🔥 The Next Big Narrative In Crypto Is Not What You Expect!

Bullish Q2 To Bring New Bitcoin ATH?

By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 Closing June with a Bang and Eyeing New Bitcoin ATH!

💎 The Next Big Narrative In Crypto Is Not What You Expect!

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

💭 Banter’s Take

GM Degens,

We’re on track to get the best Q2 in four years. After the worst Q1 in crypto history, a trend shift was probably kind of expected. Overall, the landscape remains bullish, and we’ll explore the reasons why.

Plus, we’ll also look to crypto proxy stocks we can take advantage of…

Let’s dive in!

🌍 Market Catch-Up

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 News of the Day

Closing June with a Bang and Eyeing New Bitcoin ATH!

As we wrap up June and the second quarter, things are looking pretty exciting. Let’s see why some of the reasons we are still bullish.

Bitcoin (BTC) and Ethereum (ETH) are on track to close out their best Q2 in five years, and today could see Bitcoin notch its highest monthly close ever—a massive milestone if it happens! The bulls will be excited. Closing high on such long time frames bullish.

The S&P 500 is also riding high, hitting an all-time high, which adds some serious positive vibes to the mix. If you’re wondering why the market feels like a compressed spring about to be let loose and shoot up, this is probably why. July has historically been a strong month for both Bitcoin and the Nasdaq, thanks to favorable seasonality trends.

The Nasdaq’s July strength is real, and CoinGlass data backs up Bitcoin’s tendency to shine this month.

On the macro front, we’re seeing some tailwinds that could push markets higher. There have been 64 global rate cuts this year—the most since 2020. The US is somewhat lagging on this front. We know that Trump has been pushing the Fed for a 2-2.5% rate cut from 4.25-4.5% to ease costs, despite inflation below 2.5%. What with good inflation data coming in the next cut could be imminent.

On the flip side, the U.S. is also grappling with debt refinancing, which could play a role in market dynamics. The U.S. Treasury is set to refinance $3T in debt (July-Sept 2025), part of $11T wave, facing higher 4-5% yields, adding $300-400B in annual interest. Meanwhile, the 10-year Treasury yield fell from 4.6% to 4.2% since March 2025, but high debt risks fiscal strain unless growth tops 2%.

Going back to Bitcoin, and adding to the optimism, Binance Research notes that Bitcoin tends to bounce back after major geopolitical events like the ones we saw recently, averaging a 37% return 60 days later.

Overall, the market seems ready to move on. David Sacks even called July a “big month” on X.

When we consider where to look, crypto stocks like $HOOD and $COIN are stealing some of the spotlight from altcoins, which have been lagging recently.

Let’s explore.

💎 Degens’ Den

The Next Big Narrative In Crypto Is Not What You Expect!

Some may already know about Coinbase, Robinhood, and the Layer 2 (L2) chains they’re building with Arbitrum and Optimism tech. These two platforms are definitely not ones to ignore, not just in crypto but in the broader financial world too.

Both Coinbase and Robinhood are leaning into the L2 game to scale their offerings. Coinbase’s Base, built on Optimism’s Superchain, is already live and killing it as the sixth-largest chain by TVL ($3.417 billion, per DeFiLlama). Base boasts 37.9 million monthly active users compared to Arbitrum’s 3.5 million and accounts for over two-thirds of L2 fees in 2025, according to Messari. It’s raked in $125 million in profit and is teasing a “new chapter” on July 16th. Optimism sealed the deal with a hefty 118 million $OP grant ($187 million at the time) to get Base on board, and it’s paying off with $16.9 million in revenue so far.

Robinhood, meanwhile, is rumored to be building an L2 using Arbitrum’s Orbit stack.

Arbitrum’s TVL sits at $2.492 billion, trailing Base, but its 41 Orbit chains (Arbitrum Portal) add $400 million in TVL outside the main chain. Arbitrum’s also got strong mindshare, ranking third in the last 24 hours (Dexu.ai), and its performance is leading the pack.

