❌ US Approved To Dump Bitcoin! Is This The End Of The Road For Bulls?

💵 Oklahoma To Pay Workers In Bitcoin?

By reading this newsletter, you acknowledge and accept the terms and conditions outlined in our disclaimer.

📰 US Approved To Dump Bitcoin! Is This the End Of The Road For The Bull Market?

💎 Degens’ Den

💥 Best Alpha Posts of the Day

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

💭 Banter’s Take

GM Degens,

Crazy times are here, and it all feels very familiar if you've been through at least one more bull market.

As we said a few days ago, many are calling the top. With the U.S. government now approved to sell its Bitcoin, is this the end of the current cycle? Is the bear waiting patiently ahead to greet us?

Let’s dive in!

🌍 Market Catch-Up

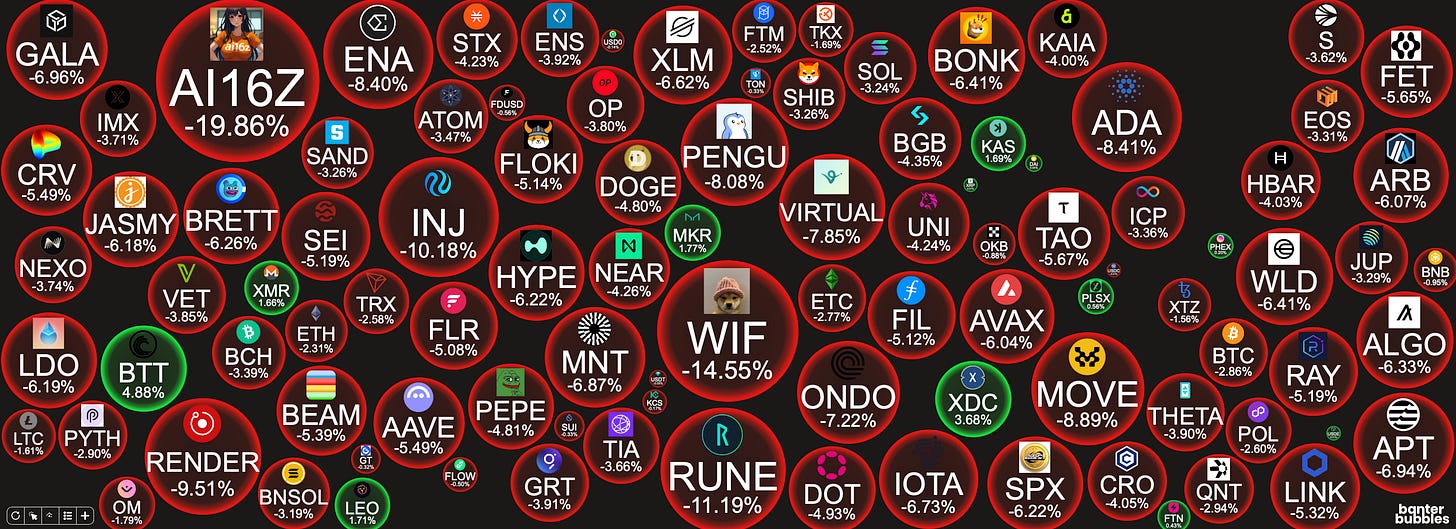

Top 100 coins Daily Performance - Banter Bubbles

Source: CoinMarketCap

📰 Question of the Day

US Approved To Dump Bitcoin! Is This The End Of The Road For The Bull Market?

Bitcoin's walking a tightrope, with Trump's crypto promises dangling like a carrot in front of it—either we're soaring past $100k or plummeting to $77k in what could be the most dramatic market mood swing since Germany sold. And just when everyone thought it was safe to invest, ETFs are bailing out faster than fans at a canceled concert.

Wait, Germany selling wasn't so bad, was it? (Spoiler alert: It was good.)

And ETFs selling? Wall Street doesn’t change their mind that easily some might say.

