Past Due! Is the Bitcoin 4-Year Cycle Dead?

BNB Is Pumping, but Solana Could Be Next!

By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 Past Due! Is the Bitcoin 4-Year Cycle Dead?

💎 BNB Is Pumping, but Solana Could Be Next!

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

💭 Banter’s Take

GM Degens,

You’ve probably noticed it — everyone’s talking about the 4-year cycle again. It’s that familiar moment when, if the pattern is still alive, the market should be nearing a top right about… NOW!

And that is probably one of the reasons the market has been dumping in recent days. But Arthur Hayes just threw a wrench in that 4-year cycle idea, arguing the cycle is not what many think it is, and that we could see this bull market continue.

Let’s dive in!

🌍 Market Catch-Up

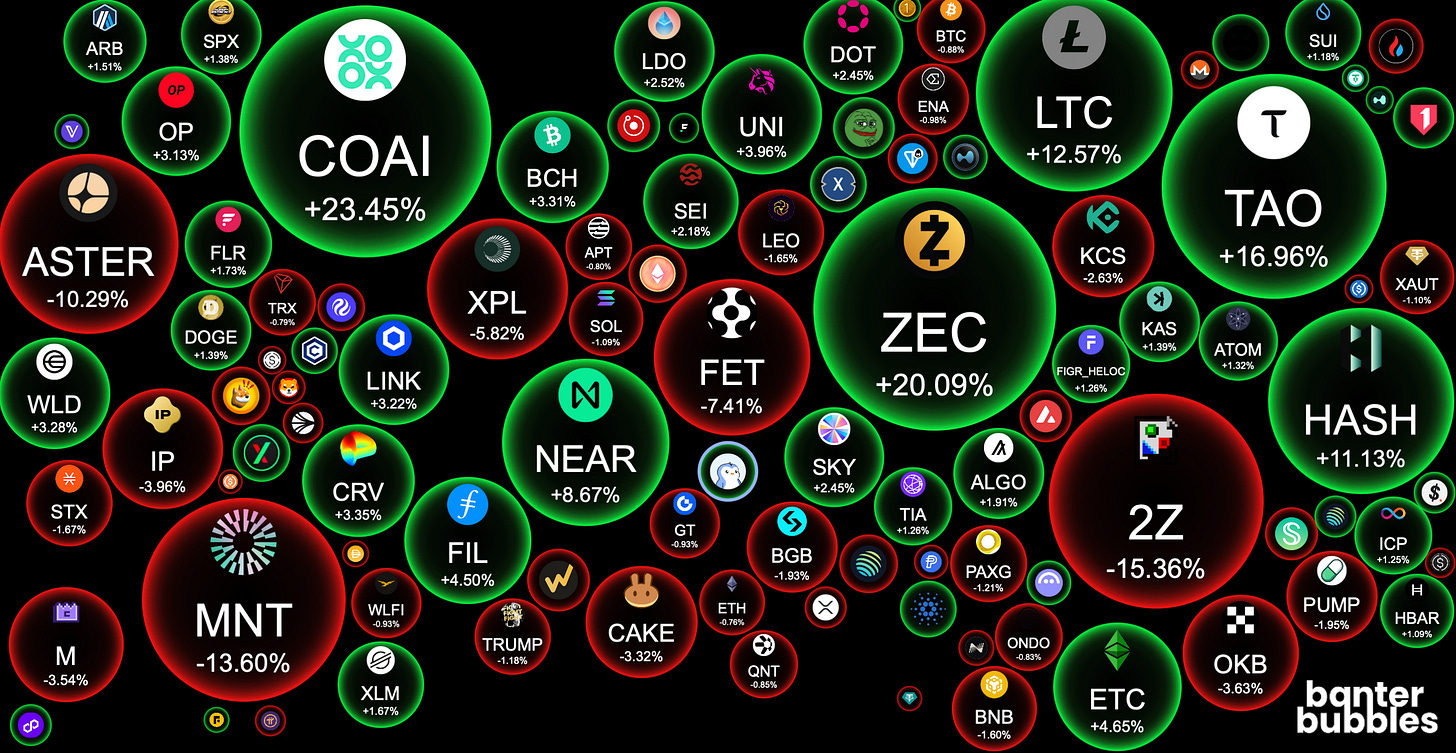

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 Question of the Day

Past Due! Is the Bitcoin 4-Year Cycle Dead?

