Is Solana still worth it?

Overview

State of Solana 2022 Q4 and beyond.

US seizes $700m of SBF funds.

FTX is Genesis' largest unsecured creditor.

Fantom’s (FTM) upcoming ecosystem funding.

Good Morning Banter Fam,

Solana faced some significant setbacks after the FTX collapse, and many questions remain about the network.

For starters, is Solana worth an investment?

We'll provide a quick summary of the recently published State of Solana Q4 2022 (available at Messari.io) in hopes it can help answer some of those questions and many more.

Some of Solana's significant setbacks in 2022:

Various network halts.

Mango Markets exploit.

FTX implosion and unsettled funds in FTT, SRM (~$134m), and FTX Trading common stock shares (~$3.34m)

Hetzner’s terms of service.

Positives from 2022:

Helium Mobile partnered with Solana Mobile to bring Saga phones to the US.

Ledger announced it would support Solana Mobile Stack (SMS).

Payments platform Strike debuted its fiat-to-crypto onramp with 11 of the 16 projects supported on Solana.

Google Cloud announces plans to introduce a Blockchain Node Engine to Solana in 2023.

Squad Protocol brings Account Abstraction (AA) to Solana.

Neon EVM is set to go live in 2023.

Jito Foundation released Jito-Solana, a third-party validator client, to maximize MEV features.

Solana's Nakamoto Coefficient (degree of decentralization) remains above the industry average:

Source: Messari.io

Q4 “Frontier Use Cases”:

Orbis (ORBC) - Enable Solana devs to use SDK to integrate social experiences in apps.

Alephi.im Network - Released Solana’s first fully open-sourced, decentralized indexer.

Hivemapper (HONEY) - Decentralized Mapping network.

Homebase - Real-Estate on-chain.

Bonk (BONK) - Solana’s first meme coin.

“The Road Ahead”

In general, the Solana platform is a thriving ecosystem with its eye set forward with various updates scheduled for 2023. Even though the FTX collapse set the network back, it improved its overall outlook in other ways. For starters, SOL token holders will have less sell pressure and influence coming from venture capitalist supporters Alameda Research and FTX ventures.

According to the report, Solana, as a platform, is working on several improvements to enhance its ecosystem, including network upgrades, mobile applications, and community building. In October, Solana Co-Founder Anatoly Yakovenko released some initiatives for the platform. One of the major initiatives is called Asynchronous Block Production, which looks to make the blockchain more efficient by allowing the blockchain producer to focus on the most critical transitions. The initiative will lead to faster confirmations for users and more fees collected by the producer. So, in other words, Solana will become more efficient!

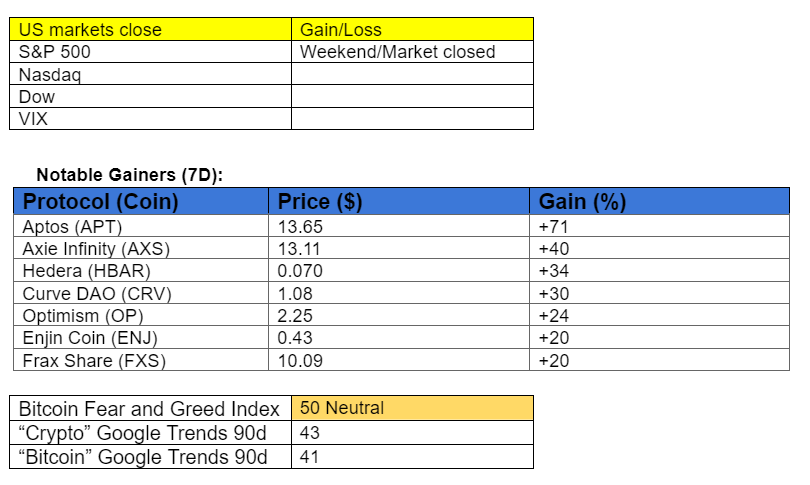

Market update 🌍

BTC/USDT 1W

It's been another solid week for Bitcoin, which gained +8.08% and nearly 47% since the low of $15,476 in Nov 2022. The weekly charts indicate more room to climb, with the next major resistance level (yellow) sitting at $24,500. Although, the Stochastic RSI (Relative Strength) oscillator shows that the current trend is nearing its top after recently breaking into overbought territory. BTC completed the weekly candle up +8.08% to $22,707.

High-resolution chart.

SOL/USD 1W

It is fair to overview the Solana chart since it complements the recently released Solana Q4 State of the Network report above. After two stints of climbing +138% in two weeks, SOL slowed down the pace last week and rose +5.33%. Stochastic RSI (Relative Strength Index) also shows that it may be slowing down. On the weekly chart, SOL is still in a long-term downtrend pattern (red) that began in August 2023. This week's good performance could break the trendline, but SOL is also facing an established resistance (yellow) of $24.00. SOL completed the weekly candle up +5.33% to $24.21.

High-resolution chart.

