The SEC is coming for BUSD! + New strict measures on bitcoin mining!

Overview

Crypto Headwinds: The week ahead.

Markets: Weekly candles close below major support levels.

Paxos faces lawsuit over BUSD.

Bitcoin risks have failed to materialize for El Salvador - IMF.

NFTs: CryptoPunks hit the main stage in Paris.

Good Morning Banter Fam,

The markets are eagerly awaiting the release of the US Consumer Price Index (CPI) data on Tuesday, and the statistics could create some short-term headwinds for cryptos.

Let’s explore.

Analysts predict the annual inflation rate will come in at 6.2%, a decrease from the previous month's figure of 6.5%. Also, the Federal Reserve will closely monitor the release as month-on-month inflation is expected to rise by 0.4%. The recent revisions from the Bureau of Labor Statistics showed that inflation was slightly higher than previously reported, which isn't helping the cause.

If the figures are higher than expected, it could lead to the Fed continuing to raise interest rates, which could hurt crypto and the markets in general. On the other hand, if the inflation rate comes in lower than expected, it could provide some relief to investors and lead to a boost in market confidence. Regardless of the outcome, the release of the annual inflation rate and the month-on-month increase in inflation will be closely watched by market participants. You can catch the core price index (CPI) release here.

Market update 🌍

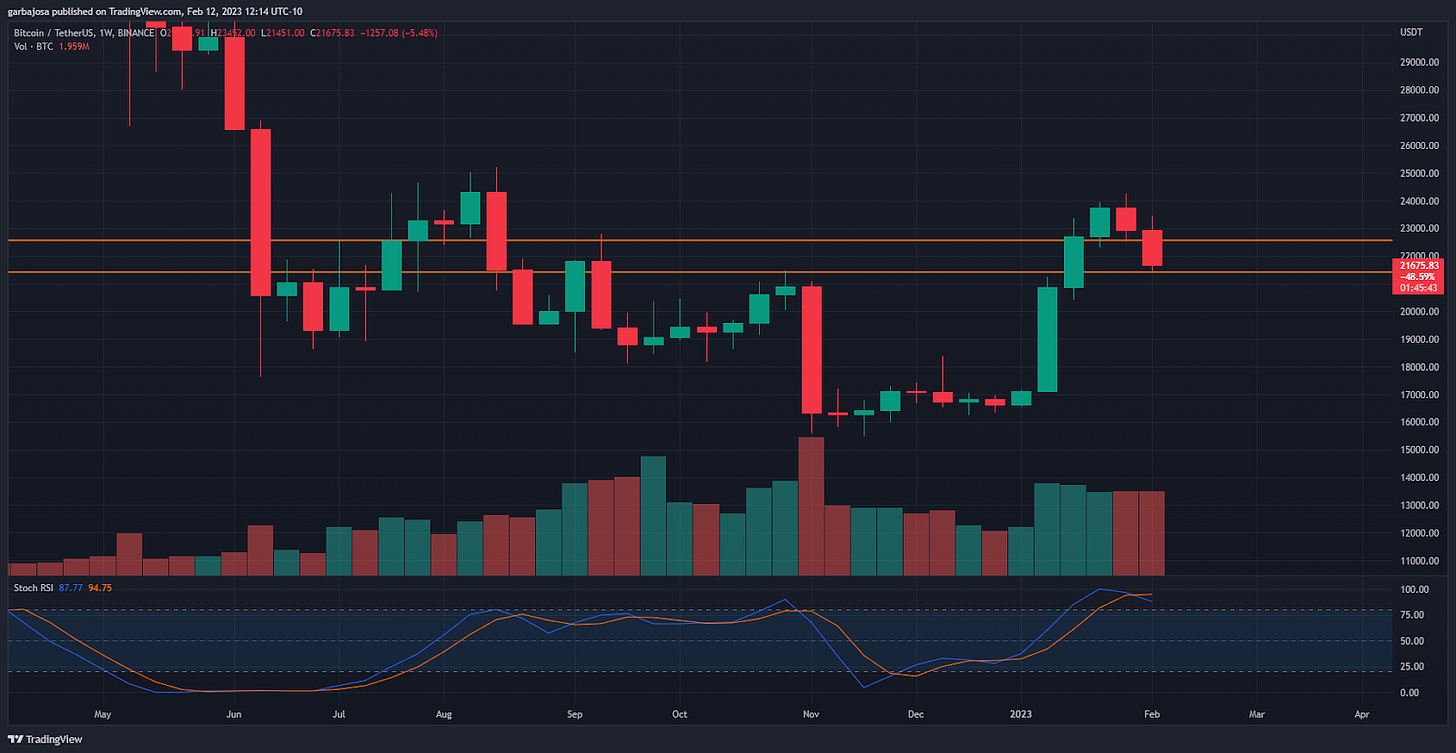

BTC/USDT 1W

BTC experienced its worst week since the FTX fallout in Nov 2022. The pressure from the Federal Reserve and revised CPI data sent BTC hurling below the $22,500 support. Volume remains elevated, but the Stochastic RSI indicator (overbought) suggests further downside. Keep a close eye on the $21,500 support (orange) this week. If it breaks, BTC will likely visit the $18,000s.

High-resolution chart.

Newswatch 📰

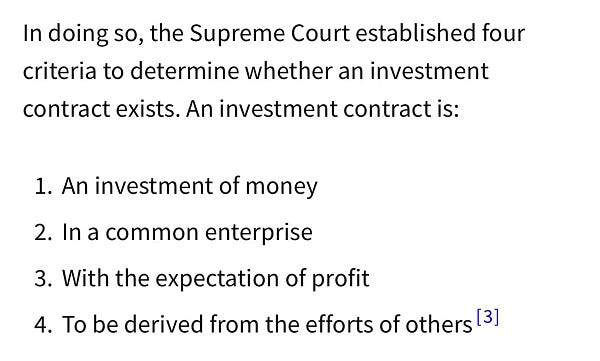

Paxos faces lawsuit over BUSD. The US Securities and Exchange Commission (SEC) has reportedly notified Paxos Trust Co. that it plans to sue the stablecoin issuer for alleged violations of investor protection laws in relation to the Binance USD token. The SEC has sent a Wells Notice to Paxos, which is a letter informing companies of planned enforcement action. The notice alleges that Binance USD is an unregistered security. The accused has 30 days to respond to the notice with a legal brief known as a Wells Submission.

