👉 Here's Why The Market Dump Is Not As Bad As You May Think!

🐋 Whales Are Buying These Memecoins!

By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 The Market Dump Is Not As Bad As You May Think!

💥 Best Alpha Posts of the Day

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

💭 Banter’s Take

GM Degens,

The market is dumping, and we, along with most people, did not expect this. But after a little digging, it seems that this may not be the end of the world. It actually might be the beginning of something very good.

Let's dive in!

🌍 Market Catch-Up

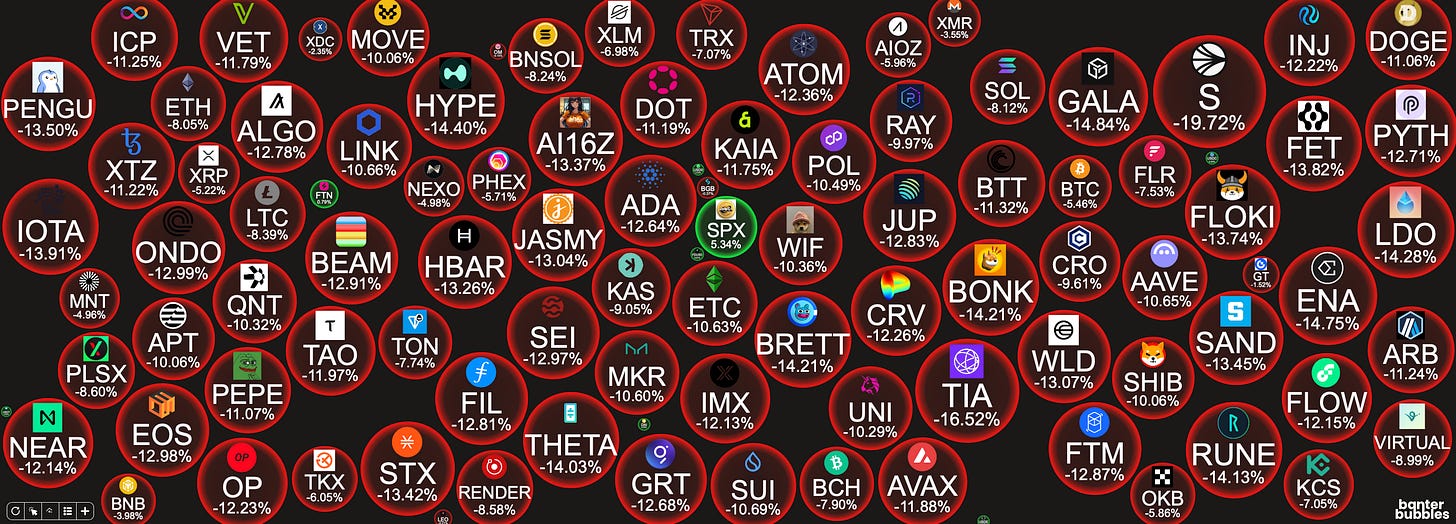

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 News of the Day

The Market Dump Is Not As Bad As You May Think!

Well, we can't win them all. Apparently, $100k was a support level that did indeed break like glass as Bitcoin touched it. This just solidifies the thesis that it would need to spend more time above $100k, consolidating to make it a stronger support.

Yesterday, everything dropped, especially certain altcoins. I'm looking at you, memecoins, down 15-20% (more on memes further down).

Why is this happening?

The drop caught everyone off guard, but it's not as bad as it may seem, even though the daily structure and the daily candle printed yesterday for Bitcoin looked bad on initial sight.

Let's explore:

The market seems to be in a bit of a confused state. Data shows that it's normal to get a drop at the start of the month; it's been happening recently, but it usually comes a bit sooner on the calendar. That's why no one was expecting this, so you could say it was delayed. However, there is a more serious reason for the dump. At the same time, let's not forget Bitcoin's price has only moved back a few weeks—it's all about perspective.

Here are the major reasons why all of this happened (Spoiler: It was all macro-driven), and keep in mind that the rest of crypto follows Bitcoin.