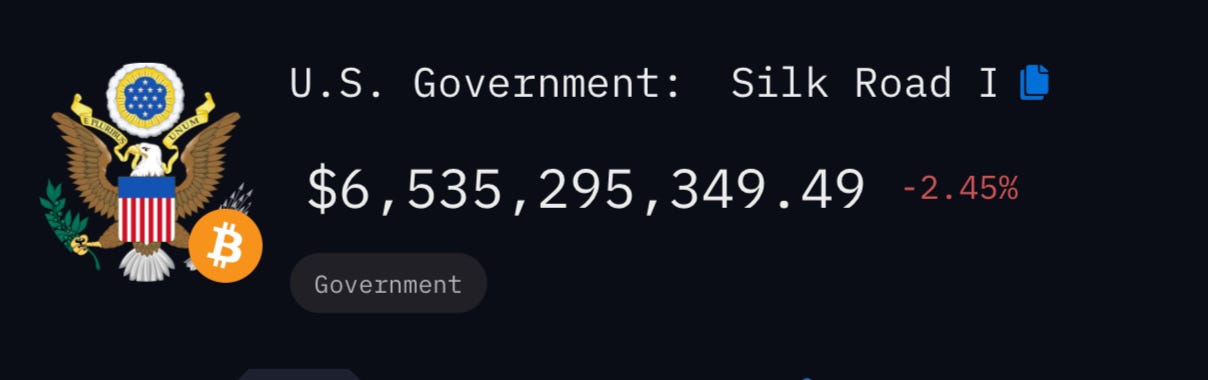

By now, you may have heard news circulating that the US government is now cleared to sell all the Bitcoin seized from Silk Road.

Here is what we know:

The US Government holds and could be ready to sell 69,000 Bitcoins seized from Silk Road. This is due to the US DOJ granting court approval to sell the Bitcoin, which is worth around $6.5B.

According to our researchers:

Assets must be converted to cash and transferred to the US Treasury.

The DOJ historically sells via Coinbase Prime early in the month due to internal USMS rules.

Now, obviously, this raises red flags, and it should. This will bring immense sell pressure, just like when the German government sold all its seized Bitcoin in 2024. But here's the silver lining: that marked the eventual bottom for Bitcoin. Remember all those memes about Germany?

Yes, the German government, in a stroke of financial genius, dumped 50,000 Bitcoins at $54,000 each back in July 2024, pocketing a mere $2.8 billion. Fast forward to now, with Bitcoin strutting at $92,850 (a 71.94% increase), those same coins would be worth around $4.64 billion. By selling early, Germany has only "saved" themselves a measly $2.4 billion loss.

Could the same be the case with the US?

Short-Term Risks:

A $6.5B sell-off could put heavy downward pressure on Bitcoin's price.

Long-Term Opportunity:

Historically, BTC rebounds strongly after such liquidations.

Insider selling suggests much of this may already be priced in.

BUUUUT…

Despite the news circulating now, the ruling that they can sell came on the 30th of December. It's old news. Does this mean insiders may have priced it all in? That's a big question, and one we will never know the answer to.

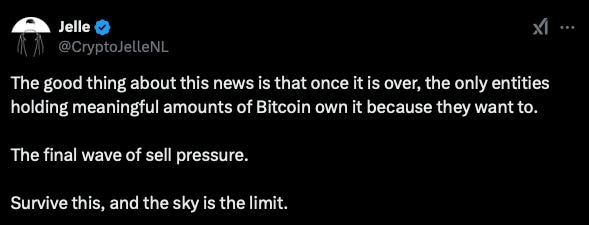

At the end of the day, the biggest silver lining of them all, as put by Jelle, is:

There are many theories circulating on X about how the coins have already been sold, but there is no concrete proof of this. Also, let's not forget that if Trump comes into power in time—seeing as the current government only has a limited time to take action on this—he could overrule the entire decision. However, on the other side of this argument is the fact that he has more important issues to deal with, like:

The current LA fires

The two major conflicts/wars happening right now in Europe and the East

So this might be long-term bullish for the market as the biggest risk departs for good (at last), but it might take some time to recover.

Overall, there are two possible outcomes:

Someone in the DOJ says, "We're not selling because Trump said we're going to make a strategic reserve."

The Bitcoin ends up in the market, and the long-term Bitcoin maxis and believers are granted another opportunity to buy. Let's not forget MicroStrategy has been buying a billion and a half dollars worth of Bitcoin each week, and despite 5,870 being sold from the Bitcoin spot ETFs yesterday, those same ETF products have collectively seen days of $1 billion dollars in inflows too.

It's all a matter of perspective.

Let’s remember the bullish stuff courtesy of Gammichan below.

And on the charts, according to Crypto Rover, there is a massive bullish pattern forming.

Do with all this info what you will! Just remember, always do your own research, as none of this is financial advice!

💎 Degens’ Den

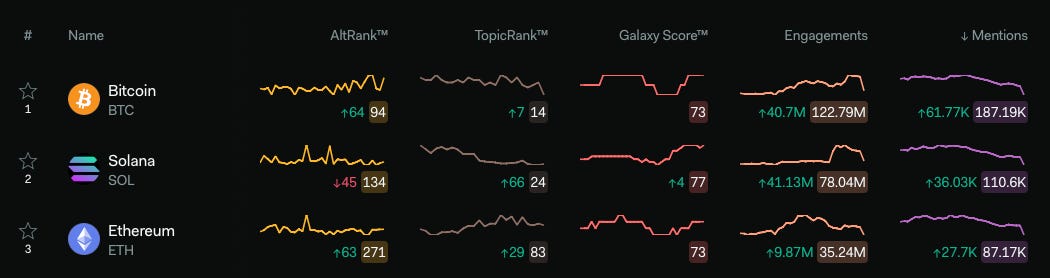

Most Engaged With Coins and Tokens Today!

