⏳ TICK TOCK! You ONLY have 20 Days Left to Get in EARLY!

PLUS: 💎 Stacks (STX) is Causing a Bitcoin L2 Season! Get Ready!

📰 Is DeFi Still a Thing?

💎 Stacks (STX) - Bitcoin L2 Season Incoming?

🔥 Is Celestia (TIA) Overvalued?

🚀 26 Days Until Bitcoin Breaches its Previous ATH?

🐕 Myro is Breaking Out!

💰 Coinbase to Report Earning; Expectations Very Bullish!

🎭 StarkNet (STRK) Airdrop Drama!

Good Morning Degens,

Everything is pumping, everyone is feeling euphoric, and everyone is a genius!

At times like these it's only logical that projects that were building in the background are considering launching properly - potentially with a token! And the best way to do that is via airdrops.

If you're wondering why, it's because plainly and simply the easiest way to get a customer is to create one by giving them your product for “free”.

To them, I say bring it on. We want airdrops!

Here’s an old Nansem article about how bullish the Arbitrum (ARB) airdrop was! If they are done well, they are extremely bullish long term!

We want more! And we will get more!

Let’s dive in!

🌍 Market Catch-Up

Top 100 coins Daily Performance - Banter Bubbles

📰 Question of the Day

Is DeFi Still a Thing?

It seems like gaming, AI, and a few more narratives are overshadowing the ones of the past.

I'm talking about DeFi. Is it still a thing?

First off, let’s just touch on this. The Total Crypto Market Cap (TOTAL) is increasing at a fast rate!

It’s reached $2,034,294,235,694. And that's a huge number!

This is Sheldon’s chart of the TOTAL. You can see it’s trying to breach a large resistance level.

Nice, okay, so it's probably gonna go up from here - unless it crashes back down to support.

But what's more interesting when looking at “number go up” charts is this one.

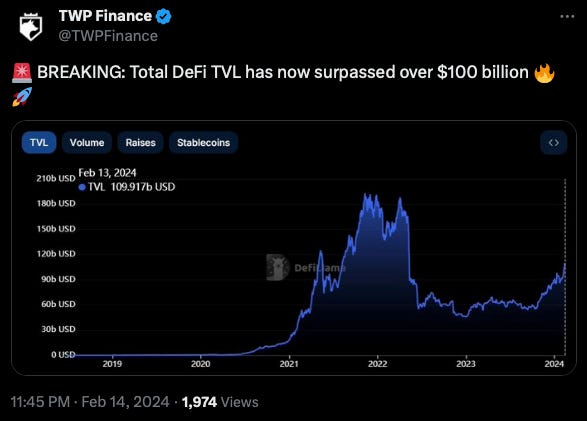

It pretty much answers the question above. The Total value Locked (TVL) across all DeFi Protocols has gone over $100 billion. So, while a ton of shiny new DeFi projects aren’t spamming our timelines, it doesn't mean things aren’t happening in the background.

On the narrative of DeFi, a lot of Curve (CRV) OTC deals are now in profit and the market was expecting a sell off in February, of which we are now over half way through… So the sell off might not come after all. Find out more about this on today’s show!

If it does, it will surely affect DeFi as a whole, but if not, I say “to the moon baby!”

💎 Degens’ Den

Stacks (STX) - Bitcoin L2 Season Incoming?

Justin Sun has just announced TRON’s Bitcoin Layer 2 (L2) and road map.

While at the same time Stacks (STX) is showing massive strength. There’s speculation that if Stacks breaks its all time highs, it’s going to kick-start a Bitcoin L2 season.

Not only is Stacks looking extremely bullish, it could actually outperform Bitcoin! Just look at what it is doing when compared to Bitcoin on the charts!

It has formed a cup and handle. If this plays out as a cup and handle pattern usually would, it means it will break to the upside, fast!

Yes. Everyone is looking towards Bitcoin reaching its ATH, but STX could reach it’s own first!

Everyone seems to be bullish on it right now, including Meltem Demirors (Chief Strategy Officer at CoinShares).

💥 Best Alpha Posts of the Day

Is Celestia (TIA) Overvalued?

TexasHedge makes a point that we all need to consider.

They talk about how everyone is so hyped to find the next 100x token (like the next Solana for example) that they're willing to throw massive valuations at anything that remotely looks like it might be THE ONE, way too early.

TexasHedge mentions Celestia (TIA) as an example, and how it's a shiny new blockchain with many token holders, and somehow has already reached a $20 billion valuation two months before Bitcoin's next halving.

Comparing it to Solana that peaked at $75 billion puts things into perspective.

Long story short, when you think of it like that, TIA may be overvalued. And chasing the next 100x might actually be riskier than just choosing the current winners.

If you want my opinion on that, check out the Myro section below for a taste!

20 Days Until Bitcoin Breaches its Previous ATH?

TedTalksMacro is predicting roughly 26 days until Bitcoin reaches its previous ATH.

This is based on all the inflows to all the new Bitcoin spot ETF products.

Here’s a summary of the analysis.

Start date of calculation: February 5th (after Grayscale outflows stabilized):

Data points since then:

$2.38 billion USD net inflows into spot ETFs

BTC price increased from $42.6k to $49.6k

Impact on BTC price:

Every $340,000 USD net inflow = $1 increase in BTC price

Every $100 million USD net inflow = $290 increase in BTC price

Every $1 billion USD net inflow = $2,900 increase in BTC price

Average daily figures:

$265 million USD net inflows into spot ETFs

Resulted in a $768 increase in BTC price per day

Time to new ATH:

BTC is about $20k away from all-time highs (ATHs)

At current net inflow rate, it would take 26 days to reach new ATHs for Bitcoin

StarkNet (STRK) Drama!

Massive drama over the StarkNet $STRK airdrop is taking place all over X.

Tons of users, farmers, and people who interacted with the system didn't get any STRK airdropped to them because they didn’t meet the minimum requirements - apparently.

Even if you had loads of transactions, volume, and were providing liquidity, if you didn't meet the minimum bar, you were left out.

And apparently the founder is being pretty uncensored!

Myro is Breaking Out!

I’ll keep talking about this one, I am starting to get dog meme coin FOMO.

Quite frankly I’ll probably sell my DOGE and get some. More room for growth and it seems to be trending day after day!

And the chart is looking extremely bullish!

🚨 Kyle will analyse it further in our charting newsletter today, The Daily Candle. Go subscribe for free here. There are also prizes and gifts on the road map for subscribers! Don’t Miss Out!

🚀 Trade of the Day

Ok hear me out on this. I know it probably ain’t degen enough for most, but it’s staring us in the face!

Coinbase (COIN) is announcing earnings later today.

And Messari expects a revenue growth of 40% at $866 million for COIN (expected is $824 million).

If numbers come in that bullish, the COIN stock could soar - or at the very least start a longer term rally. And since COIN is a proxy to Bitcoin, and vice versa (to an extent), it really helps that Bitcoin is pumping like crazy right now!

🐸 MEMEoirs of a Degen!

Not a real meme, but if you ask me, it’s a meme in and of itself!

📢 Biggest Announcements

MicroStrategy $3 Billion Away from S&P 500 Inclusion

Japan Falls into Recession and Loses its Spot to Germany as World's Third-Largest Economy

UK Economy Enters Recession

Arthur Hayes - “Who cares about Fed rate cuts.”

💭 Banter’s Take

“We are pumping too hard! Bitcoin won’t reach its ATH any time soon!”

Yeah… no!

There is probably not going to be much slowing down with all these ETF inflows we are seeing. And then there’s this that definitely doesn’t help with deceleration!

Bring it on!

See you all tomorrow!