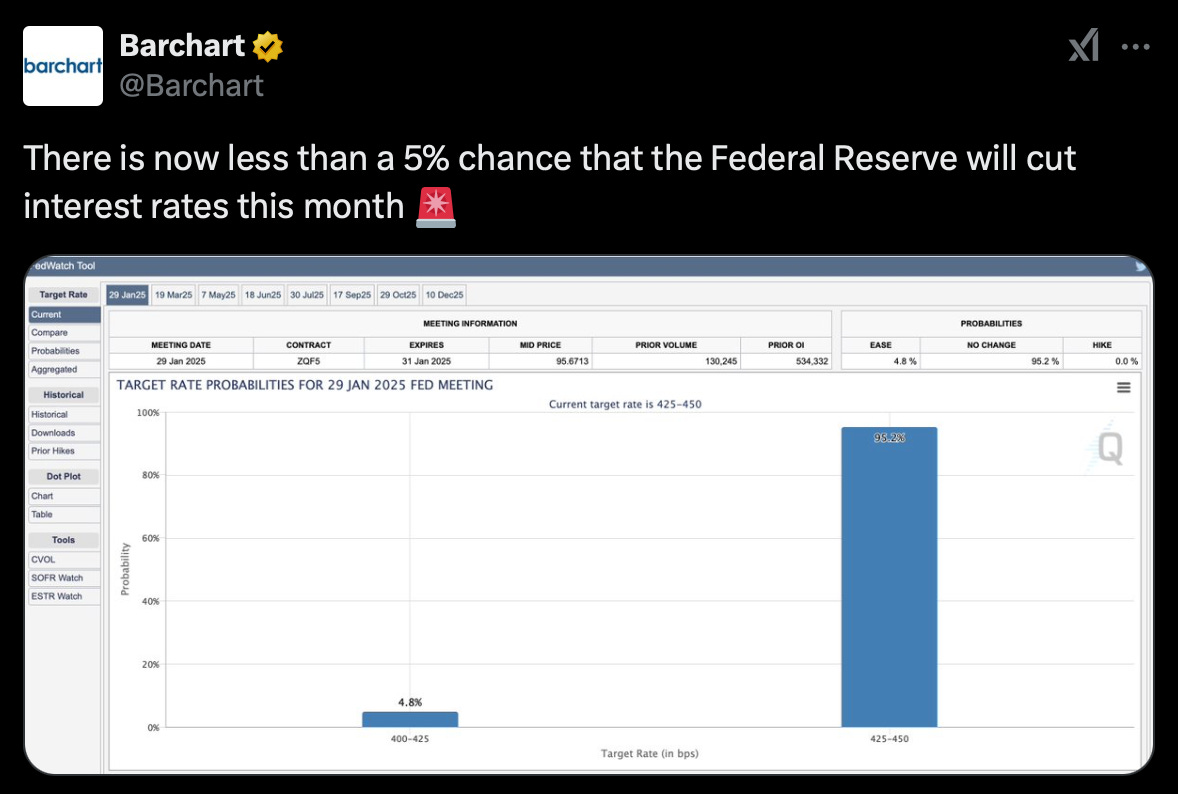

The latest jobs numbers and ISM Manufacturing Index came in hot!

Jobs Numbers: Expectations were set at 7.8 million, but we saw a robust 8 million. This shows the economy is beefing up, and could mean a tight labor market and potentially higher consumer spending.

ISM Manufacturing Index: Forecasts pegged it at 53.5, but it came in hotter at 54.1. This means manufacturing activity is accelerating, which could drive up prices and in turn raise eyebrows regarding inflation risks.

Speaking of inflation, President-elect Donald Trump said that both inflation and interest rates are too high. But that's a bit of a weird statement because there's a balance between the two.

However, it could be possible to reduce both!

Reducing interest rates can stimulate borrowing and spending, which can lead to increased demand for goods and services. If demand outpaces supply, it can indeed push inflation higher. But…

Reducing government expenditure can decrease the amount of money circulating in the economy, theoretically helping to lower inflation. This is because less government spending can lead to lower demand, which might stabilize prices.

And we know government spending might be reduced in the US because of Vivek Ramaswamy and Elon Musk running the Department of Government Efficiency (D.O.G.E.), which aims at cutting lots of government spending and other inefficiencies.

If all this happens, technically we could see:

Stocks: Lower rates will make borrowing cheaper, boosting corporate profits and stock valuations. Reduced government spending might increase economic uncertainty but could also lead to lower bond yields, pushing investors towards equities for better returns.

High-Yield Bonds & Crypto: With lower yields on safer investments, investors might chase higher returns in riskier assets. Government spending cuts could introduce volatility, but if seen as a move towards fiscal responsibility, it might support (aka pump) these assets.

Cool. So things aren’t as bad as they seem now, eh? At least that is what the data says. You all need to do your own research as none of this is financial advice.

