👉 If This Plays Out, Bitcoin Could Crash To $90K!

Bitcoin Crashed 32% The Last Time Altcoins Did This!

By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 If This Plays Out, Bitcoin Could Crash To $90K!

💎 Bitcoin Crashed 32% The Last Time Altcoins Did This!

🐸 MEMEoirs of a Degen!

💭 Banter’s Take

GM Degens,

We’ve been saying a dip was likely for a while now, and here it is. This will surely scare a lot of newcomers, but if you’ve been around, you know this is just part of the game… Or is this time different?

We’re gonna look at how low Bitcoin could potentially go while dragging the rest of the market with it.

Let’s dive in!

🌍 Market Catch-Up

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 News of the Day

If This Plays Out, Bitcoin Could Crash To $90K!

First, note that this week is packed with macro events, including:

Tuesday: Fed Chair Powell speaks.

Wednesday: August New Home Sales.

Thursday: August Durable Goods Orders; US Q2 2025 GDP; August Existing Home Sales.

Friday: August PCE Inflation.

But, over to what concerns crypto most right now: the market is dropping fast, especially altcoins.

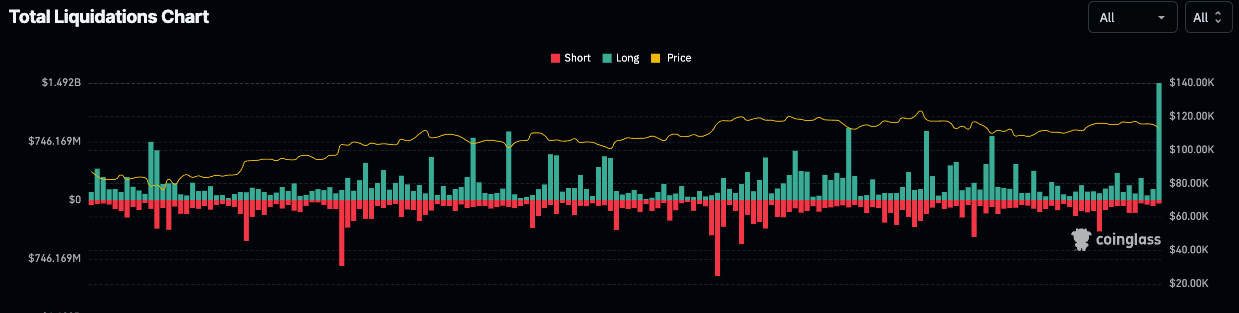

We’ve just seen the biggest liquidation of the year, with over $1 billion wiped out in less than an hour; zooming out, Bitcoin (BTC) isn’t down much, but the weakness hints at lower levels potentially coming, while alts are getting obliterated. The market just saw its largest daily liquidations since summer 2023 for Ethereum (ETH) and Solana (SOL), and since June for Bitcoin.