Kazakhstan’s new crypto mining regulations. The President of Kazakhstan, Kassym-Jomart Tokayev, signed a new law that regulates the use of digital assets in the country. The legislation requires digital asset issuers to obtain government permission and be monitored by anti-money laundering laws. It also mandates crypto miners to sell a minimum of 75% of their revenue through registered exchanges for tax purposes. The first law will become effective on Apr 1, 2023, and the second on Jan 1, 2024.

El Salvador's BTC risk has yet to materialize - IMF. The International Monetary Fund (IMF) has reiterated caution regarding El Salvador's adoption of Bitcoin, citing the "legal risks, fiscal fragility, and largely speculative nature of crypto markets." Despite the lack of risks materializing thus far, the IMF has advised the country's authorities to reconsider plans to expand government exposure to the cryptocurrency. The statement followed an annual visit from the IMF to El Salvador, which recently made Bitcoin legal tender and suffered paper losses of at least 50% on their Bitcoin investments. The IMF emphasized the need for greater transparency in the government's transactions with Bitcoin and the financial situation of the state-owned Bitcoin wallet, Chivo.

News tidbits:

Brazil's oldest bank allows taxes to be paid in crypto.

Ethereum developers set Feb 28 for Sepolia testnet to get Shanghai Hard Fork.

“Coinbase’s staking services are not securities. And here’s why.” - Coinbase.

NFT & metaverse update 🐵

Europe’s largest modern art museum in Paris to showcase CryptoPunks and Autoglyphs NFTs.

Friends With Benefits DAO introduces social networking app.

Banter’s take

This week will be tough for crypto, but if it continues to perform well during the storm, it would be saying a lot about the long-term state of the market. In addition, Tuesday's CPI data will be one to tune into because everyone is predicting a Month over Month (MoM) jump in inflation, but if it fails to materialize, it'll likely turn into fuel for the next leg up.

Until tomorrow!

Gabriel

Follow me on Twitter for daily updates!