According to Arthur Hayes, yes.

There have been three cycles, where the all-time high (ATH) occurring every four years. As the four-year anniversary of this fourth cycle is upon us, traders wish to apply the historical pattern and forecast an end to this bull run. They apply this rule without understanding why it worked in the past. And without this historical understanding, they miss why it will fail this time. Arthur Hayes

If you didn’t know, Arthur Hayes is a well-known figure in crypto who co-founded and served as CEO of BitMEX, one of the first major crypto derivatives exchanges. He’s a big deal and many follow his Bitcoin theses closely.

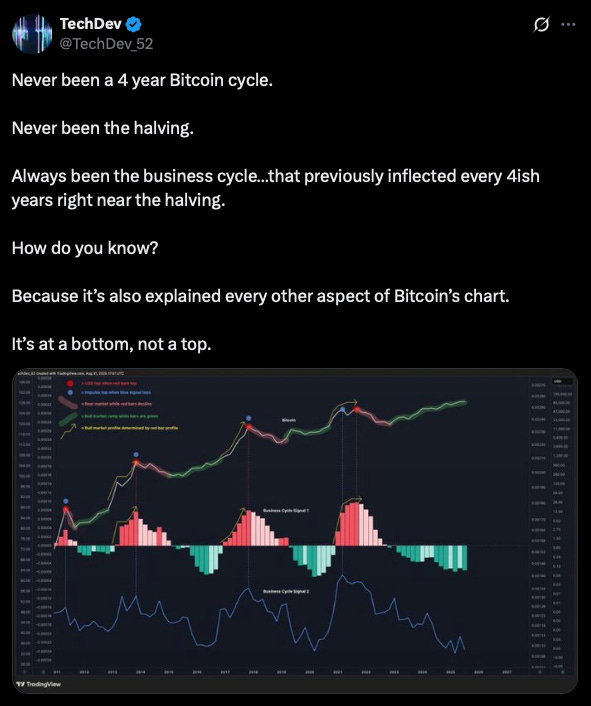

Hayes dropped a blog post a few days ago explaining why he believes the 4-year cycle is dead, or to be more precise: never existed... at least not as many think.

Hayes says that Bitcoin’s price cycles aren’t just about predictable four-year patterns anymore—they’re deeply entangled with the global supply and price of fiat money, especially policies set by the U.S. Federal Reserve and China. Hayes points out that previous boom-bust cycles were driven by abrupt shifts in global liquidity, not the Bitcoin halving schedule many investors and traders fixate on.