It's no surprise today that the most engaged with coins are the top coins by market cap, including Bitcoin. They have the most holders. LunarCrush data below shows the data.

Mentions on social media ‘winners’:

Bitcoin (BTC)

Solana (SOL)

Ethereum (ETH)

Source: LunarCrush

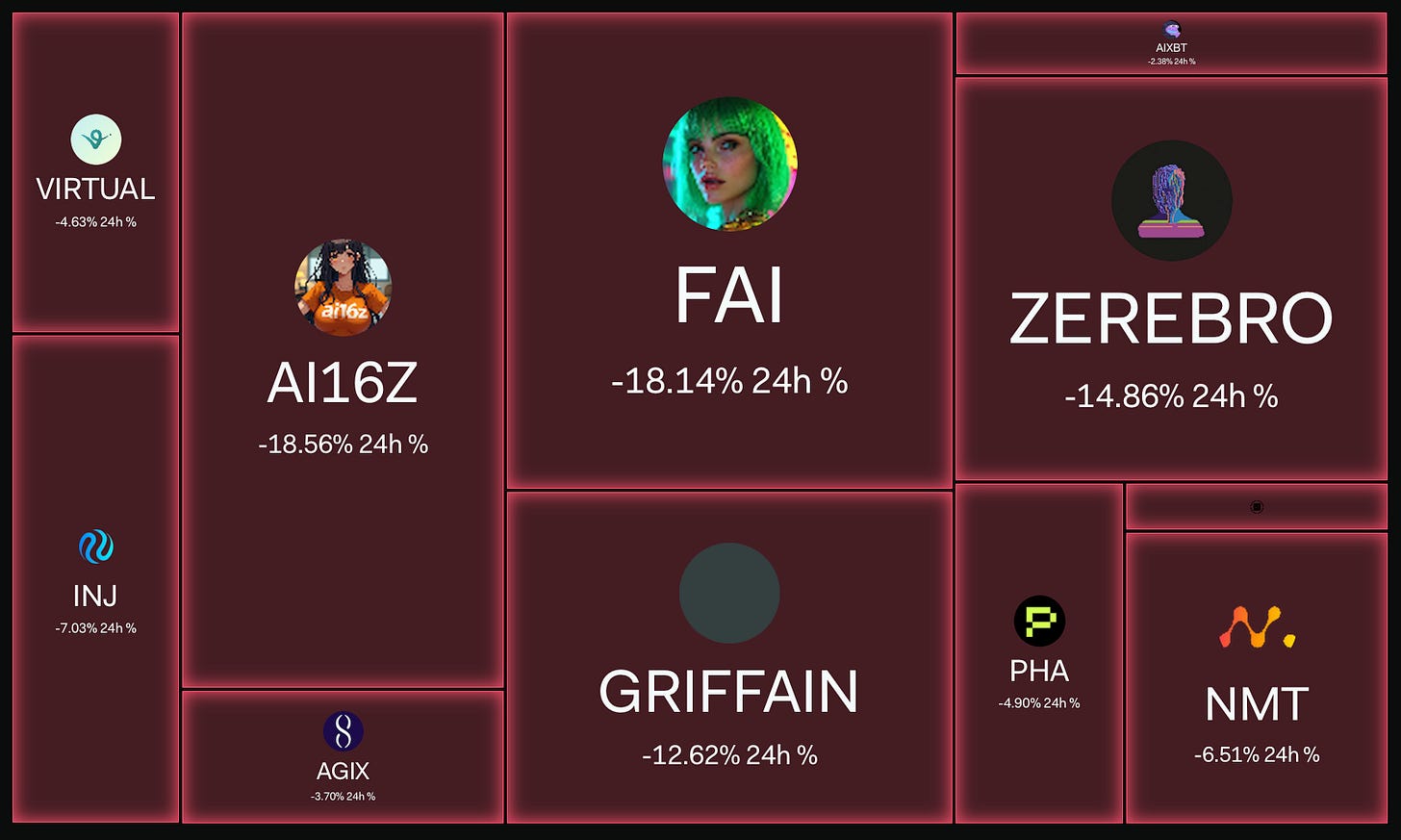

Which Coins Were Hit The Hardest?

The dip we are seeing in the majors also makes the smaller coins suffer.

