By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 The Biggest Day In Crypto History!

💎 Are Real-World Assets (RWAs) The Next Big Narrative?

💥 Best Alpha Posts of the Day

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

💭 Banter’s Take

GM Degens,

Crypto is an extremely wild ride; one day you get bad news, the next day good news, and then days like yesterday where everything seems to line up!

Big things that many have been expecting for a long time are now coming to fruition, all on the adoption level; frankly it’s crazy.

And the fun part about all this is that we are here and we are early.

Let’s dive in!

🌍 Market Catch-Up

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 News of the Day

The Biggest Day In Crypto History!

Yesterday was extremely bullish. So many things were happening when it comes to adoption that it's beyond comprehension.

As we anticipated initially, Trump didn't sign any executive orders related to crypto on day one; he signed things that were potentially more important. But now he's done it, and things could be about to get wild.

This is everything that happened yesterday:

Senate Banking Subcommittee on Digital Assets: Senator Lummis has been tapped to head the newly formed Senate Banking Subcommittee on Digital Assets. This subcommittee is part of the broader Senate Banking Committee and focuses specifically on digital currencies, aiming to craft legislation that fosters responsible innovation while addressing market risks.

David Sacks went on FOX Business to say that Trump signed the executive order to favor crypto and digital assets in the USA. Sacks touched upon how, after Trump's famous speech in Nashville about changing the regulatory environment for crypto, he has now followed through, stating: “[Trump] has now acted on that promise. He signed this executive order today. He has directed our working group to produce a regulatory framework that's going to encourage innovation in crypto in the United States keeping the industry on-shore rather than driving it off-shore which is what was happening under the Biden administration.”

David Sacks will lead this cryptocurrency working group that President Trump has announced. The group is part of Sacks’ broader role as the "White House AI & Crypto Czar," where he will guide policy for artificial intelligence and cryptocurrency, aiming to make America a global leader in these areas.

The official executive order that the White House released called ‘STRENGTHENING AMERICAN LEADERSHIP IN DIGITAL FINANCIAL TECHNOLOGY’ outlines how a digital currency stockpile is going to be created noting:

‘The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.’

Here are the key policies of the act:

Protects rights to use public blockchains for lawful activities.

Promotes dollar-backed stablecoins globally.

Ensures fair banking access and regulatory clarity for digital assets.

Prohibits Central Bank Digital Currencies (CBDCs) within the U.S. to protect financial stability, privacy, and national sovereignty. No U.S. agency can work on or promote CBDCs.

The official White House document, which you can find here, outlines how the group has 180 days to present their plan to Trump.

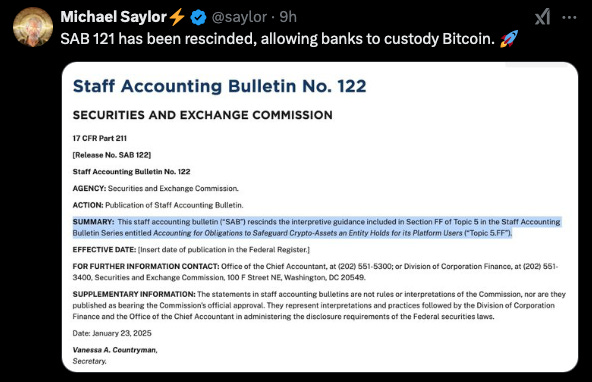

Another thing which has been changed, as expected, is SAB121, which didn't really favor banks. Now they can custody Bitcoin.

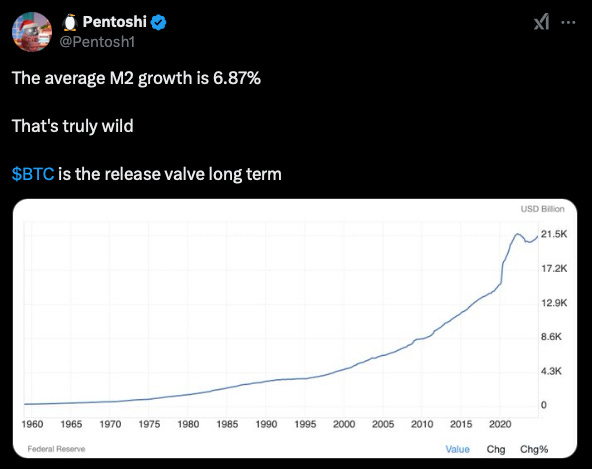

Also, the global M2 money supply is going up—aka printer go BRRRR.

And as expected, the Bank of Japan (BOJ) raised its short-term policy rate by 25 basis points to 0.5% from 0.25%.

The biggest takeaway from this is potentially the way it is phrased which leaves it open to interpretation. It's not just Bitcoin that has been mentioned, but crypto and digital assets in general. In the wording, terms like ‘national digital asset stockpile’ and ‘cryptocurrencies’ shows that they are potentially open to more than just Bitcoin. So, the US could end up holding many different coins if that is to be taken literally.

As usual, none of this is financial advice, and you all need to do your own research. But boy oh boy, did the game just change.