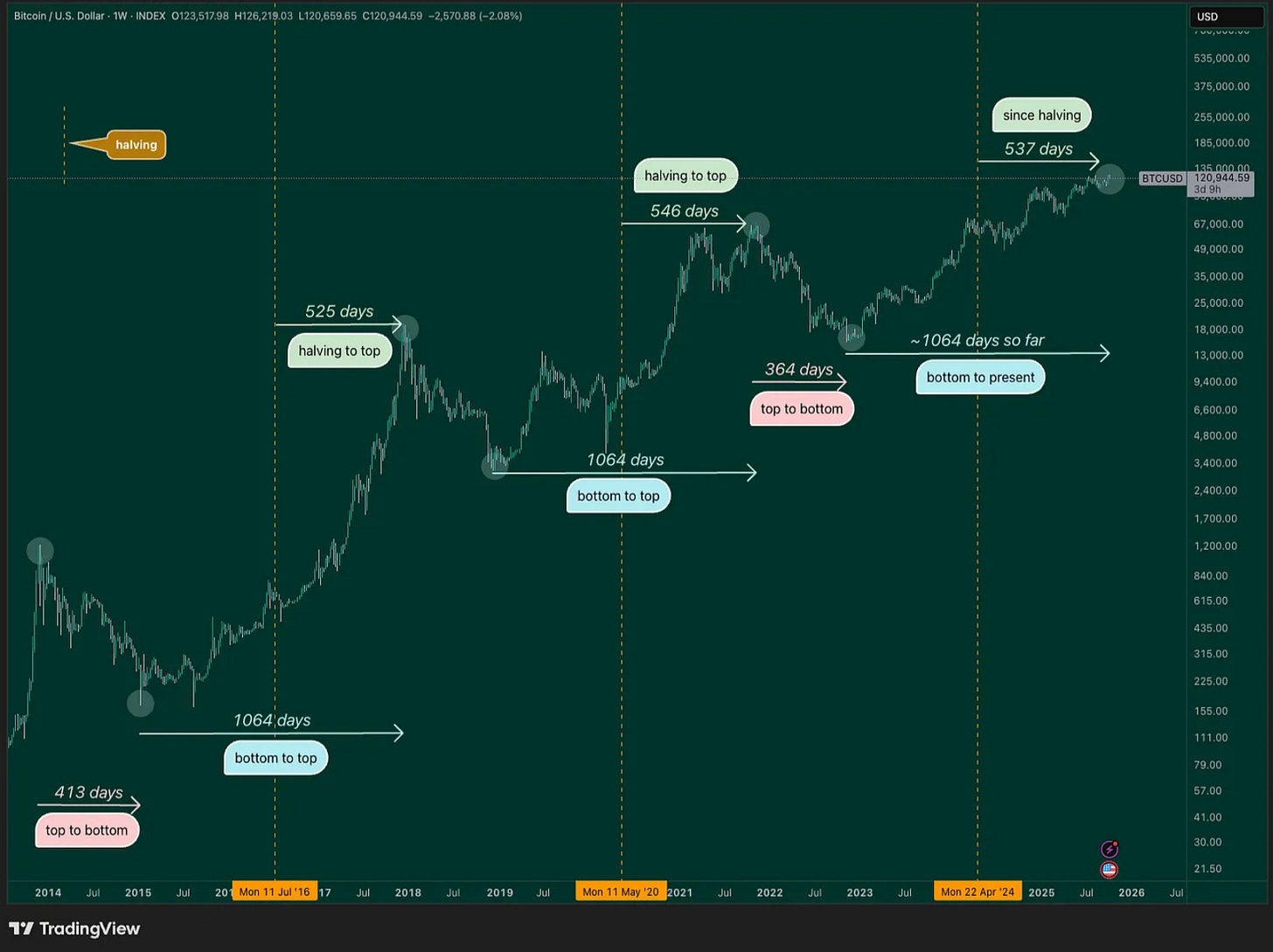

One of our Crypto Banter researchers put together the chart below — and it’s a simple yet powerful breakdown of three key Bitcoin cycle timelines:

Bottom to top

Halving to top

Top to bottom

Right now, we’re sitting about ~1,064 days from the last bottom — the same timing that previously lined up with a market peak. If the pattern holds, this week, or even the next few days, could be make-or-break for the 4-year cycle theory.

But this time could be different (and yes, we don’t like that phrase normally.) But with everything that’s changed lately — from shifting regulations, to surging institutional adoption, to the launch of ETFs — this might not play out like the past. The cycle could well be history… and the market’s next move might look nothing like before.

But the most important part of it all, as Hayes argues, is a clear message from monetary policymakers in Washington and Beijing: money will become cheaper and more plentiful, and because of this expanding liquidity, Bitcoin’s price is expected to continue rising, breaking free from the constraints of the so called “four-year cycle”. The theory is based on Hayes finding a similar pattern in all the past Bitcoin movements.

Let’s take a look. But first, please hit subscribe if you are enjoying this content.

Arthur Hayes on Bitcoin’s Historical Cycles and Liquidity Regimes

Genesis Cycle (2009–2013): Bitcoin’s first major bull run was driven by aggressive U.S. quantitative easing following the 2008 financial crisis, combined with a surge in Chinese credit expansion. This flood of global liquidity pushed Bitcoin prices higher until both the Fed and China slowed their money printing, popping the bubble in 2013.

ICO Cycle (2013–2017): This cycle mainly stemmed from a massive increase in Chinese yuan credit and a yuan devaluation, which injected large liquidity into global markets. During this period, Ethereum’s rise and the ICO boom played a crucial role too. This cycle ended as Chinese credit growth decelerated and the U.S. Federal Reserve tightened monetary policy.