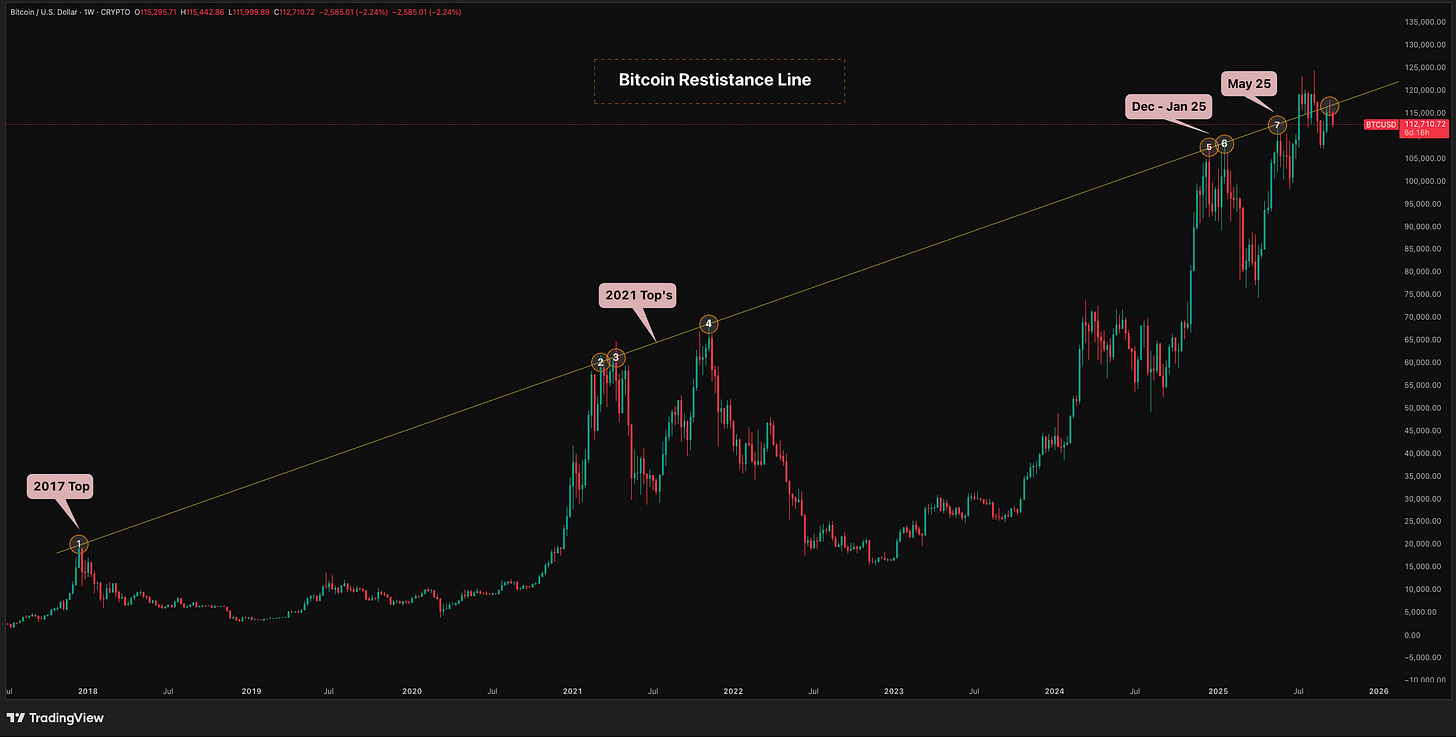

Interestingly, this BTC pullback came exactly at the 2017–2021 resistance line you can see below.

It also landed during the triple witching, which we touched on last week: it’s the quarterly event when major Bitcoin‑linked derivatives (like CME BTC options and futures) expire simultaneously—typically the third Friday of March, June, September, and December—often bringing increased volume and volatility.

Overall, no one should be shocked by today’s price action. For days, Bitcoin’s derivatives interest has lagged altcoins, some stablecoins have traded slightly above their peg, random altcoins are mooning without fundamentals, and new altcoin Digital Treasury Assets (DATs) are crashing 90% within a week—classic froth.

So, how low might Bitcoin go?

Year to date, in 6 out of 8 months, Bitcoin set its low in the first couple of days of the month. $107,000 is the September low so far, and based on that data odds favor it won’t break—but what if it does and echoes the other two times?

