👉 Last Time This Happened, Crypto Skyrocketed!

💎 This Is Where The Volume And Fees Are Right Now!

By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 Last Time This Happened, Crypto Skyrocketed!

💎 This Is Where The Volume And Fees Are Right Now!

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

💭 Banter’s Take

GM Degens,

Every day that passes brings us closer to the end of this cycle, but with what’s happening in the US, some believe there’s still room for expansion. The charts seem to be pointing to movement soon—whether up or down. But right now, Bitcoin’s volatility is at some of its lowest levels in a long time.

Let’s dive in!

🌍 Market Catch-Up

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 News of the Day

Last Time This Happened, Crypto Skyrocketed!

Bitcoin finds itself in a tight range, with volatility at some of the lowest levels in its history. This kind of stillness has only happened about 15 times since Bitcoin began—a period many call "boring." The Bollinger Bands, which measure volatility, are so contracted it’s almost comical. As we’ve noted before, such contraction typically precedes an explosion—either to the upside or downside—but no one can predict which way it’ll go. As usual, none of this is financial advice and you all need to do your own research!

With the Bollinger Bands this tight, it’s a 50-50 shot. To get a better sense of market sentiment, we turn to other metrics. Like the one below, showing long-term holder selling is diminishing.

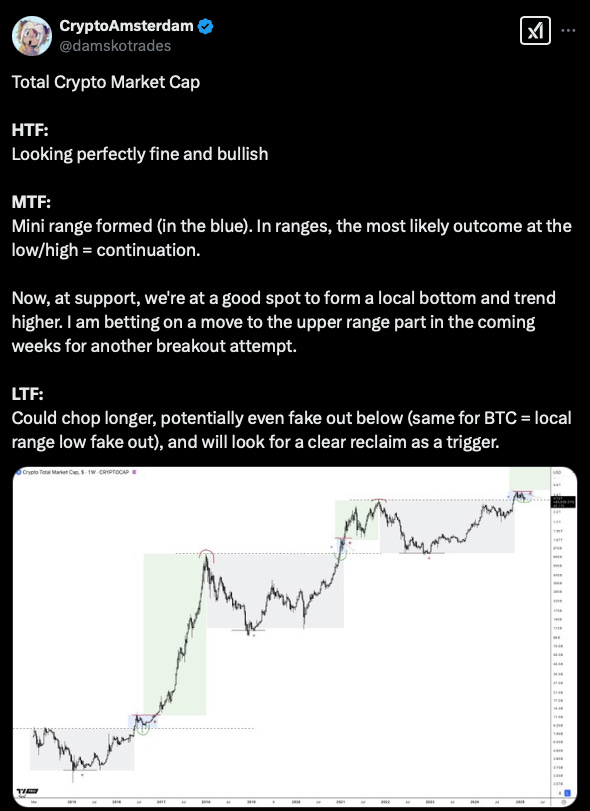

Looking at Bitcoin’s open-to-close path since its inception, it tends to have more red days than green. However, the green days are so massive that they’ve driven the overall price upward over time. Zooming out, charts like the one below from Crypto Amsterdam—who analyzes high, medium, and low timeframes—give us clues about what might happen next.

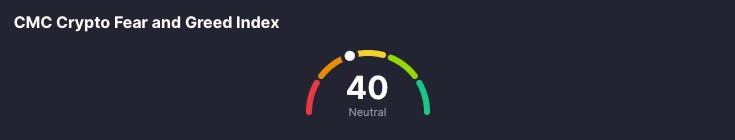

Meanwhile, traditional stock markets are near all-time highs, but here’s the interesting part: the Fear and Greed Index was showing "fearful" just a few days ago. Technically, this could signal further expansion potential. Is this being fueled by bullish news and statements tied to Donald Trump, like the one below?

One of the biggest stories in the last 24 hours is that the U.S. Securities and Exchange Commission (SEC) has voluntarily withdrawn its appeal in a case aimed at expanding securities laws to DeFi.

Or some might argue the real headline comes from the Fed Minutes, which revealed that the U.S. Federal Reserve plans to halt quantitative tightening around mid-2025. That alone could excite the bulls, but add in the possibility of U.S. taxpayers receiving a $5,000 check sometime in the future, and it gets even spicier. Elon Musk has hinted at redistributing savings from the Department of Government Efficiency (D.O.G.E.) back to taxpayers—a move reminiscent of the stimulus checks during the COVID lockdown era. Back then, people stuck at home with fewer expenses funneled that money into markets, injecting liquidity. This time, with people still earning regular income plus an extra $5K, could we see another flood of cash into the markets?

Meanwhile, our man Ran Neuner is in Hong Kong, and what he’s seeing is a bit odd. On our morning call, he noted that people are still deep in the trenches, trading memecoins on-chain. Many believe the memecoin era is over—at least for now—but this suggests otherwise.

With so many on-chain warriors still active, let’s head on-chain to check out the altcoins.

