

The UK Deal Is NOT A Big Deal…

Looks like Trump wanted to make his first announcement a big one. When it comes to numbers, as we’ll see, the UK is not realistically a “big one,” but we’ll give him the fact that the UK is big when it comes to the historic relationship with the US.

Let’s explain.

The biggest U.S. trading partners, based on total trade volume, are Mexico, followed by Canada and China, according to US Census Bureau data.

Top 3 US Trading Partners (2024, Goods and Services)

Mexico: Total Trade: ~$762.1 billion

Canada: Total Trade: ~$739.9 billion

China: Total Trade: ~$582.4 billion

However, to the U.S.—particularly under Trump’s policies in 2025—trade deficits matter more than total trade or trade surpluses. Trump likely views large deficits—where the US imports more than it exports—as signs of economic weakness and “unfair” trade. A trade deficit pushes leaders like Trump to tax imports to balance things out. Total trade size makes the tariff’s effects bigger, but the deficit is the main reason tariffs happen.

On that note, the three countries with the largest trade deficits with the US in 2024 (where US imports exceed exports) are:

China: -$295.4 billion

Mexico: -$171.8 billion

Vietnam: -$123.5 billion

When it comes to trade surplus, it's less important to the US and Trump because it indicates the US is exporting more than it imports from a country.

Since there is an $11.9 billion surplus with the UK—which likely aligns with the US’s economic goals—you start to see that a US-UK trade deal is not a big deal.

Lastly, let’s rank the top three countries with the largest US trade deficits in 2024 by combining total trade volume, deficit size, and looking at deficit ratio (deficit divided by total trade) to reflect both scale and imbalance. A higher deficit ratio means a more imbalanced trade partnership.

Vietnam: 92.1%

China: 50.7%

Mexico: 22.5%

When a trade deal with one of the above gets announced, things could turn bullish FAST. If we start seeing rumors about one of these top countries nearing a trade deal with the US, we now know things could shift bullish really quickly—either because the impact will be bigger than the UK deal, or, if the UK deal leads to a market dump, we at least got a dress rehearsal of what could happen.

FOMC and Powell

President Trump says, "Our economy is doing well, but it's going to BOOM in a way never seen before." And based on Fed Chair Powell's speech yesterday, it seems he aligns.

The Fed kept interest rates steady at 4.25%–4.50% for the third meeting in a row, playing it safe with some economic unknowns out there. Powell said inflation’s still a bit high, above the Fed’s 2% goal, but the overall vibe on inflation looks good—even if folks are expecting prices to creep up soon. He flagged big concerns about tariffs, which are way larger than anyone saw coming and could push up prices while slowing jobs. Still, Powell thinks the economy’s in a pretty good spot and said there’s no rush to cut rates, giving the Fed time to figure out how tariffs and weird trade swings—which mess with GDP numbers—will play out. He brushed off Trump’s rate-cut demands and stressed the Fed’s ready to move fast if things shift, keeping a close eye on new data as it comes.

Powell didn’t drop the word "stagflation" at the press conference, but he kinda hinted at it by talking about a "tension" in the Fed’s goals. He pointed out that those huge, unexpected tariffs could jack up prices and unemployment, slowing down the Fed’s push for 2% inflation and max jobs. It seems the Fed is in wait-and-see mode.

For those that don’t know, stagflation is when high inflation and stagnant economic growth happen at the same time, often with high unemployment.

Conclusion

Some deals will affect the market more than others.

If the US market does not dump on news of the US-UK trade deal, it shows that the bigger deals will bring extremely bullish market sentiment.

If the market does dump on US open, it’s not the end of the world—this pump was a dress rehearsal for what will happen when one of the big ones is announced.

Bitcoin has a major psychological level to overcome now at $100K.

The Fed is not in a rush to cut interest rates—Powell is playing hard to get with Trump!

Be prepared for a volatile move today when the US market opens. If the market likes the UK deal, Bitcoin could continue tracking the M2 as we’ve been monitoring.

💎 Degens’ Den

Are These Altcoins About To Dump?

Ethereum seems to be making a move, but it’s hard to tell whether it’s due to the Pectra upgrade or broader market momentum. The chart shows it's up nearly 7% today, but it faces strong resistance ahead.

Two other performers today are Celestia (TIA) and Io.net (IO), thanks to their Upbit listing. Historically, when tokens are listed on big exchanges, they experience significant price movements due to platform influence and market dynamics. But what happens next?

A 2025 analysis conducted by CryptoNinjas in collaboration with Storible examined the price behavior of tokens listed on six major centralized exchanges (CEXs) in 2024: Binance, Bybit, OKX, Coinbase, Bithumb, and Upbit. They analyzed 389 tokens, focusing on their price at listing, all-time high (ATH), and current price as of February 4, 2025.

Key Findings:

Average Initial Surge: Tokens saw an average price increase of 54% upon listing.

ATH at Listing: Around 37% of tokens hit their ATH at listing, never surpassing that peak again.

Post-Listing Decline: A significant 89% of tokens declined in price after listing, with an average drop of 52% from their peak.

Source: CryptoNinjas

As always, this is not financial advice — you should all do your own research. That said, based on historical patterns, it seems likely that the pump won’t last. While this doesn’t change anything fundamentally or in the long term, it may offer some indication of the next short-term move.

The Daily Candle

Did you know that Crypto Banter also offers a newsletter featuring our traders’ journals?

Today, Dylan and his team are looking at Optimism (OP) and Virtuals Protocol (VIRTUAL) amongst others! 👇

🐸 MEMEoirs of a Degen!

💭 Banter’s Take

Keep a close eye on the US market open to see how it prices in the done deal between the US and the UK. This will provide a major indication of what might happen next in both the short and medium term.

A volatile move is likely, regardless of the direction the market takes.

See you all tomorrow!