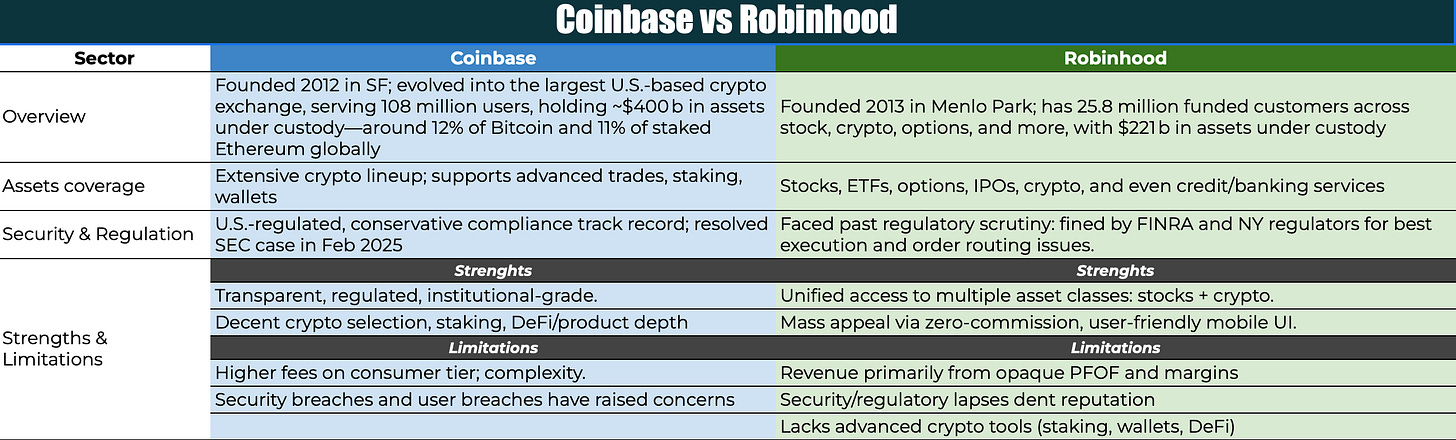

Now, let’s talk Coinbase vs. Robinhood as companies. Below you can see a detailed view our researchers put together on this.

Coinbase’s user base is massive—108 million compared to Robinhood’s 25.8 million—and its assets under management ($328 billion) outpace Robinhood’s ($255 billion). Coinbase is also a crypto powerhouse, acting as custodian for 90% of Bitcoin ETFs and powering crypto integrations for ~200 banks and fintechs. It’s also the second-ranked crypto exchange globally and is set to launch futures in the U.S.

Robinhood, however, dominates retail stock trading, leading in app-based stock trading users.

So what do we do?

Both are top picks in their sectors, but Coinbase’s scale and crypto focus give it an edge, while Robinhood’s retail dominance and potential L2 play make it a contender. Diversifying a portfolio could mean holding both to some investors. However as usual none of this is financial advice and you all need to do your own research.

One thing’s clear: some of the focus is shifting from altcoins like Ethereum (ETH) and Solana (SOL) to crypto stocks like $HOOD and $COIN. Robinhood’s L2 move could be the big story, especially if they expand stock trading to the EU.

Want to go one step further? Catch Ran’s show today on the main crypto Banter channel!

🐸 MEMEoirs of a Degen!

Courtesy on naiive

📢 Biggest Announcements

SEC Faces Final Deadline This Week for Grayscale Digital Large Cap ETF Approval

Canada Withdraws Digital Services Tax to Restart Crucial US Trade Negotiations

Crypto Total Value Locked Hits $375 Billion

💭 Banter’s Take

With all these factors lining up—seasonality, macro shifts, and market sentiment—Bitcoin could be gearing up for a serious push in July. So, we will stay ready and not get caught on the sidelines!

See you all tomorrow!