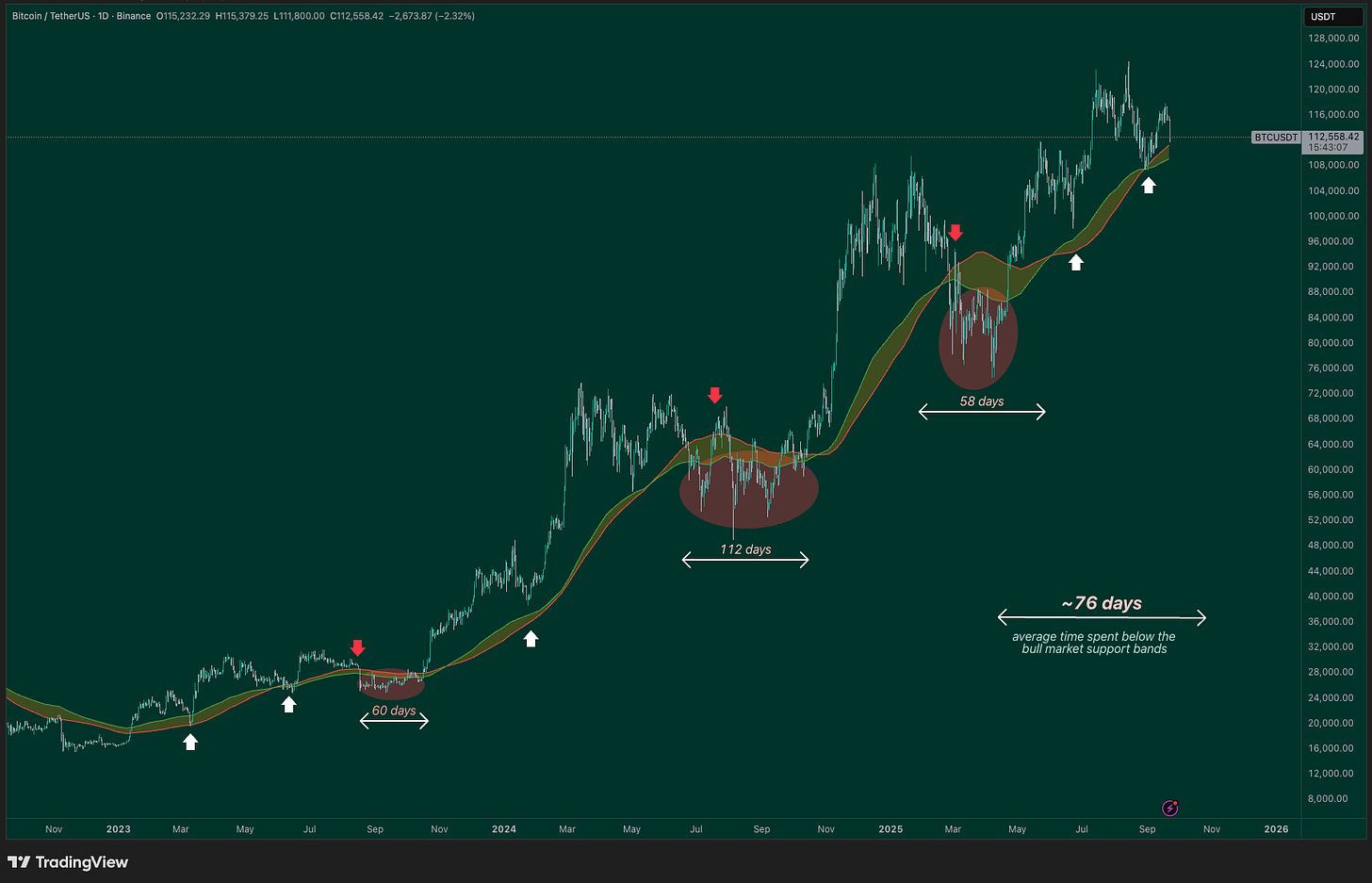

Well, recently, Bitcoin has tested its bull market support band about eight times; three of those times it broke below and then spent about 76 days on average under that line. If we do head lower, history would suggest we could see bearish sideways action for a similar amount of time.

Final thoughts

As we've been saying for some time now, bull markets don't come without major dips. This is one of those. Despite varied timeline theses, we still believe that there is going to be a blow off top as always at the end of the bull cycle.

When it comes to altcoins, one more sign we have room to run is the Russell 2000—kind of like the altcoin chart for stocks—pushing toward ATHs after 1+ year. Dig deeper into the thesis on today’s episode of Crypto Banter with Ran. 👇

The Biggest Bet of This Cycle: 0G Labs

0G is being called the “Solana for AI”—a Layer 1 chain purpose-built for AI, backed by $325M in funding, with 50,000x faster performance than competitors and 300+ partnerships including Alibaba and Optimism. Last cycle, DeFi defined the narrative. This cycle, it’s Decentralized AI—and our new partner, 0G, is already positioning itself as the clear leader.

As costs of centralized AI explode and regulators demand verifiable systems, 0G delivers an all-in-one stack for AI: storage, compute, and execution—at up to 90% cheaper than today’s alternatives. Think Ethereum for DeFi, Solana for dePIN… now 0G for AI.

Why is 0G Labs set up to be the biggest breakout launch of this cycle?

50,000x faster AI performance

First all‑in‑one AI stack (storage + compute + execution + marketplace)

90% cheaper AI training costs

+300 partnerships (Alibaba, Optimism, NTT Docomo)

+$325M in funding from tier-1 VCs

The 0G token launches today, September 22nd.👇

💎 Degens’ Den

Bitcoin Crashed 32% The Last Time Altcoins Did This!

Remember that Binance Smart Chain project we mentioned last week—Aster (ASTER)?

ASTER has flipped Bitcoin in 24h perpetual volume on Hyperliquid (HYPE). We’ll look at this token again in a second, but first on HYPE: Arthur Hayes sold all 96,628 HYPE (~$5.1M) he bought a month ago, making about $823K (+19.2%), after previously suggesting HYPE could 126x.

Does Hayes know something? Why would HYPE show any weakness right now?

