By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 Sovereign Funds To Buy Bitcoin Soon?

💎 AO Flying Under The Radar?

💥 Best Alpha Posts of the Day

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

💭 Banter’s Take

GM Degens,

A very significant international banking group with a substantial global footprint has predicted that more sovereign wealth funds could start buying Bitcoin soon. If this is the case, it could cause a global adoption domino effect.

Meanwhile, one project launched recently seems to be posting some interesting metrics, yet it seems to be flying under the radar.

Let's dive in!

🌍 Market Catch-Up

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 Question of the Day

Sovereign Funds To Buy Bitcoin Soon?

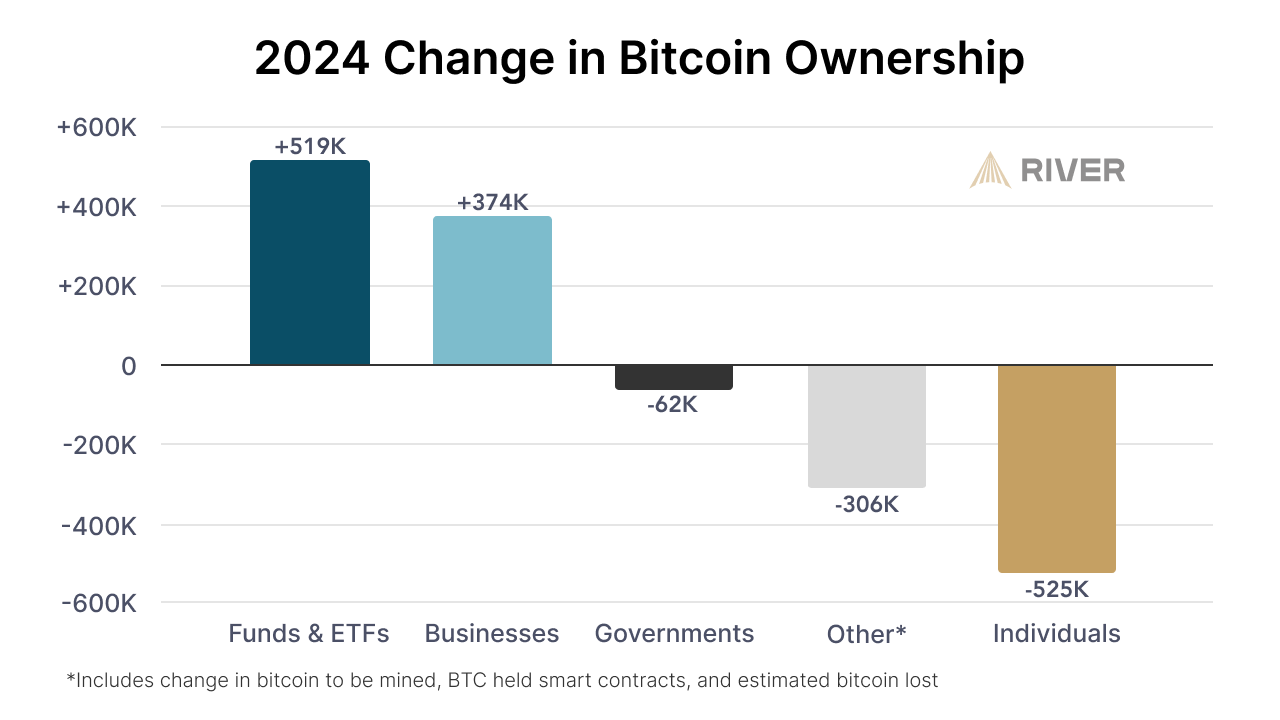

As the S&P 500 officially hits a new all-time high, now up +4.5% year-to-date, Bitcoin (BTC) hovers around $95k as accumulation seems to continue by the long-term holders. During 2024, many individuals exited while many ETFs, funds, and businesses bought Bitcoin.

Something that gave the market hope yesterday was Strategy (former MicroStrategy) announcing a $2.0 billion offering of 0% convertible senior notes due 2030. The capital raised from these will most likely go straight towards Bitcoin purchases if we were to make an educated guess based on the CEO’s previous behavior. The news seemed to bring a local bottom to Bitcoin. Some X accounts are questioning whether one entity’s actions affecting the price of Bitcoin is healthy or not.

But if many governments start buying soon, as is speculated by many due to news like that of US state Texas below, the graph above could change the dynamic.

Something we noticed that has people talking is Howard Lutnick being confirmed as Commerce Secretary. Lutnick is against income taxes and proposes alternatives such as using tariffs to fund the US government.

One of the most bullish things being discussed though is asset manager Standard Chartered expecting more sovereign wealth funds to start buying Bitcoin.

Well would you look at that! Oh how it aligns with the above thesis!

A sovereign wealth fund (SWF) is a state-owned investment fund composed of financial assets like stocks, bonds, property, or other financial instruments. The primary purpose of SWFs is to manage a country's national savings for investment purposes. Institutional investment in Bitcoin ETFs has seen a 54.5 times rise in institutional holders from March 2024 to February 2025, so this is not a wild prediction.

As usual, none of this is financial advice, and you all need to do your own research!

💎 Degens’ Den

AO Flying Under The Radar?