According to CoinGecko, the coin that has been hit the hardest in the last 24 hours is ai16z (AI16Z) (from the top 100 coins by market).

Yes, the AI agents that everyone has been talking about recently have taken a particularly big hit. It is usually the case that the newer narratives that pumped hardest suffer the most during major dips. And now history repeats.

The question is if they can make a strong comeback.

Source: LunarCrush

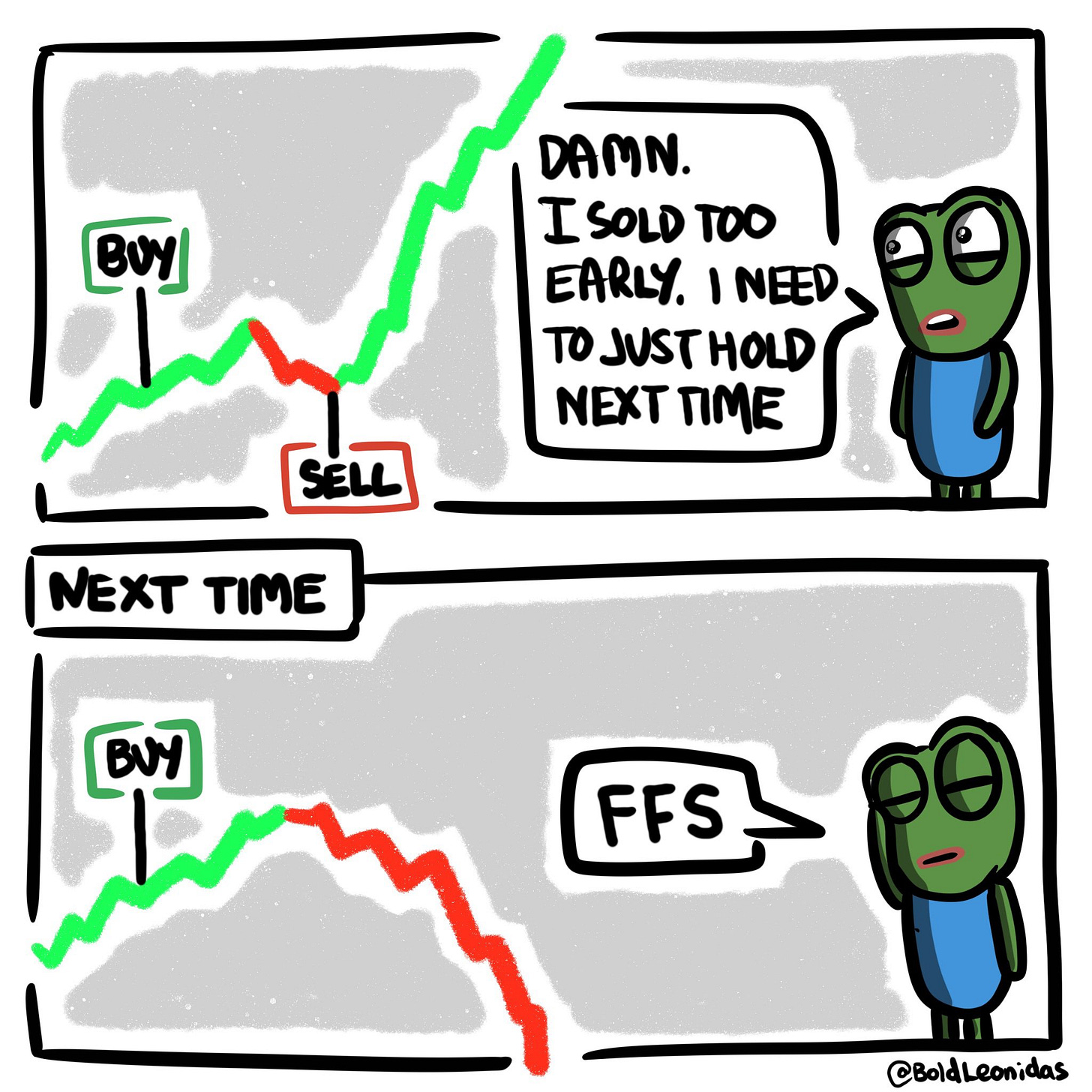

🐸 MEMEoirs of a Degen!

📢 Biggest Announcements

Mark Cuban Prefers Bitcoin Over Gold as Safe Haven Amid Economic Turmoil

Oklahoma Senator Proposes 'Bitcoin Freedom Act' Allowing Workers to Receive Salaries in Bitcoin

💭 Banter’s Take

So what do you think? Is this the end of the road, or are you more aligned with the chart below? I truly believe each person's view is dependent on whether they have been paying attention to previous market cycles, but to each their own.

See you all tomorrow!