COVID Cycle (2017–2021): COVID policy triggered massive U.S. dollar printing, with “helicopter money” under President Trump and continued stimulus under President Biden. This liquidity fueled a rampant crypto bull run, but ended when the Fed tightened.

Each major Bitcoin surge was powered by expansive liquidity. And with the U.S. Federal Reserve expected to continue cutting rates, and many hoping for Quantitative Easing (QE) to follow, this could be the case once more.

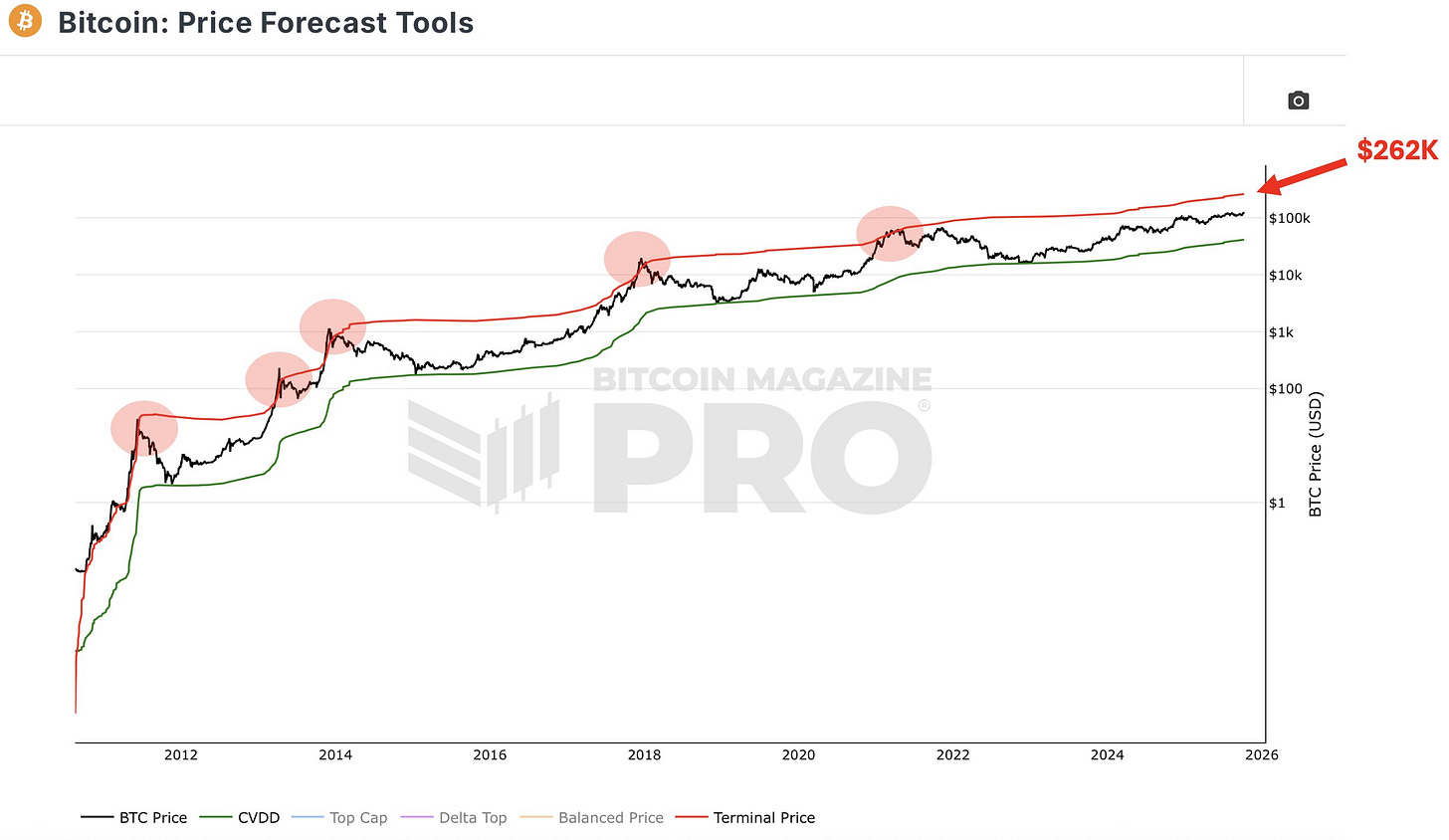

Add in charts like this one, showing that every Bitcoin bull cycle top “pierced through the red Terminal Price,” as On-Chain College describes on X (now sitting at $262K), and you start to see how many people might want to remain bullish.