(Disclaimer: This is not an endorsement of AO, or any other project. It is simply an analysis.)

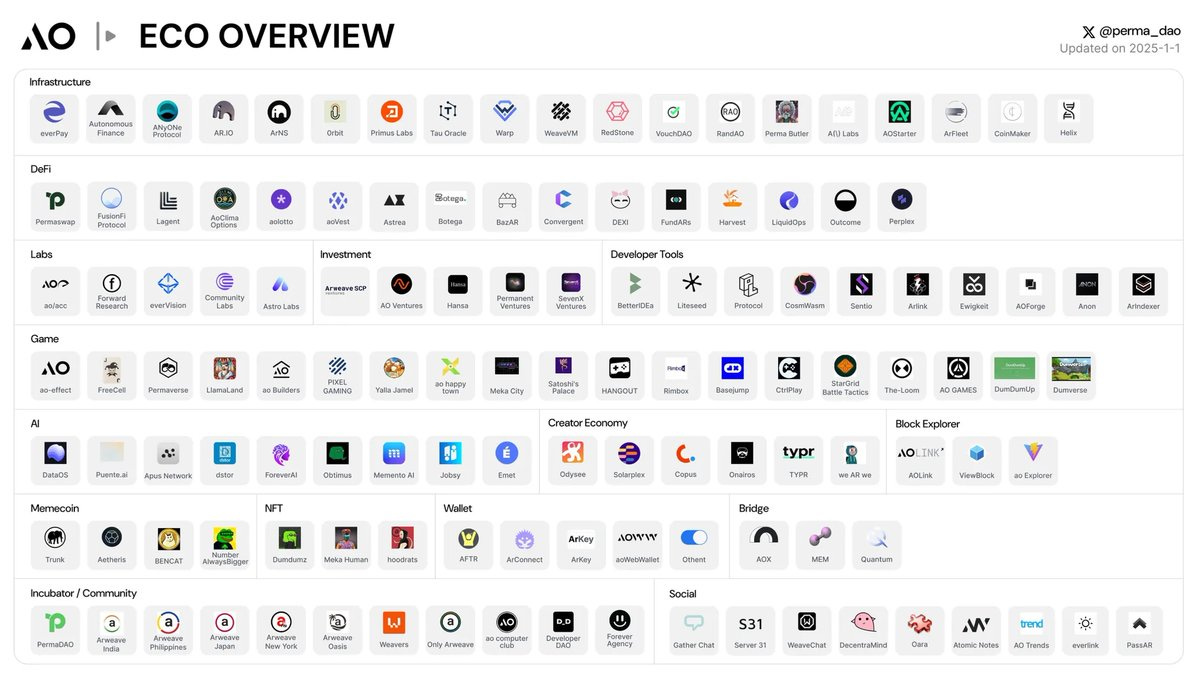

The AO ecosystem is growing…

Though there was some controversy with the AO launch and some developers we have been talking to in the ecosystem seem to be somewhat frustrated by the lack of documentation available to help them code properly within the ecosystem, this has not stopped the adoption.

As Internet Child reports, many projects on AO are building, including Autonomous Finance which is creating a Decentralised Finance (DeFi) layer for the whole ecosystem with stablecoin AstroUSD (AUSD) and the decentralised exchange (CEX) Botega. Meanwhile AR.IO which is building a decentralised gateway to the permaweb recently airdropped tokens to users that have been active in the ecosystem.

zac.eth mentions that not many are talking about AO, but those who are might find some interesting data. Though these stats are ever changing, zac.eth reports on AO’s stats:

Up 2x since TGE (10 days ago)

100% fair launch

$140m market cap ($900m fully diluted valuation)

$475m TVL

There's a lot happening on AO, and we found a great guide if you want to learn more, posted below by Moni.

💥 Best Alpha Posts of the Day

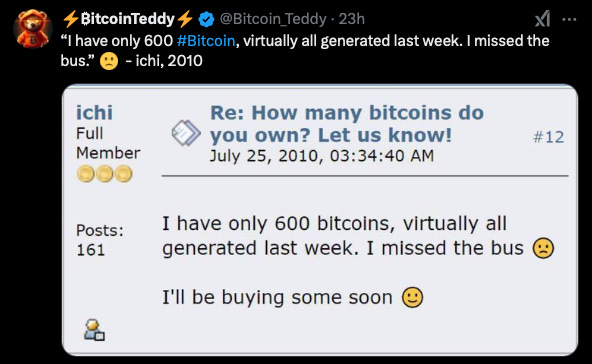

Are We Late?

When is it really too late?

Latest From Consensus Hong Kong

The Consensus Hong Kong 2025 conference is taking place from February 18-20, 2025, at the Hong Kong Convention and Exhibition Centre. Here are some key takeaways from Andy:

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

Utah Strategic Bitcoin Reserve Bill Advances to Senate for Approval

Tether Co-Founder to Launch New Decentralized Yield-Bearing Stablecoin

SEC Acknowledges Bitwise's Filing for Spot XRP ETF

💭 Banter’s Take

As you see, things are happening, and the big players like funds and big businesses are accumulating. Despite that, many bears believe the end is here, while the bulls remain hopeful. No one knows what could happen next, though. But adoption is not slowing down for anyone.

See you all tomorrow!