By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 IMMINENT: This Could Be THE Catalyst For Crypto!

💎 Memecoins Dead? And What’s Up With ETH?

💥 Best Alpha Posts of the Day

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

💭 Banter’s Take

GM Degens,

Something is happening under the radar, and if you're not in crypto, you probably have no clue. The way people are talking about it, it could be one of the biggest things to happen in recent crypto history. Some are saying it could be one of the greatest catalysts for adoption ever!

Let’s dive in!

🌍 Market Catch-Up

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 News of the Day

IMMINENT: This Could Be THE Catalyst For Crypto!

So, the US stock market is closed today as it is Presidents' Day. And we probably won't get any announcements from Michael Saylor about Strategy buying Bitcoin last week, seeing as he hasn't teased anything on X as he usually does.

Now, on a global scale, crazy things are happening for Bitcoin and crypto. First off, before the big story, let's just take a brief look at how Argentine lawyers are going after Argentine President Milei for promoting a memecoin that turned out to be a rug pull called LIBRA. He has since gone on X to say that he is not associated with the project, however. But this certainly is not a good look for crypto.

Now onto something quite significant. And though this is just a thesis going around, it is extremely interesting.

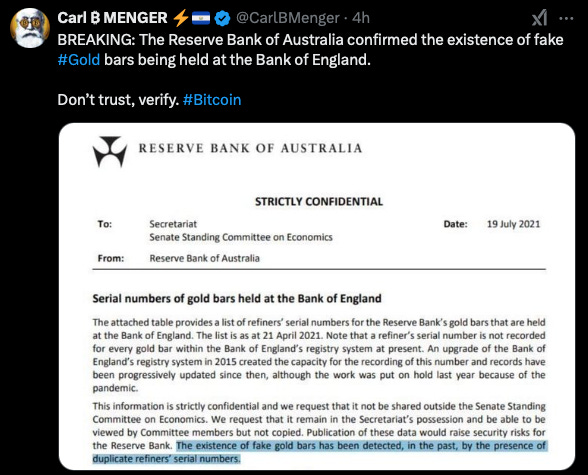

Gold is held in many countries' reserves, as you may know. It's seen as a hedge against inflation and is believed to hold its value long-term. Just ask Peter Schiff about it. But recent news showing that the Reserve Bank of Australia (RBA) has confirmed the Bank of England holds counterfeit gold bars has now raised many concerns about the actual reserves held by all other countries.

As you probably guessed, the US is no exception.

Discussions on X show people calling for an audit of the USA's reserves. The reserves are held in Fort Knox, but there has reportedly not been an audit since 1974 to check on the US's over 8,000 metric tons of gold, worth over $540 billion.

The shift from the gold standard in 1971 by President Nixon might have been a catalyst for a more 'meh' response to people wanting to audit the reserves. But guess who's hinting at an audit now...

Why does this matter, you ask?

Well, here's the thesis, and it's not far-fetched. However, take this with a pinch of salt.

Imagine this plays out, and Trump says something like, "Hey, look, the previous admins didn’t check, and now we have barely any gold left. How do we solve this? With a digital currency on an immutable, transparent, public ledger, aka Bitcoin."

All hell could break out as FOMO kicks in, but as we said, that is just what people are speculating, and no one can know what would actually happen. As usual, none of this is financial advice, and you all need to do your own research.

However, according to Jelle's chart below, it would somewhat align, would it not?

“Higher lows after a period of slowly grinding lower. Not the first time we're seeing that this cycle. All previous instances played out the same, price flying higher shortly after.” - Jelle

💎 Degens’ Den

Memecoins Dead? And What’s Up With ETH?

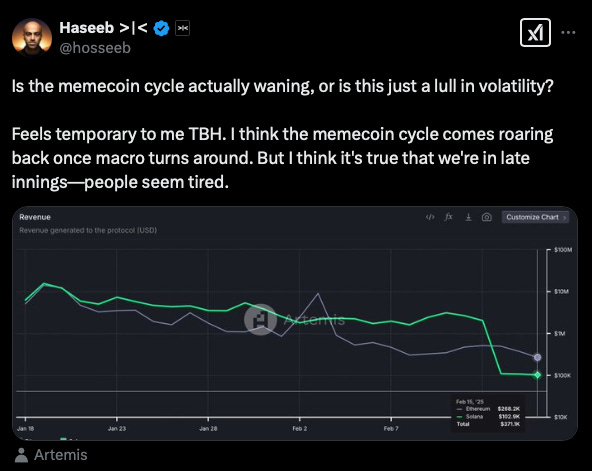

People have been talking about how the memecoin cycle caused damage to the altcoins market, creating liquidity flows to memes-only, and also how the immense number of coins being released are literally diluting that liquidity more and more. There are more coins on the market than participants, and this is highly due to the one-click coin creation tools available to all and any.

There are, however, some who believe the cycle will return, like Haseeb below.

Many are known to look to the leading altcoin, Ethereum (ETH), to form their sentiment, but it seems that it is not doing as well as some might have hoped, especially when considering Bitcoin’s trajectory. Daan Crypto trades explains this in a post on X.

💥 Best Alpha Posts of the Day

Where Is US Taxpayer Money Going?

If you live in the US, you might want to read this.

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

California State Pension Funds Invest $41 Million in Strategy (MSTR)

J.P. Morgan Acquires $100 Million in Strategy

Elon Musk's SpaceX Holds $800 Million in Bitcoin

💭 Banter’s Take

Wall Street has the day off, and as it has influenced a lot lately, there might be less stuff happening today. There isn't a massive week ahead in terms of events, but it will be interesting to see if this gold reserve issue kickstarts the global Bitcoin adoption many have been expecting.

See you all tomorrow!