Final Thoughts

Hayes makes a strong point.

Listen to our monetary masters in Washington and Beijing. They clearly state that money shall be cheaper and more plentiful. Therefore, Bitcoin continues to rise in anticipation of this highly probable future. Arthur Hayes

Unlike before, Bitcoin’s fate depends less on programmed halvings and much more on the unpredictable macro moves of central banks and governments in a regime guided by credit and liquidity.

And with the institutions actually here, this time could indeed be different.

The great part, if this time truly is different, is that many whales who’ve been offloading will likely start buying back and accumulating as they realize this reality. It’s hard to blame them. True Bitcoin OGs have seen the same patterns repeat for the past 1.5 decades. It’s only logical to follow the historical data—until it eventually fails.

Remember: A thesis is right, until it isn’t.

The Biggest Bet of This Cycle: 0G Labs

0G is being called the “Solana for AI”—a Layer 1 chain purpose-built for AI, backed by $325M in funding, with 50,000x faster performance than competitors and 300+ partnerships including Alibaba and Optimism. Last cycle, DeFi defined the narrative. This cycle, it’s Decentralized AI—and our new partner, 0G, is already positioning itself as the clear leader.

As costs of centralized AI explode and regulators demand verifiable systems, 0G delivers an all-in-one stack for AI: storage, compute, and execution—at up to 90% cheaper than today’s alternatives. Think Ethereum for DeFi, Solana for dePIN… now 0G for AI.

Why is 0G Labs set up to be the biggest breakout launch of this cycle?

50,000x faster AI performance

First all‑in‑one AI stack (storage + compute + execution + marketplace)

90% cheaper AI training costs

+300 partnerships (Alibaba, Optimism, NTT Docomo)