Newswatch 📰

US seizes $700m of SBF assets. Officials in the US have filed paperwork to claim $700 million worth of assets, including 55 million Robinhood shares valued at $525 million and $171 million from bank accounts linked to former FTX CEO Sam Bankman-Fried's companies, which were seized earlier this month. The government is now seeking to forfeit these assets, per a bill of particulars filed in Bankman-Fried's criminal case.

FTX’s largest unsecured creditor: Genesis. FTX's largest unsecured creditor is revealed to be crypto lender Genesis Global Capital, with a debt of $226.3 million, per a court filing. In addition, the revised list of the top 50 creditors includes any creditor appointed by the US trustee in the Official Committee of Unsecured Creditors case.

Fantom’s funding efforts: Fantom has launched Ecosystem Vault, a decentralized fund financed by 10% of the transaction fees on the blockchain and controlled by the community. The fund was made possible by decreasing the burn rate of FTM and redirecting the resulting 10% to the vault. Any proposal must receive at least 55% approval from the community to be funded, with at least 55% of FTM stakers in attendance. Payments will be executed manually via the Fantom Foundation to fund projects whose proposals are approved by the Ecosystem Vault.

News tidbits:

The first day of the Genesis Bankruptcy hearing is on Monday, Jan 23.

Stellar Foundation owed $13m from Genesis.

Moody’s further downgrades Coinbase's credit rating.

Signature Bank reduces crypto exposure.

Vitalik: Incomplete guide to stealth addresses.

Ethereum devs ACDE call writeup.

Comos-based Layer-two: Nitro Labs.

NFT & metaverse update 🐵

DefiLlama’s NFT Twitter spaces with some great alpha.

Banter’s take

Don't be lulled to sleep by the favorable price action in the crypto markets. Although it seems promising for now, there still may be a long road ahead. After all, the Federal Reserve is still hiking rates and performing Quantitative Tightening (QT).

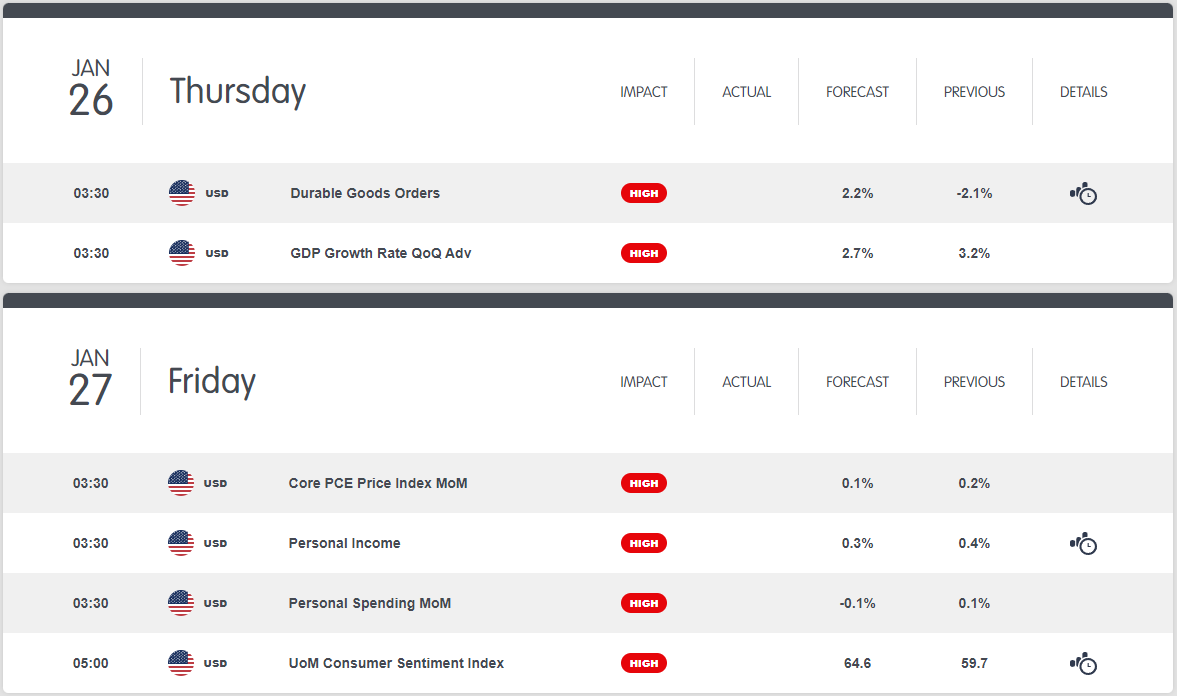

This week is no exception. There are several big-name earnings this week, including Microsoft (MSFT), Tesla (TSLA), IBM (IBM), and a few others, that could hold some influence on the overall markets, especially if they fail to meet expectations.

Below are some other essential scheduled releases set for this week.

Source: Babypips.com

Until tomorrow!

Gabriel

Follow me on Twitter for daily updates!