Remember yesterday we looked at how the CEO of Coinbase (COIN), Brian Armstrong, said that many of the G20 countries will likely follow suit if the US announces a Bitcoin strategic reserve, or in this case, as has happened, a crypto reserve. He also mentioned he has been talking to many finance ministers from various countries who are becoming more and more interested in establishing their own Bitcoin strategic reserves.

Therefore, adoption-wise, yesterday was probably one of the biggest days in history for crypto.

💎 Degens’ Den - Powered By LunarCrush

Are Real-World Assets (RWAs) The Next Big Narrative?

So, what is everybody talking about right now?

According to LunarCrush, the top trending sectors over the last 24 hours are:

Base Ecosystem +4.87%

DePin +4.39%

Lending/Borrowing +4.24%

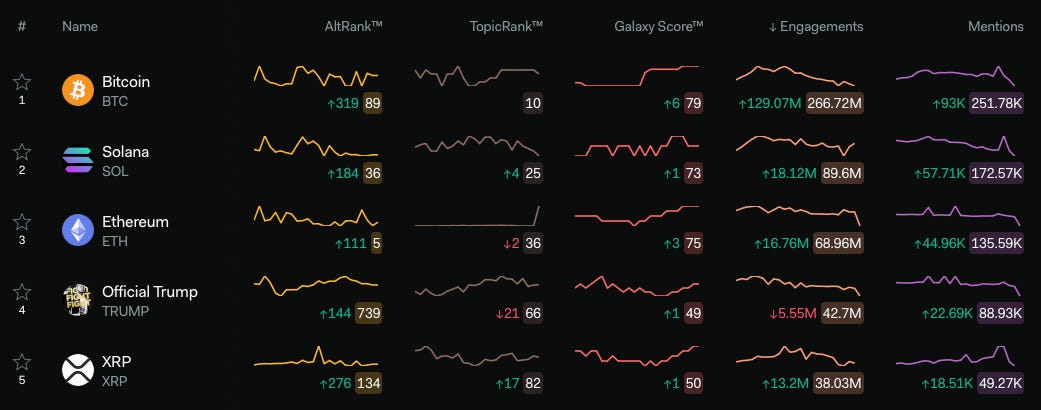

And according to their social metrics, it seems that most engagements on social platforms is on content related to Bitcoin (BTC), followed by Solana (SOL), Ethereum (ETH), OFFICIAL TRUMP (TRUMP), and XRP( XRP).

But what is BlackRock CEO Larry Fink talking about?

Well, he has just urged the SEC to approve the tokenization of bonds and stocks, aka Real-World Assets (RWAs). This is one of the major things we talked about last year and how BlackRock is extremely bullish on this sector. It's the reason why many RWA projects have been in the spotlight.

As you can see, there is growth when it comes to the Total Value Locked (TVL) across RWAs.

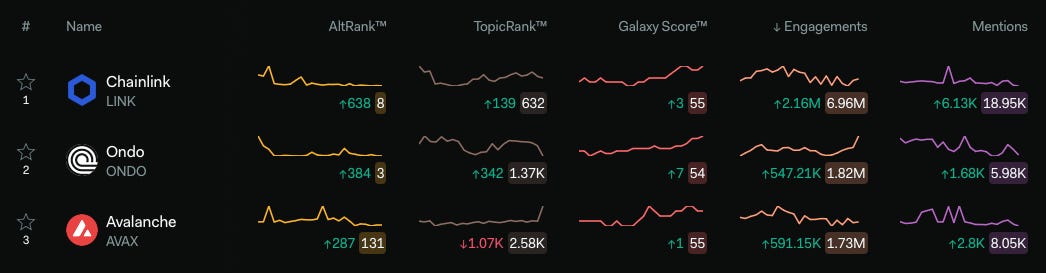

So, if we switch the view on LunarCrush to check only real-world assets protocols, this seems to be what everybody is engaging with.

In one way or another, these projects are involved in RWAs.

You can check out LunarCrush yourself below.

💥 Best Alpha Posts of the Day

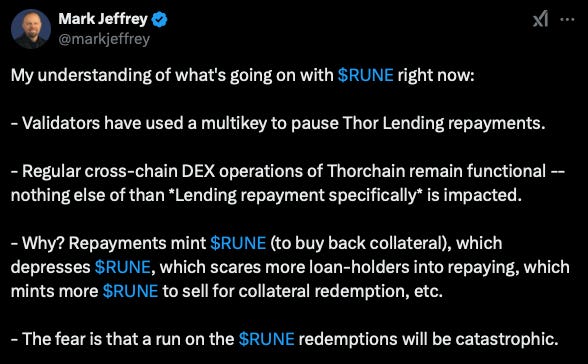

The Current RUNE Situation

There's a lot of talk going around about THORChain (RUNE) and their lending section of the protocol. Mark Jeffrey gives some thoughts on it.

L1 & L2 7-Day Volumes

Which L1s and L2s are leading the volume game?

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

Mainland Chinese Citizens May Soon Access BTC ETFs.

💭 Banter’s Take

One word. Bullish. But don't forget that, historically, bullishness comes and goes as the seasons change.

See you all on Monday!