💎 Degens’ Den

This Is Where The Volume And Fees Are Right Now!

Though many coins are stagnant, some are making moves.

Take newcomer Story (IP), which is up +35% today (at time of writing). Meanwhile, Layer-1s (L1s) are showing signs of life too:

Berachain (BERA) +12%

Sonic (prev. FTM) (S) +12%

Sei (SEI) +10%

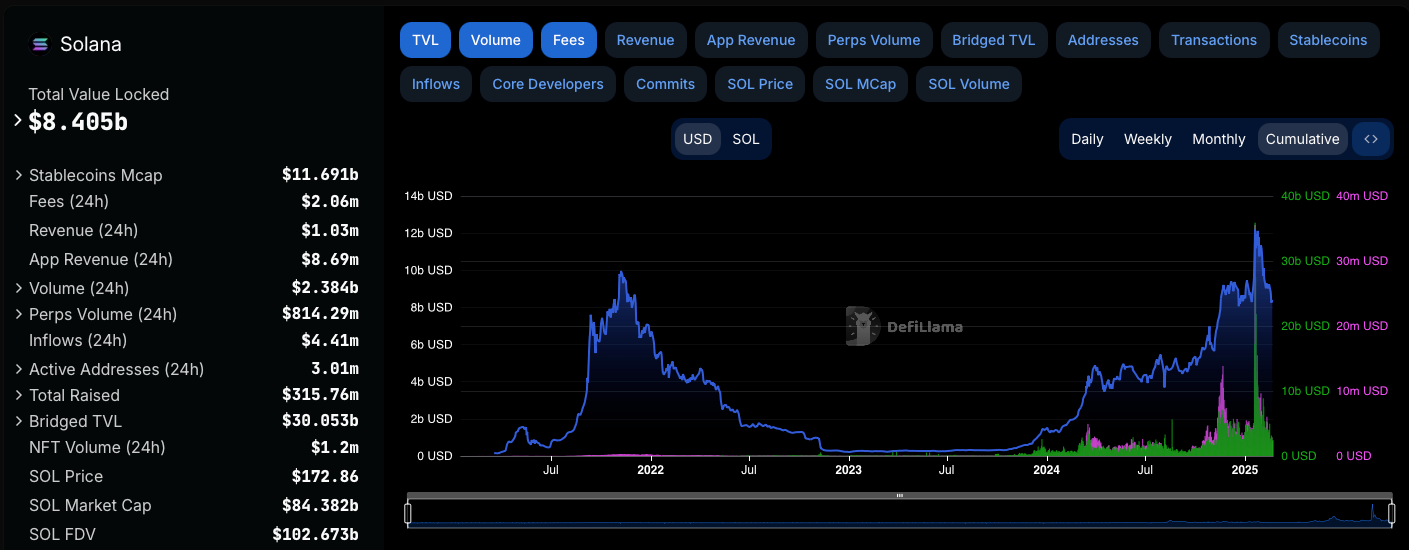

Meanwhile, Solana is holding above its $170 range, even after the recent Solana ecosystem FUD we covered a few days ago. Interestingly, most metrics favor Solana. DeFiLlama shows that many of the top fee-generating protocols for the last 7-days are either Solana-based or on the Solana chain, with Solana (according to our researchers) claiming about 65% of total on-chain transacted volume. Even amidst the recent FUD, Meteora ranks 3rd in 7-day volume on DeFiLlama at $7.442B, trailing only Uniswap in 2nd place with $14.306B.

Source: DefiLlama

Then there’s BNB (BNB) chain’s decentralized exchange (DEX) PancakeSwap, which tops the 7-day volume charts at $23.965B. This surge might tie back to ex-Binance CEO CZ posting about his dog Broccoli, sparking the creation of thousands of Broccoli-themed memecoins on BNB.

Another big story from yesterday: the SEC acknowledged a filing to permit staking for 21Shares’ Spot ETH ETF. We recently discussed how ETH staking on the spot ETFs could act as a major catalyst, reigniting excitement around the second-biggest crypto after months of stability.

After all this, the big question is, does it feel like a bear market right now?

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

Coinbase Adds Support for Bittensor (TAO)

dYdX CEO Predicts Epic DeFi Boom in September

Mexico’s Third Richest Billionaire: Bitcoin To Skyrocket to $10 Million!

Binance US Restores USD Deposits and Withdrawals for First Time Since 2023

💭 Banter’s Take

More and more people are making high estimations, but they’re likely talking long-term. No one can predict anything with certainty, and we can’t think of any entity out there expecting Bitcoin to shoot straight up to the millions from here. Most believe a bear market or two will interrupt the journey along the way.

Below, we see Adam Back—a British cryptographer, cypherpunk, and CEO of Blockstream, best known for inventing Hashcash, which is used in Bitcoin's mining process—stating we’re in "the early stages of a bull market." In the past, around February 2023 he called for Bitcoin to reach $10 million within 9 years, so around 2032.

See you all tomorrow!