+$325M in funding from tier-1 VCs

The 0G token is now live.👇

💎 Degens’ Den

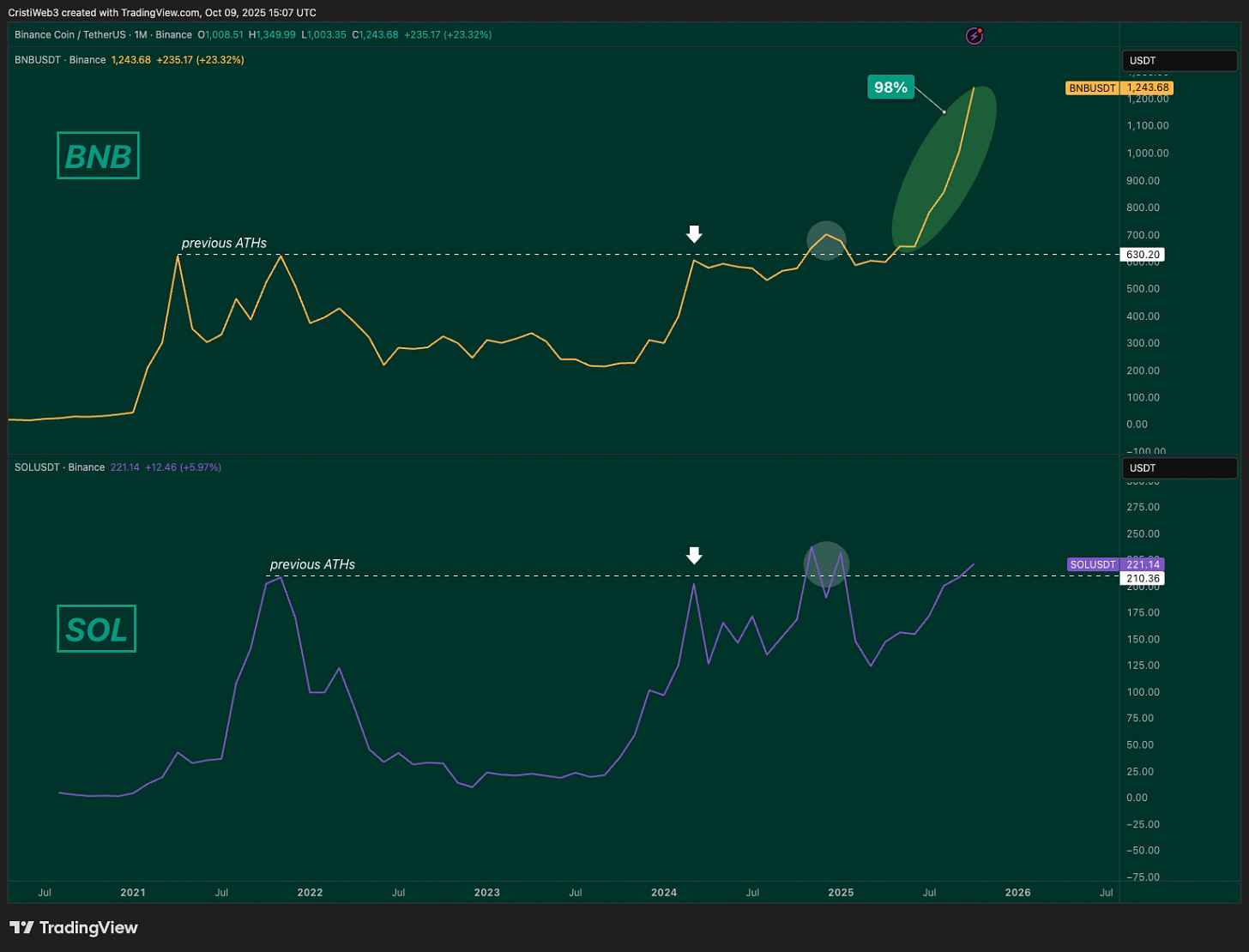

BNB Is Pumping, but Solana Could Be Next!

One of our researchers has been digging into Solana’s (SOL) setup for Q4, and the picture is starting to look pretty interesting.

BNB’s chart recently went parabolic after crossing the $1,000 milestone, showing real strength even at those high levels. Naturally, we’re always on the lookout for the next big runner—and Solana (SOL) seems to be ticking a lot of the same boxes.

From a charting perspective, Solana is mirroring much of BNB’s previous pattern—the only missing piece is a decisive breakout above its prior all-time highs. And there are several potential catalysts lining up that could ignite that move:

We’re coming right up on final ETF decision deadlines; the only real holdup is the US government shutdown situation.

Solana staking ETFs have an edge over Ethereum staking options thanks to shorter unstaking periods.

The upcoming Solana Breakpoint event in December could provide fresh momentum.

Over the past 30 days, Solana has commanded over 95% of all tokenized stock trading volume.

Still leading the blockchain pack in app revenue generation.

Continues to see heavy activity and engagement across the ecosystem, especially with new degen token launches.

It may not play out exactly like BNB’s trajectory, but the catalysts are undeniable—and the timing heading into Q4 couldn’t be better.

Speaking of BNB, take a look at the incredible gains our Front Runners members are locking in. 👇

If you are looking for more daily trades and expert alpha, join Front Runners, the community committed to sharing vital market knowledge, strategies, and support for investors and traders at every level.

Join and unlock exclusive access to:

Premium Trading Signals

Private Livestreams

Exclusive Newsroom Access

Access to Daily Team Research Calls

20+ Page Daily Market Report

Access to Initial DEX Offerings (IDOs)

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

Coinbase and Mastercard in Advanced Talks to Acquire Stablecoin Startup BVNK for $2 Billion

Jack Dorsey’s Square Introduces a Bitcoin Wallet Solution to Enable Local Businesses to Accept BTC Payments With Zero Fees

💭 Banter’s Take

If you follow historical data like we do, there’s no denying that we’re at the end of the four-year cycle. At the same time, though, many signs hint that it might not be over just yet. Either way, we still believe Q4 is shaping up to be bullish. As always, none of this is financial advice—make sure to do your own research.

I want to end with a quote from the Arthur Hayes post. It will likely resonate with many.

The gift that Satoshi gave to humanity via their Bitcoin whitepaper is a technological miracle that was launched at a very important time in history.

See you all on Monday!