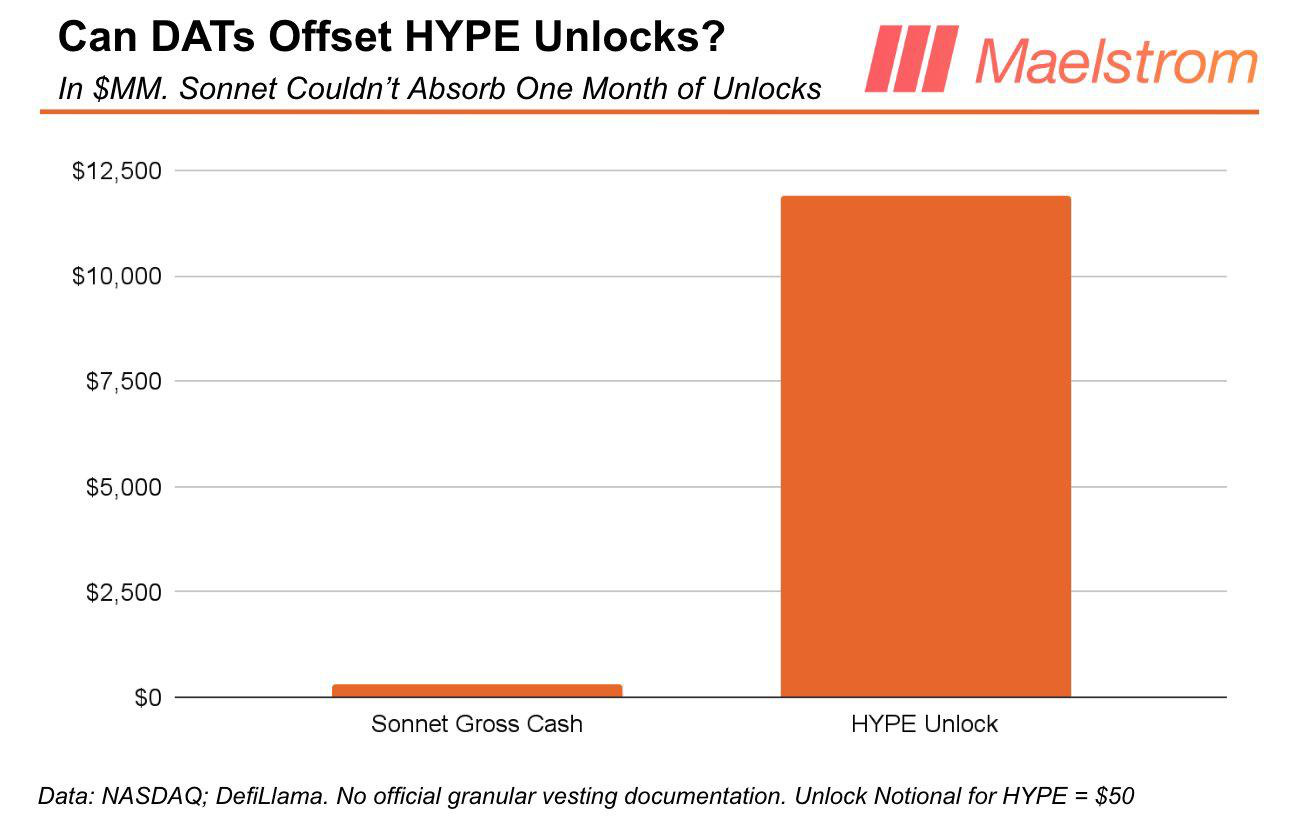

This is why: HYPE is heading into unlocks, with a major date on Nov 29th. Here’s the dashboard for those unlocks:

At current levels, there’s roughly $11,892,000,00 in unlocks. But it’s hard to see Digital Asset Treasurers (the biggest buyers right now) offsetting that potential sell pressure.

Lion Group Holding Ltd. have publicly announced a strategic treasury reallocation, converting a significant portion of their previous Solana (SOL) and Sui (SUI) holdings into Hyperliquid tokens. Lion Group's treasury holds approximately 194,726 HYPE tokens as part of a $600 million treasury allocation plan focused on Hyperliquid, making them the biggest institutional holder and buyer of HYPE to date.

Sonnet BioTherapeutics, target a $583 million treasury primarily allocated to HYPE tokens.

There are more, but their buys look minuscule relative to the unlocks.

Back to Aster. For many, it was a great trade with quick gains, but probably not great for the broader altcoin market. Liquidity got sucked from other coins, similar to the TRUMP launch on Jan 17th, which preceded a 32% BTC drawdown.

The TOTAL3 also topped on the TRUMP launch day, perfectly testing the 2021 ATH before getting rejected and dropping 42%.

History doesn’t repeat, but it does rhyme in crypto.

🐸 MEMEoirs of a Degen!

Everyone is like:

💭 Banter’s Take

As October approaches, it’s interesting to think about those who believe in the four‑year cycle selling into the idea that history repeats. Whether this cycle runs longer thanks to institutional adoption or digital asset treasurers is anybody’s guess, but if the sellers are wrong, they’ll likely chase higher, causing a cascade of short liquidations and upside momentum when that time comes.

For now, we are monitoring the dip, which seems normal for any crypto bull market.

Have a great start to the week.

See you all tomorrow!