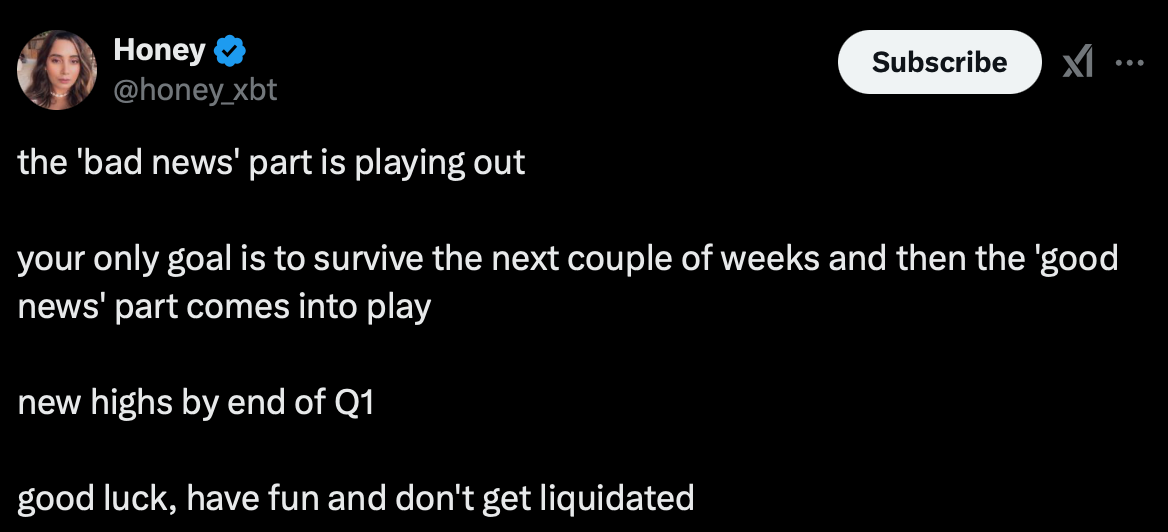

So, this could all be a big overreaction to the news, but it is what it is right now. The market is pricing in future bad news, so things would improve massively if we don’t get that bad news. We just need to wait.

💥 Best Alpha Posts of the Day

Groundhog Day Ending Soon?

Is it a matter of time before altcoins break out? According to Jelle, altcoins are following Bitcoin's 2021 move eerily similarly. You can see this in Jelle's chart below. If the chart continues playing out, altcoin holders could soon be in for a nice surprise.

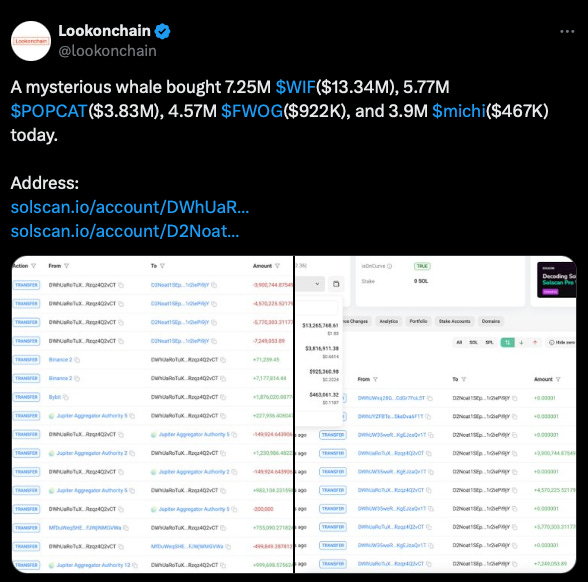

Whale Buys A Dog And A Cat

Memecoins were dumped as mentioned in the section above. What did the whales do?

You guessed it, they bought!

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

Bhutan's Gelephu Mindfulness City to Include BTC, ETH, and BNB in Strategic Reserves

Bitfinex Acquires Digital Assets Provider License in El Salvador

Elon Musk Clarifies No Immediate Plans for Crypto Payments on X Platform, Cites Licensing Requirements

South Korea to Lift Ban on Institutional Crypto Trading

💭 Banter’s Take

Just when it seems crypto is breaking through, we go on to get another dump. Yes, for many, this can be exhausting. But that is crypto. In fact, that is more than crypto. Have you checked some of the traditional lower-cap stocks? Many dumped. But the mindset of most people in crypto is "get rich fast." And barring getting lucky and picking a micro cap that does 100-1000x, that is not the case for 99.9% of the people here.

But exhaustion is real.

See you all tomorrow!